Question: Assignment 06 - Interest Rates Attempts: Keep the Highest: /4 8. Pure expectations theory Aa Aa D The pure expectations theory, or the expectations hypothesis,

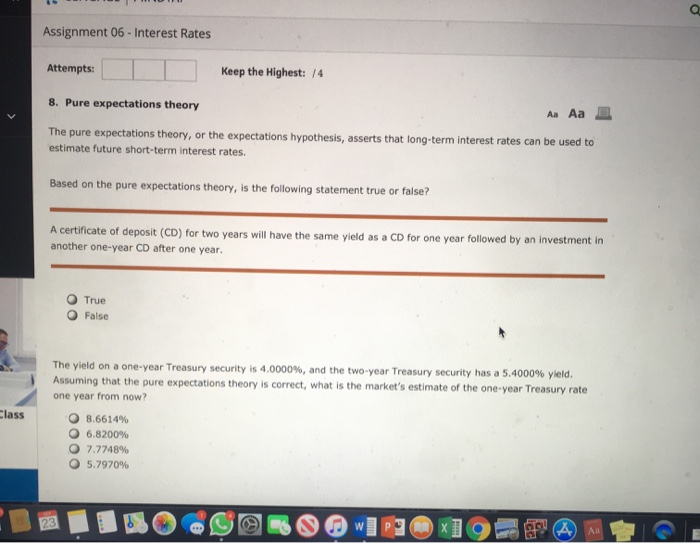

Assignment 06 - Interest Rates Attempts: Keep the Highest: /4 8. Pure expectations theory Aa Aa D The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an investment in another one-year CD after one year. True False O The yield on a one-year Treasury security is 4.0000%, and the two-year Treasury security has a 5.4000% yleld. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? Class O 8.6614% O 6.8200% 7.7748% O 5.7970% Assignment 06 - Interest Rates Attempts: Keep the Highest: /4 8. Pure expectations theory Aa Aa D The pure expectations theory, or the expectations hypothesis, asserts that long-term interest rates can be used to estimate future short-term interest rates. Based on the pure expectations theory, is the following statement true or false? A certificate of deposit (CD) for two years will have the same yield as a CD for one year followed by an investment in another one-year CD after one year. True False O The yield on a one-year Treasury security is 4.0000%, and the two-year Treasury security has a 5.4000% yleld. Assuming that the pure expectations theory is correct, what is the market's estimate of the one-year Treasury rate one year from now? Class O 8.6614% O 6.8200% 7.7748% O 5.7970%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts