Question: Assessment 5, Parts 2 - 5 Solve the given problem based on the following information (2): Solve the given problem based on the following information

Assessment 5, Parts 2 - 5

Solve the given problem based on the following information (2):

Solve the given problem based on the following information (3):

Solve the given problem based on the following information (4):

Solve the given problem based on the following information (5):

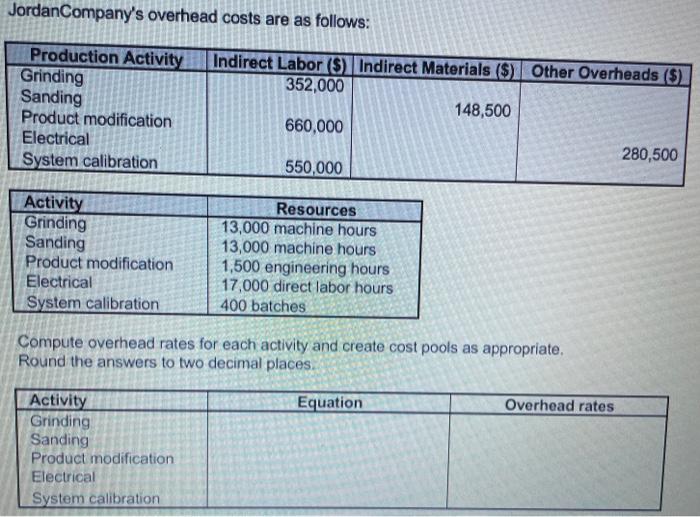

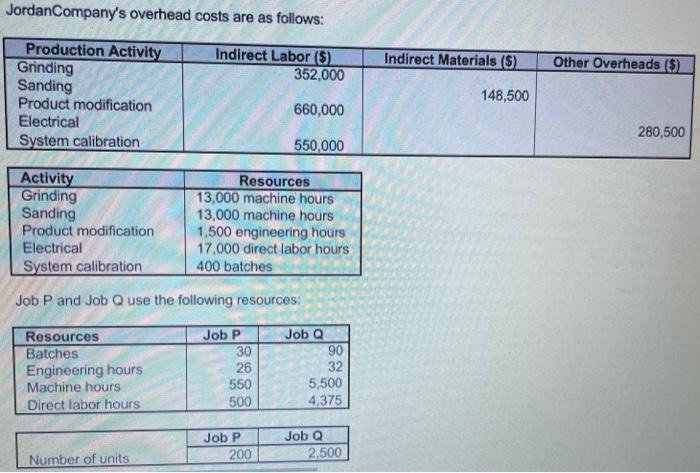

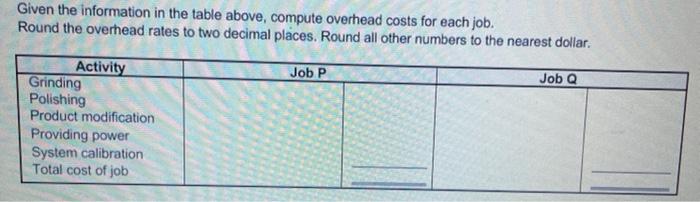

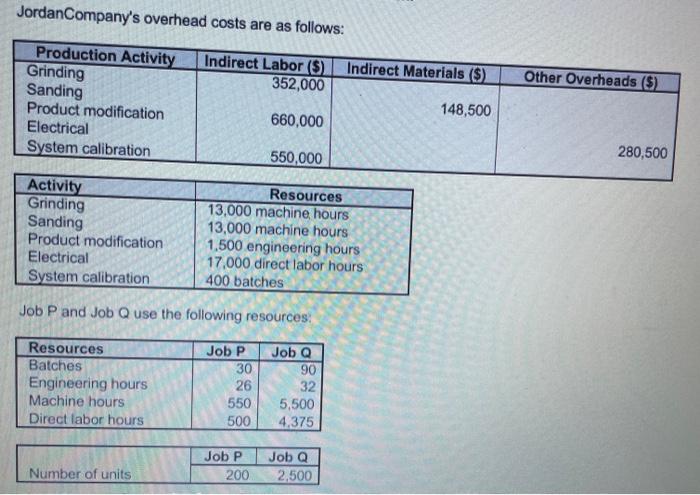

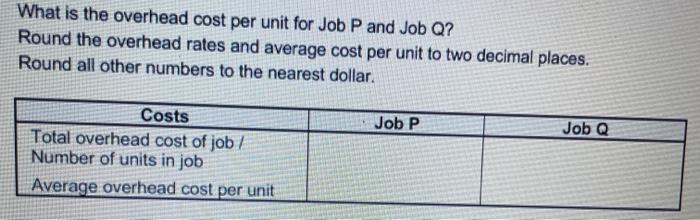

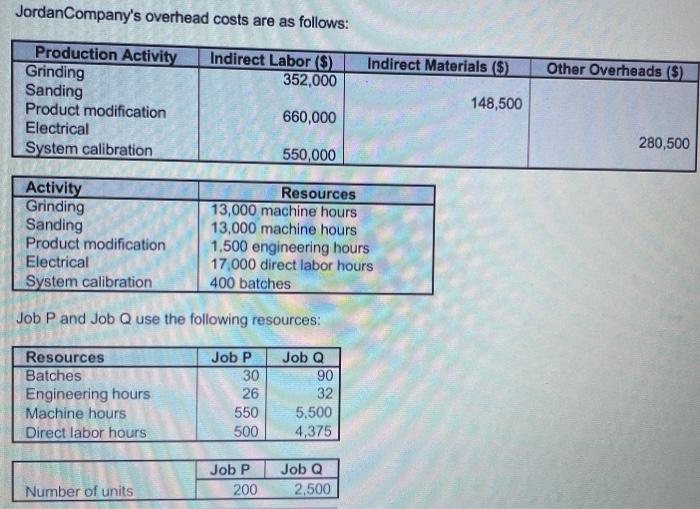

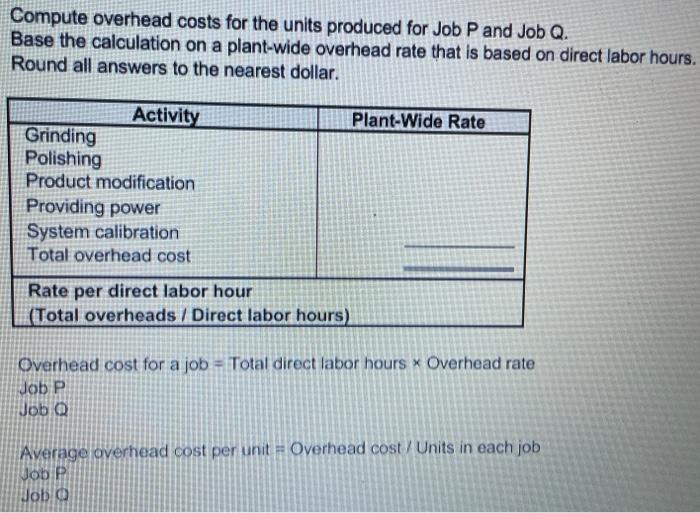

JordanCompany's overhead costs are as follows: Production Activity Grinding Sanding Product modification Electrical System calibration Indirect Labor ($) Indirect Materials ($) Other Overheads ($). 352,000 148,500 660,000 280,500 550,000 Activity Grinding Sanding Product modification Electrical System calibration Resources 13,000 machine hours 13,000 machine hours 1,500 engineering hours 17,000 direct labor hours 400 batches Compute overhead rates for each activity and create cost pools as appropriate. Round the answers to two decimal places Activity Equation Overhead rates Grinding Sanding Product modification Electrical System calibration JordanCompany's overhead costs are as follows: Indirect Labor ($) 352,000 Indirect Materials ($) Other Overheads ($) Production Activity Grinding Sanding Product modification Electrical System calibration 148,500 660,000 280,500 550,000 Activity Grinding Sanding Product modification Electrical System calibration Resources 13,000 machine hours 13,000 machine hours 1.500 engineering hours 17,000 direct labor hours 400 batches Job P and Job Q use the following resources: Resources Batches Engineering hours Machine hours Direct labor hours Job P 30 26 550 500 Job Q 90 32 5,500 4,375 Job P 200 Job Q 2.500 Number of units Given the information in the table above, compute overhead costs for each job. Round the overhead rates to two decimal places. Round all other numbers to the nearest dollar Job P Job Q Activity Grinding Polishing Product modification Providing power System calibration Total cost of job Jordan Company's overhead costs are as follows: Indirect Labor ($) 352,000 Indirect Materials ($) Other Overheads ($) Production Activity Grinding Sanding Product modification Electrical System calibration 148,500 660,000 550,000 280,500 Activity Grinding Sanding Product modification Electrical System calibration Resources 13,000 machine hours 13,000 machine hours 1,500 engineering hours 17,000 direct labor hours 400 batches Job P and Job Q use the following resources: Resources Batches Engineering hours Machine hours Direct labor hours Job P 30 26 550 500 Job Q 90 32 5,500 4.375 Job P 200 Number of units Job Q 2,500 What is the overhead cost per unit for Job P and Job Q? Round the overhead rates and average cost per unit to two decimal places. Round all other numbers to the nearest dollar. Job P Job Q Costs Total overhead cost of job / Number of units in job Average overhead cost per unit Indirect Materials ($) Other Overheads (5) JordanCompany's overhead costs are as follows: Production Activity Indirect Labor ($) Grinding 352,000 Sanding Product modification 660,000 Electrical System calibration 550,000 148,500 280,500 Activity Resources Grinding 13,000 machine hours Sanding 13,000 machine hours Product modification 1,500 engineering hours Electrical 17.000 direct labor hours System calibration 400 batches Job P and Job Q use the following resources: Resources Batches Engineering hours Machine hours Direct labor hours Job P 30 26 550 500 Job Q 90 32 5,500 4,375 Job P 200 Job Q 2.500 Number of units Compute overhead costs for the units produced for Job P and Job Q. Base the calculation on a plant-wide overhead rate that is based on direct labor hours. Round all answers to the nearest dollar. Plant-Wide Rate Activity Grinding Polishing Product modification Providing power System calibration Total overhead cost Rate per direct labor hour (Total overheads / Direct labor hours) Overhead cost for a job - Total direct labor hours * Overhead rate Job P Job @ Average overhead cost per unit - Overhead cost/Units in each job Job P Job o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts