Question: Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow: begin{tabular}{|l|rr|r|} hline & Department A & Department B & Department C

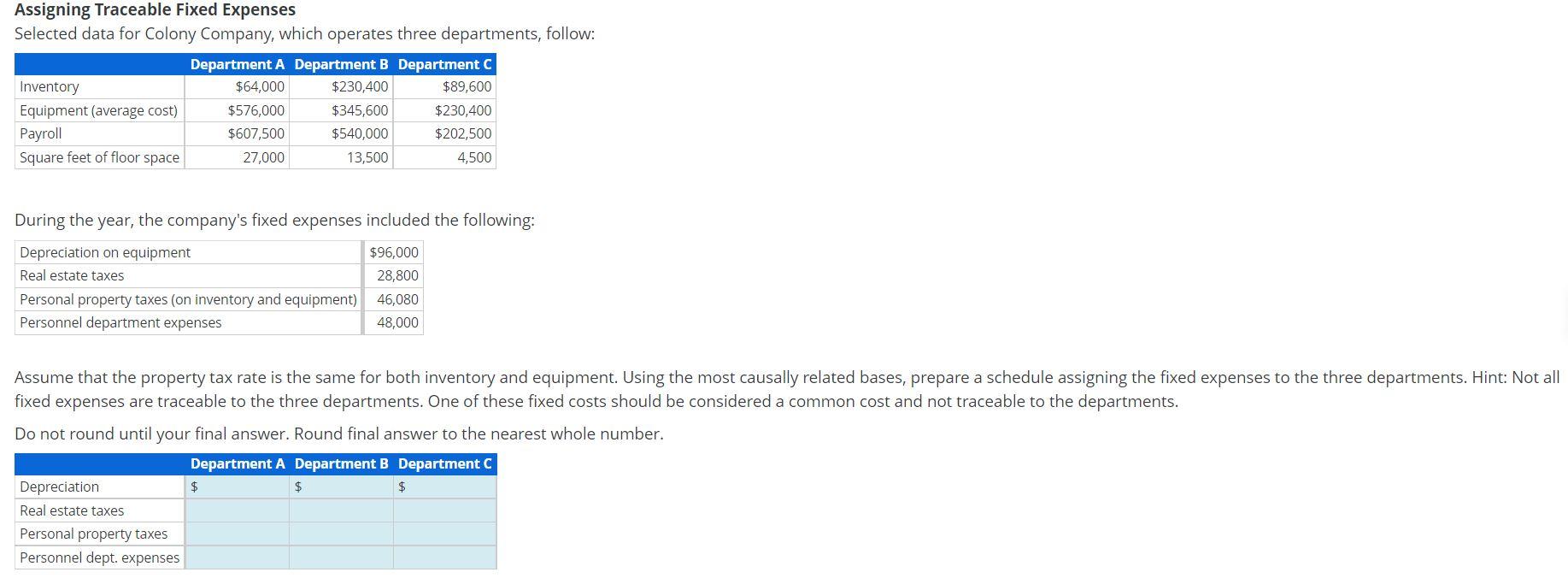

Assigning Traceable Fixed Expenses Selected data for Colony Company, which operates three departments, follow: \begin{tabular}{|l|rr|r|} \hline & Department A & Department B & Department C \\ \hline Inventory & $64,000 & $230,400 & $89,600 \\ \hline Equipment (average cost) & $576,000 & $345,600 & $230,400 \\ \hline Payroll & $607,500 & $540,000 & $202,500 \\ \hline Square feet of floor space & 27,000 & 13,500 & 4,500 \\ \hline \end{tabular} During the year, the company's fixed expenses included the following: \begin{tabular}{|l||r|} \hline Depreciation on equipment & $96,000 \\ \hline Real estate taxes & 28,800 \\ \hline Personal property taxes (on inventory and equipment) & 46,080 \\ \hline Personnel department expenses & 48,000 \\ \hline \end{tabular} Assume that the property tax rate is the same for both inventory and equipment. Using the most causally related bases, prepare a schedule assigning the fixed expenses to the three departments. Hint: Not all fixed expenses are traceable to the three departments. One of these fixed costs should be considered a common cost and not traceable to the departments. Do not round until your final answer. Round final answer to the nearest whole number. \begin{tabular}{|l|l|l|l|} \hline & \multicolumn{1}{|c|}{ Department A } & Department B & Department C \\ \hline Depreciation & $ & $ & $ \\ \hline Real estate taxes & & & \\ \hline Personal property taxes & & & \\ \hline Personnel dept. expenses & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts