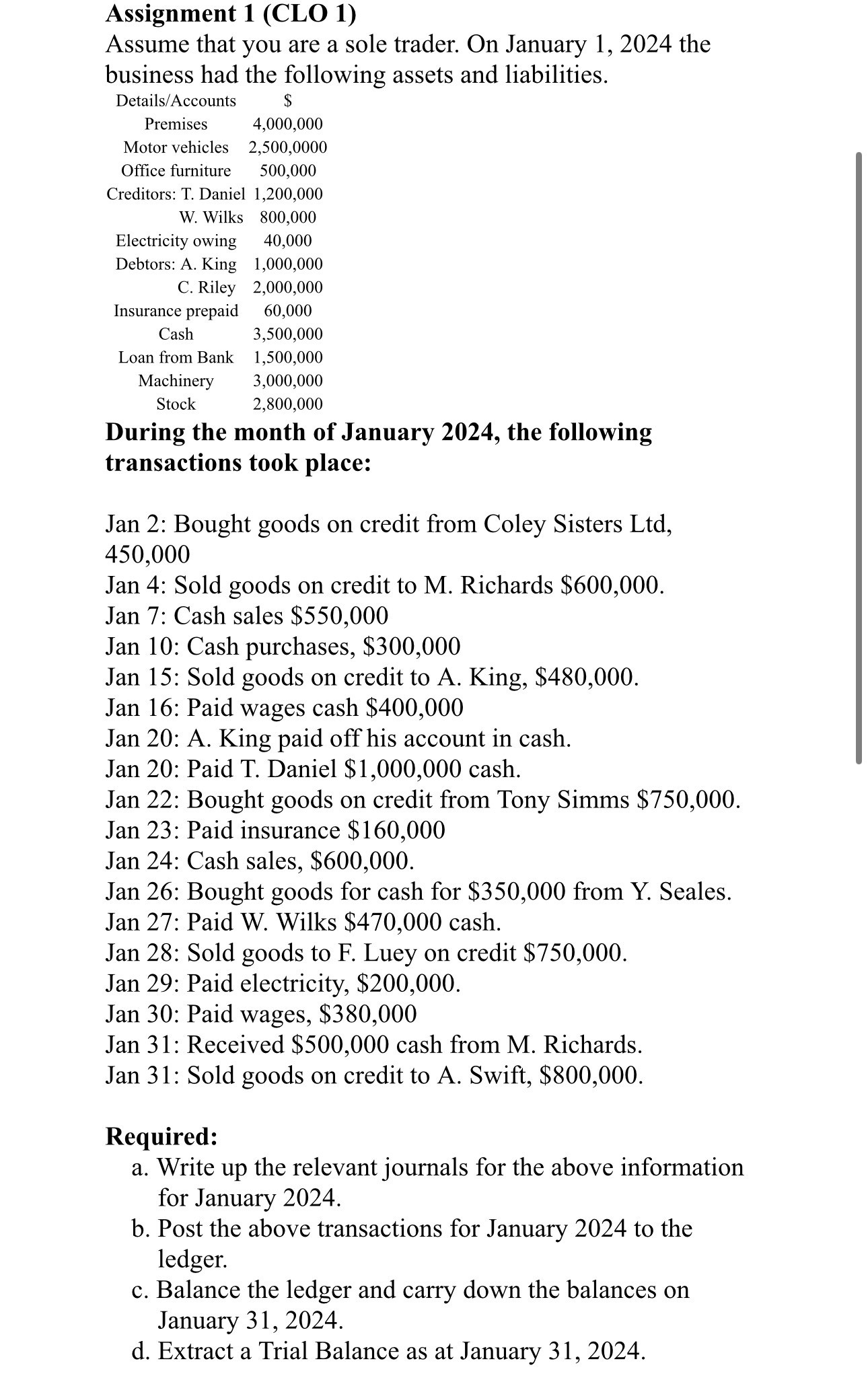

Question: Assignment 1 ( C L O 1 ) Assume that you are a sole trader. O n January 1 , 2 0 2 4 the

Assignment

Assume that you are a sole trader. January the

business had the following assets and liabilities.

During the month January the following

transactions took place:

Jan : Bought goods credit from Coley Sisters

Jan : Sold goods credit Richards $

Jan : Cash sales $

Jan : Cash purchases, $

Jan : Sold goods credit King, $

Jan : Paid wages cash $

Jan : King paid off his account cash.

Jan : Paid Daniel $ cash.

Jan : Bought goods credit from Tony Simms $

Jan : Paid insurance $

Jan : Cash sales, $

Jan : Bought goods for cash for $ from Seales.

Jan : Paid Wilks $ cash.

Jan : Sold goods Luey credit $

Jan : Paid electricity, $

Jan : Paid wages, $

Jan : Received $ cash from Richards.

Jan : Sold goods credit Swift, $

Required:

Write the relevant journals for the above information

for January

Post the above transactions for January the

ledger.

Balance the ledger and carry down the balances

January

Extract a Trial Balance January

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock