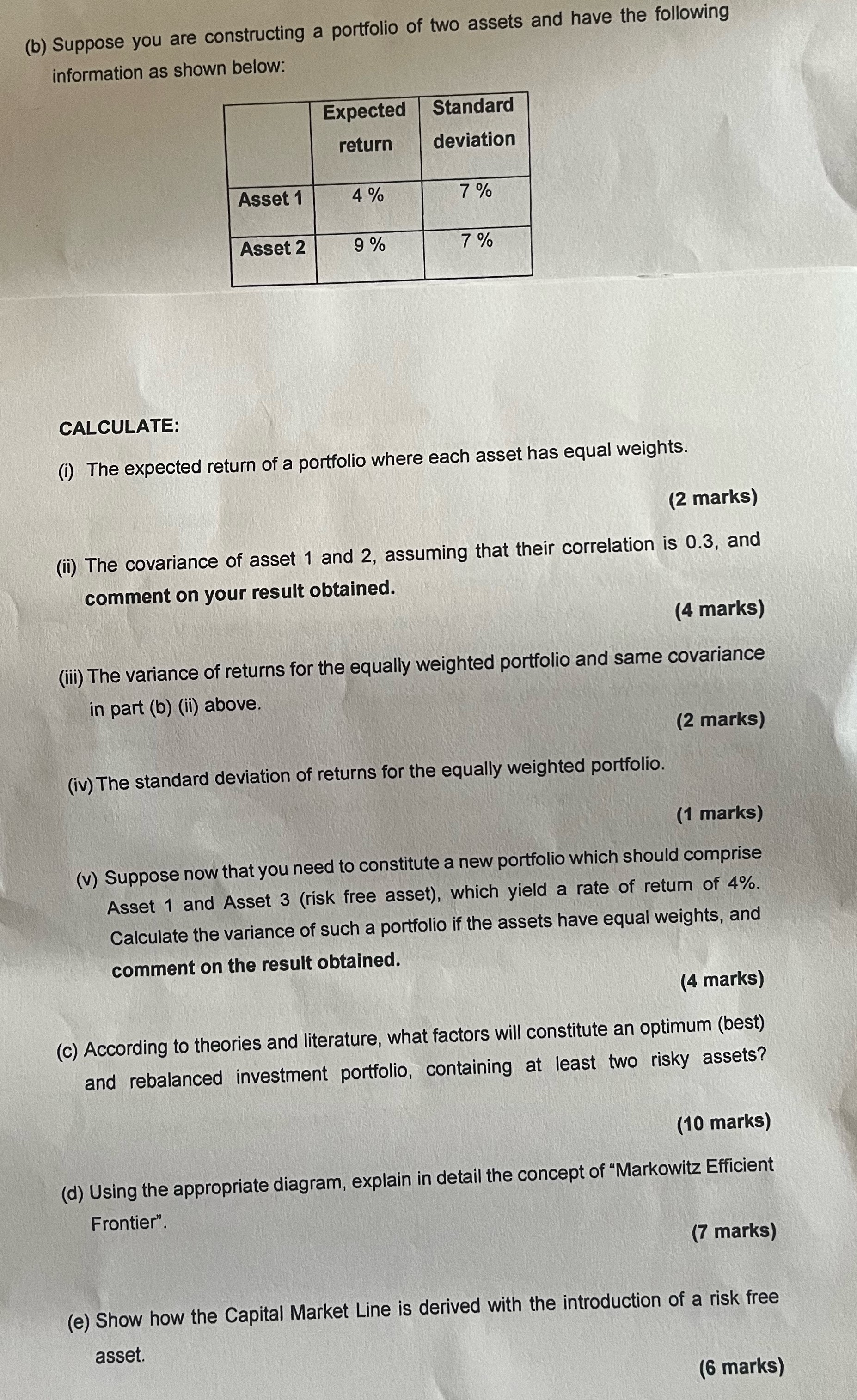

Question: Asset 1 :Expected return 4 % , Standard Deviation 7 % Asset 2 : Expected return 9 % , Standard Deviation 7 % CALCULATE: (

Asset :Expected return Standard Deviation

Asset : Expected return Standard Deviation

CALCULATE:

i The expected return of a portfolio where each asset has equal weights.

marks

ii The covariance of asset and assuming that their correlation is and

comment on your result obtained.

marks

iii The variance of returns for the equally weighted portfolio and same covariance

in part bii above.

iv The standard deviation of returns for the equally weighted portfolio.

marks

v Suppose now that you need to constitute a new portfolio which should comprise

Asset and Asset risk free asset which yield a rate of return of

Calculate the variance of such a portfolio if the assets have equal weights, and

comment on the result obtained.

marks

c According to theories and literature, what factors will constitute an optimum best

and rebalanced investment portfolio, containing at least two risky assets?

d Using the appropriate diagram, explain in detail the concept of "Markowitz Efficient

Frontier".

marks

e Show how the Capital Market Line is derived with the introduction of a risk free

asset.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock