Question: Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow: Department A Department B Department C Inventory $60,000 $216,000 $84,000 Equipment

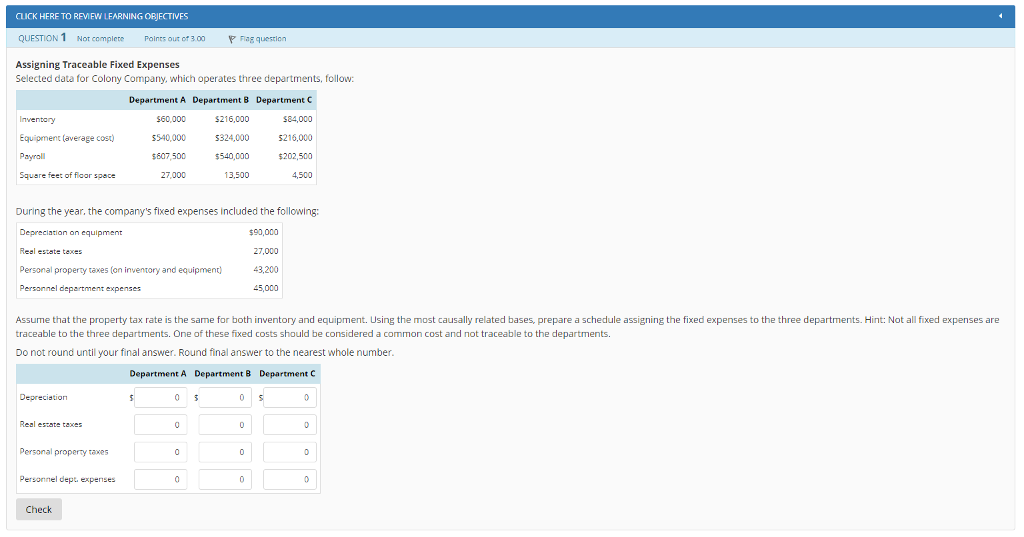

Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow:

| Department A | Department B | Department C | ||

|---|---|---|---|---|

| Inventory | $60,000 | $216,000 | $84,000 | |

| Equipment (average cost) | $540,000 | $324,000 | $216,000 | |

| Payroll | $607,500 | $540,000 | $202,500 | |

| Square feet of floor space | 27,000 | 13,500 | 4,500 |

During the year, the company's fixed expenses included the following:

| Depreciation on equipment | $90,000 | |||

| Real estate taxes | 27,000 | |||

| Personal property taxes (on inventory and equipment) | 43,200 | |||

| Personnel department expenses | 45,000 |

Assume that the property tax rate is the same for both inventory and equipment. Using the most causally related bases, prepare a schedule assigning the fixed expenses to the three departments. Hint: Not all fixed expenses are traceable to the three departments. One of these fixed costs should be considered a common cost and not traceable to the departments.

Do not round until your final answer. Round final answer to the nearest whole number.

| Department A | Department B | Department C | ||

|---|---|---|---|---|

| Depreciation | $Answer | $Answer | $Answer | |

| Real estate taxes | Answer | Answer | Answer | |

| Personal property taxes | Answer | Answer | Answer | |

| Personnel dept. expenses | Answer | Answer | Answer |

CLICK HERE TO REMEW LEARNING OBJECTIVES QUESTION1 Not complete Points out of 3.00 P Flag question Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow: Equipment (average cos) Payrall Square feet of floor space $60,000 540,000 $607,500 27,000 $216,000 5324,000 $540,000 13,500 $84,000 5216,000 202,500 4,500 During the year, the company's fixed expenses included the following: 90,000 27,000 43,200 45,000 Real estate texes Personal property taxes (on inventory and equipment) Assume that the property tax rate is the same for both inventory and equipment. Using the most causally related bases, prepare a schedule assigning the fixed expenses to the three departments. Hint: Not all fixed expenses are traceable to the three departments. One of these fixed costs should be considered a common cost and not traceable to the departments. Do not round until your final answer. Round final answer to the nearest whole number Department A Department B Department C Real eszate taxes ersonal propery taxes Check CLICK HERE TO REMEW LEARNING OBJECTIVES QUESTION1 Not complete Points out of 3.00 P Flag question Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow: Equipment (average cos) Payrall Square feet of floor space $60,000 540,000 $607,500 27,000 $216,000 5324,000 $540,000 13,500 $84,000 5216,000 202,500 4,500 During the year, the company's fixed expenses included the following: 90,000 27,000 43,200 45,000 Real estate texes Personal property taxes (on inventory and equipment) Assume that the property tax rate is the same for both inventory and equipment. Using the most causally related bases, prepare a schedule assigning the fixed expenses to the three departments. Hint: Not all fixed expenses are traceable to the three departments. One of these fixed costs should be considered a common cost and not traceable to the departments. Do not round until your final answer. Round final answer to the nearest whole number Department A Department B Department C Real eszate taxes ersonal propery taxes Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts