Question: Assessment Tasks with Case study You have been appointed assistant to the management accountant at Mazee Ltd. You have been asked to complete the following

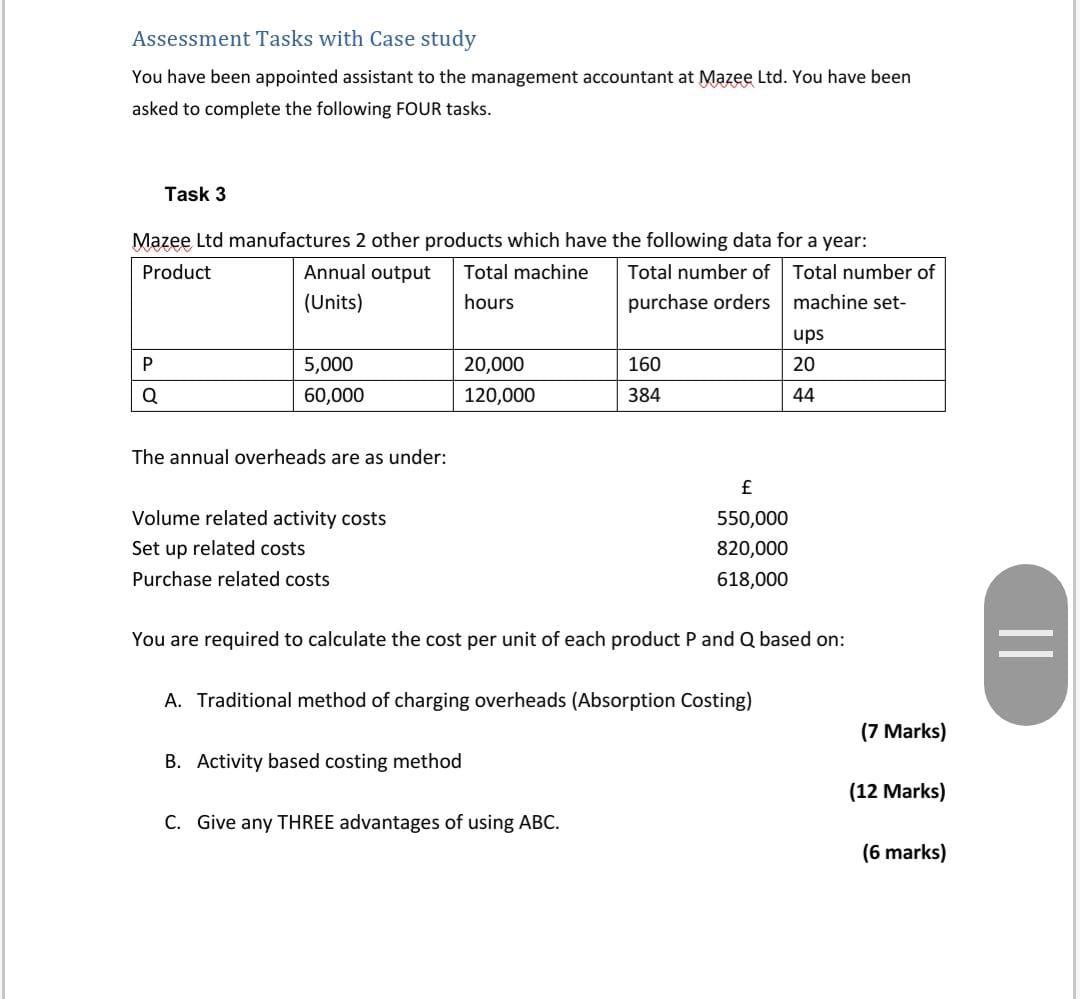

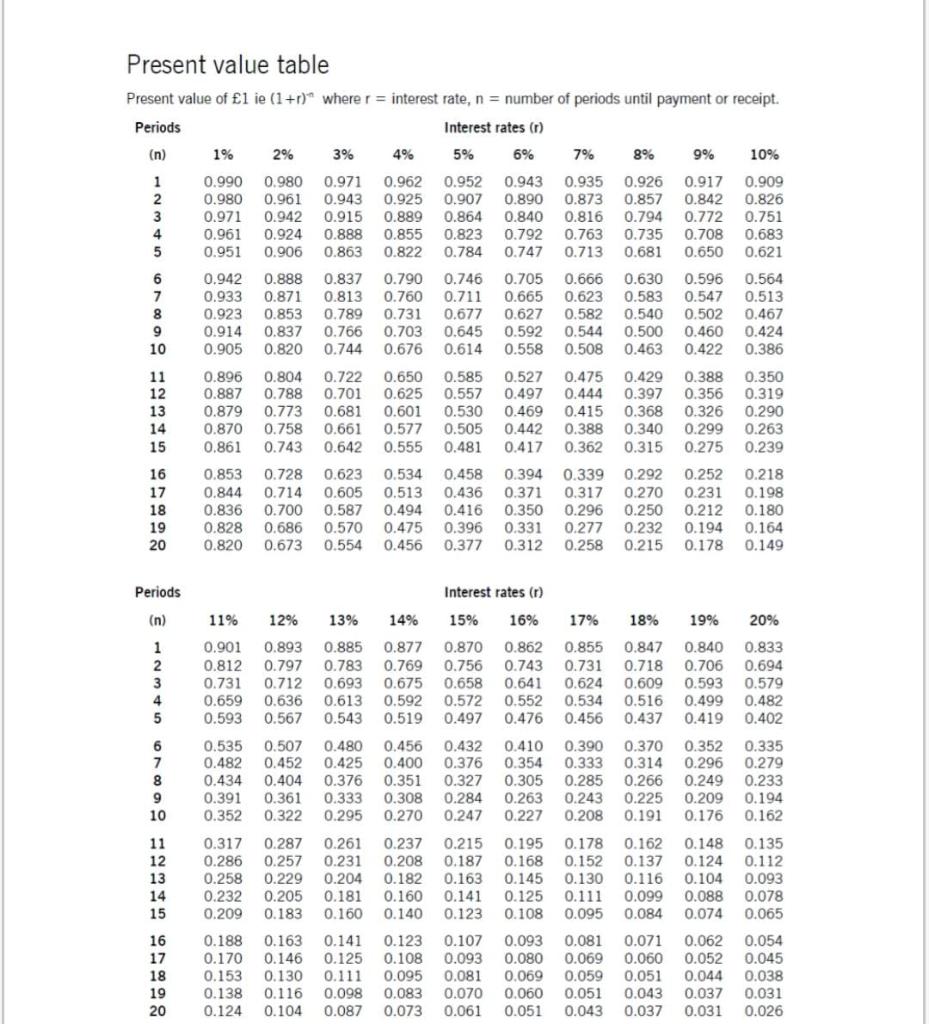

Assessment Tasks with Case study You have been appointed assistant to the management accountant at Mazee Ltd. You have been asked to complete the following FOUR tasks. Task 3 Mazee Ltd manufactures 2 other products which have the following data for a year: Product Annual output Total machine Total number of Total number of (Units) hours purchase orders machine set- ups 5,000 20,000 160 20 Q 60,000 120,000 384 44 P The annual overheads are as under: Volume related activity costs Set up related costs Purchase related costs f 550,000 820,000 618,000 You are required to calculate the cost per unit of each product P and Q based on: = A. Traditional method of charging overheads (Absorption Costing) (7 Marks) B. Activity based costing method (12 Marks) C. Give any THREE advantages of using ABC. (6 marks) Present value table Present value of 1 ie (1+r)^ where r = interest rate, n = number of periods until payment or receipt. Periods Interest rates (1) (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 Periods Interest rates (1) (n) 11% 12% 14% 15% 16% 1 2 3 4 5 0.901 0.812 0.731 0.659 0.593 0.893 0.797 0.712 0.636 0.567 13% 0.885 0.783 0.693 0.613 0.543 0.877 0.769 0.675 0.592 0.519 0.870 0.756 0.658 0.572 0.497 0.862 0.743 0.641 0.552 0.476 6 7 8 9 10 0.535 0.482 0.434 0.391 0.352 0.507 0.452 0.404 0.361 0.322 0.480 0.425 0.376 0.333 0.295 0.456 0.400 0.351 0.308 0.270 0.432 0.376 0.327 0.284 0.247 0.410 0.354 0.305 0.263 0.227 17% 18% 19% 20% 0.855 0.847 0.840 0.833 0.731 0.718 0.706 0.694 0.624 0.609 0.593 0.579 0.534 0.516 0.499 0.482 0.456 0.437 0.419 0.402 0.390 0.370 0.352 0.335 0.333 0.314 0.296 0.279 0.285 0.266 0.249 0.233 0.243 0.225 0.209 0.194 0.208 0.191 0.176 0.162 0.178 0.162 0.148 0.135 0.152 0.137 0.124 0.112 0.130 0.116 0.104 0.093 0.111 0.099 0.088 0.078 0.095 0.084 0.074 0.065 0.081 0.071 0.062 0.054 0.069 0.060 0.052 0.045 0.059 0.051 0.044 0.038 0.051 0.043 0.037 0.031 0.043 0.037 0.031 0.026 11 12 13 14 15 0.317 0.286 0.258 0.232 0.209 0.287 0.261 0.257 0.231 0.229 0.204 0.205 0.181 0.183 0.160 0.237 0.215 0.195 0.208 0.187 0.168 0.182 0.163 0.145 0.160 0.141 0.125 0.140 0.123 0.108 0.123 0.107 0.093 0.108 0.093 0.080 0.095 0.081 0.069 0.083 0.070 0.060 0.073 0.061 0.051 16 17 18 19 20 0.188 0.170 0.153 0.138 0.124 0.163 0.146 0.130 0.116 0.104 0.141 0.125 0.111 0.098 0.087

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts