Question: Assignment 1. A portfolio that is short a call option and a put option on the same stock with the same exercise date and strike

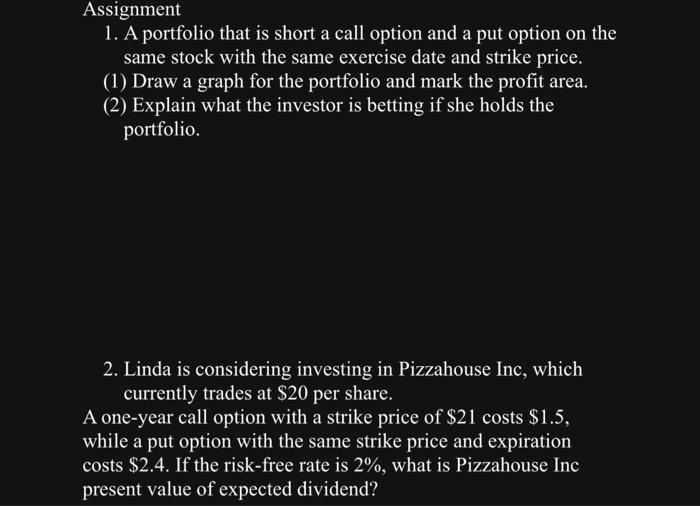

Assignment 1. A portfolio that is short a call option and a put option on the same stock with the same exercise date and strike price. (1) Draw a graph for the portfolio and mark the profit area. (2) Explain what the investor is betting if she holds the portfolio. 2. Linda is considering investing in Pizzahouse Inc, which currently trades at $20 per share. A one-year call option with a strike price of $21 costs $1.5, while a put option with the same strike price and expiration costs $2.4. If the risk-free rate is 2%, what is Pizzahouse Inc present value of expected dividend? Assignment 1. A portfolio that is short a call option and a put option on the same stock with the same exercise date and strike price. (1) Draw a graph for the portfolio and mark the profit area. (2) Explain what the investor is betting if she holds the portfolio. 2. Linda is considering investing in Pizzahouse Inc, which currently trades at $20 per share. A one-year call option with a strike price of $21 costs $1.5, while a put option with the same strike price and expiration costs $2.4. If the risk-free rate is 2%, what is Pizzahouse Inc present value of expected dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts