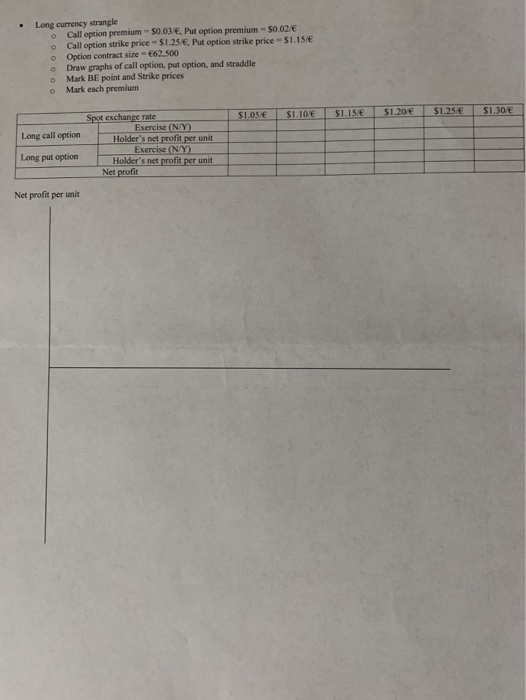

Question: Long cury strangle Call option premium - 50.03., Put option premium - $0.02 Call option strike price 1.25/6, Put option strike price $1.15 Option contract

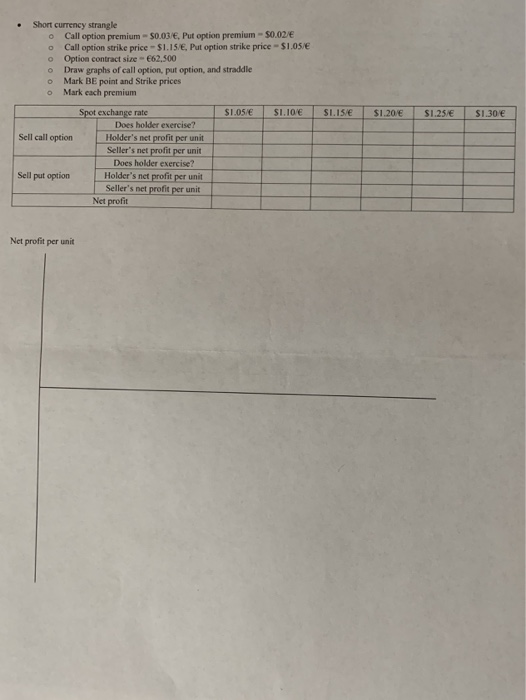

Long cury strangle Call option premium - 50.03., Put option premium - $0.02 Call option strike price 1.25/6, Put option strike price $1.15 Option contract size - 62,500 Draw graphs of call option, put option, and straddle Mark BE point and Strike prices Mark each premium 1 S105 S 15E $1.20 $1.25 $1.30/E Long call option Spot exchange rate Exercise (NY) Holder's net profit per unit Exercise (NY Holder's net profit per unit Net profit Long put option Net profit per unit Short currency strangle Call option premium - $0.03 E, Put option premium - $0.02/ Call option strike price - $1.15 E. Put option strike price - $1.05 Option contract size - 62.500 Draw graphs of call option, put option, and straddle Mark BE point and Strike prices Mark each premium $1.05 SI IO S 115 S120 S 1.25 S1,30 Sell call option Spot exchange rate Does holder exercise? Holder's net profit per unit Seller's net profit per unit Does holder exercise? Holder's net profit per unit Seller's net profit per unit Net profit Sell put option Net profit per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts