Question: ( ASSET PRICING MODELS: Fama-French 3 Factor Model [ 3 points ] The three factors chosen are Market, Size, and Book to Market (B/M). Your

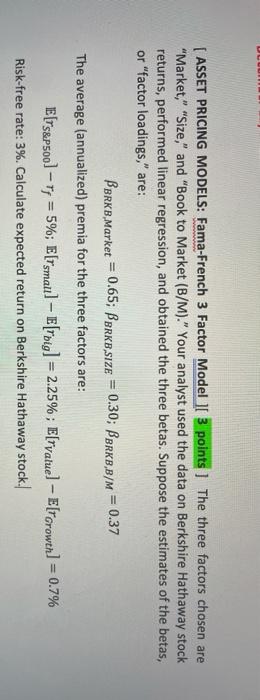

( ASSET PRICING MODELS: Fama-French 3 Factor Model [ 3 points ] The three factors chosen are "Market," "Size," and "Book to Market (B/M)." Your analyst used the data on Berkshire Hathaway stock returns, performed linear regression, and obtained the three betas. Suppose the estimates of the betas, or "factor loadings," are: BBRKB,Market = 0.65; Borke,size = 0.30; BBRKB,B/M = 0.37 The average (annualized) premia for the three factors are: E[TS&P500) ry = 5%; E[rsmaull - E[rnig] = 2.25%; E[rvatue] - E[rGrowth] = 0.7% Risk-free rate: 3%. Calculate expected return on Berkshire Hathaway stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock