Question: Files Virtual Project X ACCT615-Gro x ACCT615-Gro X MSpreadsheet : X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search

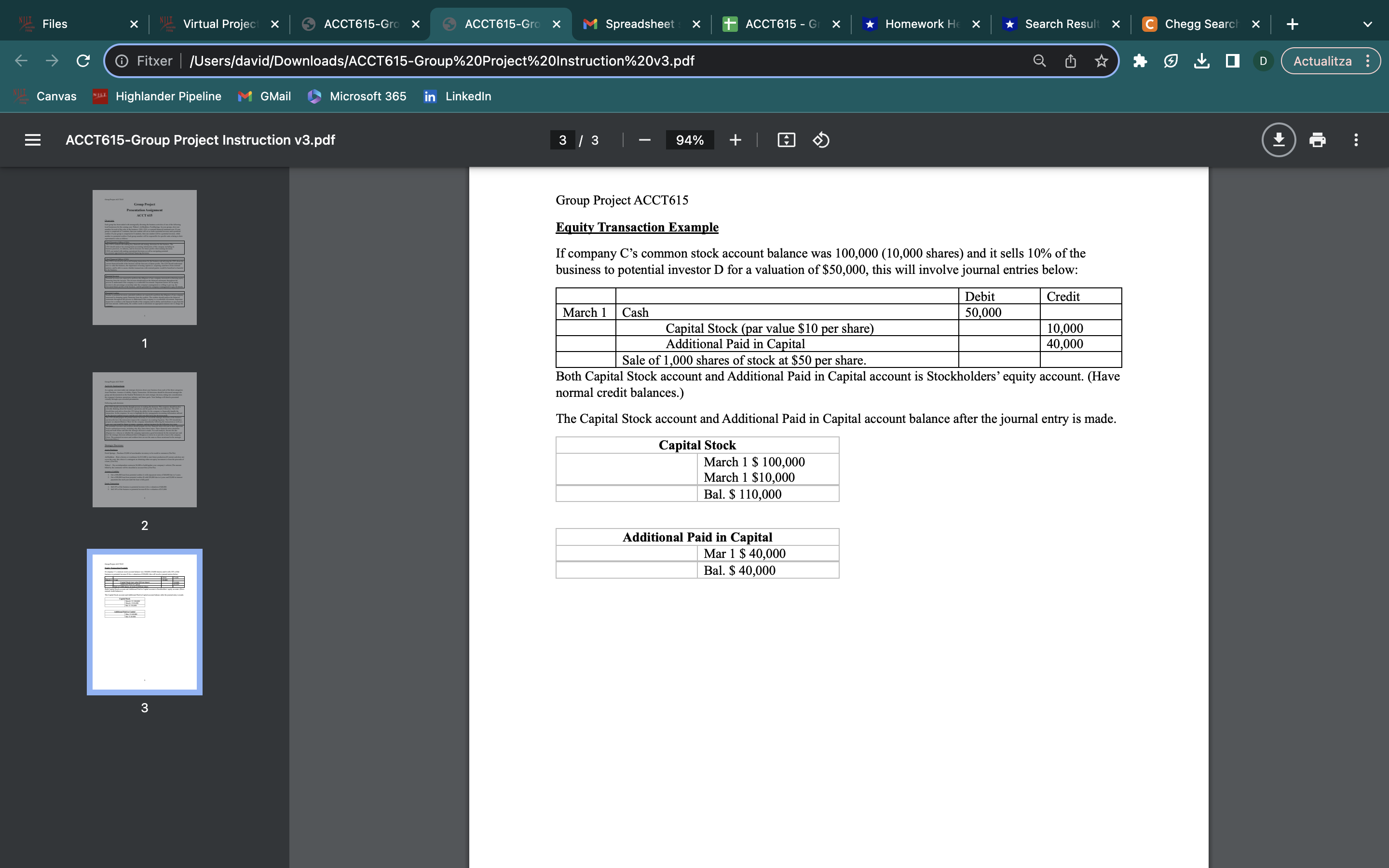

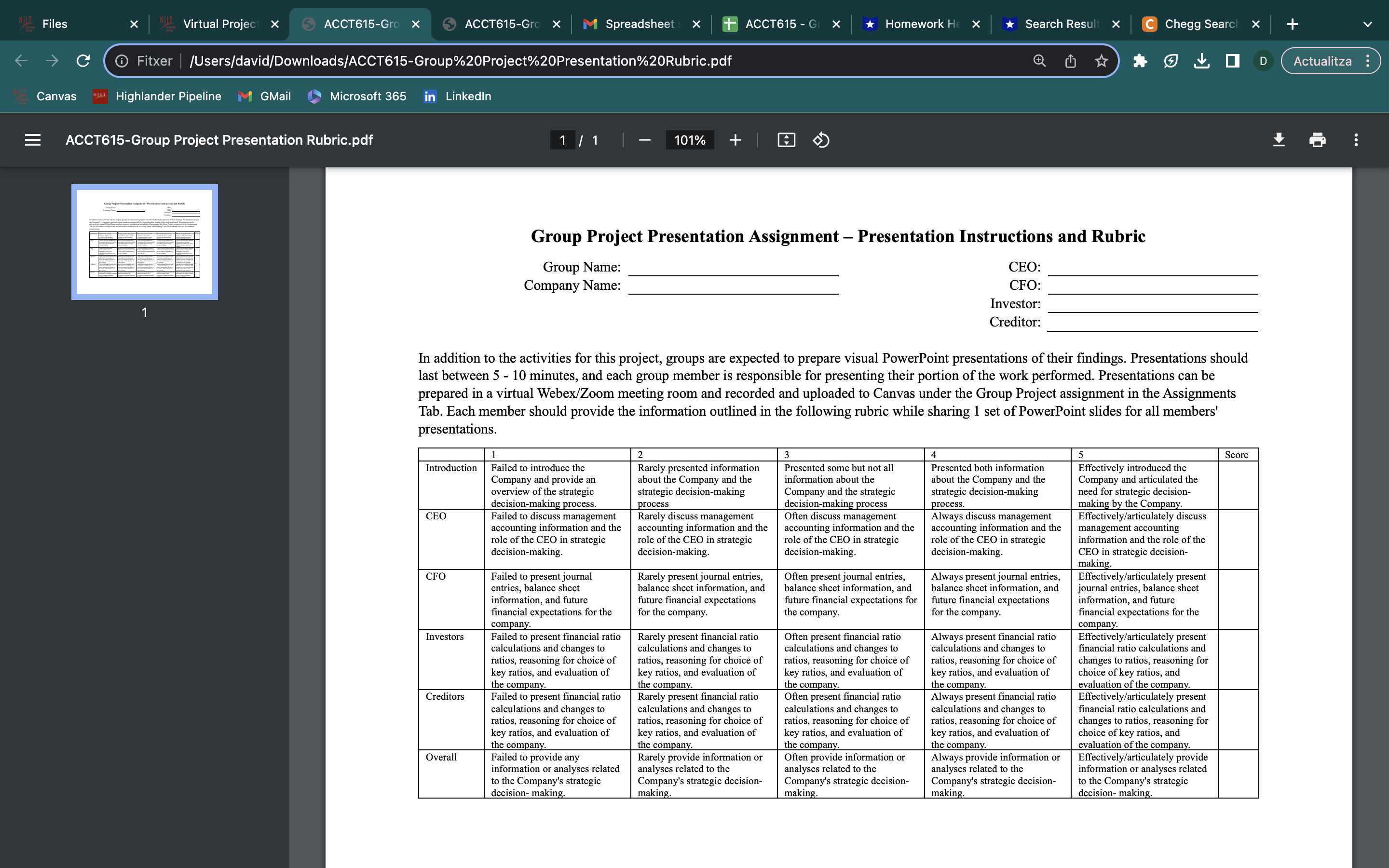

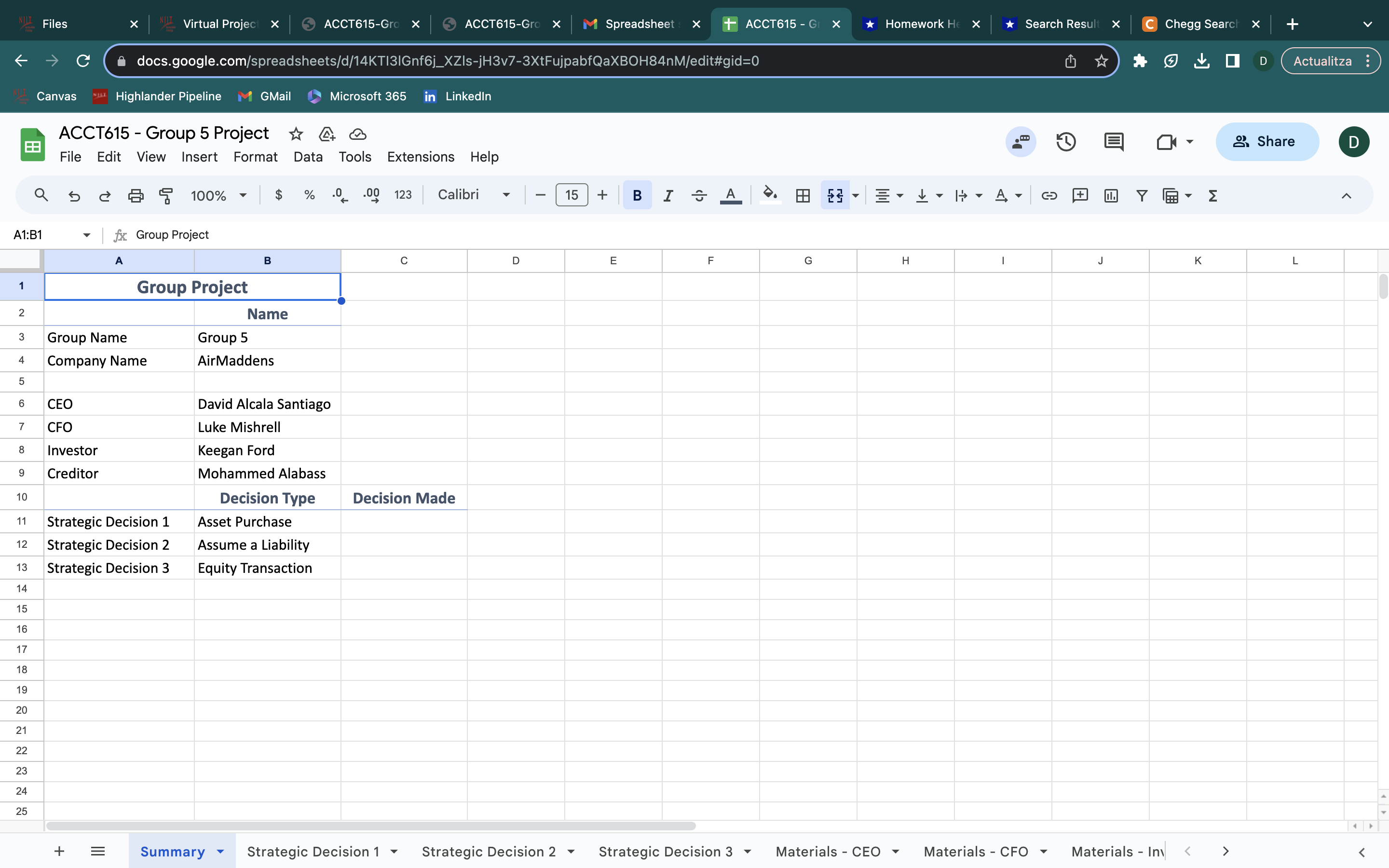

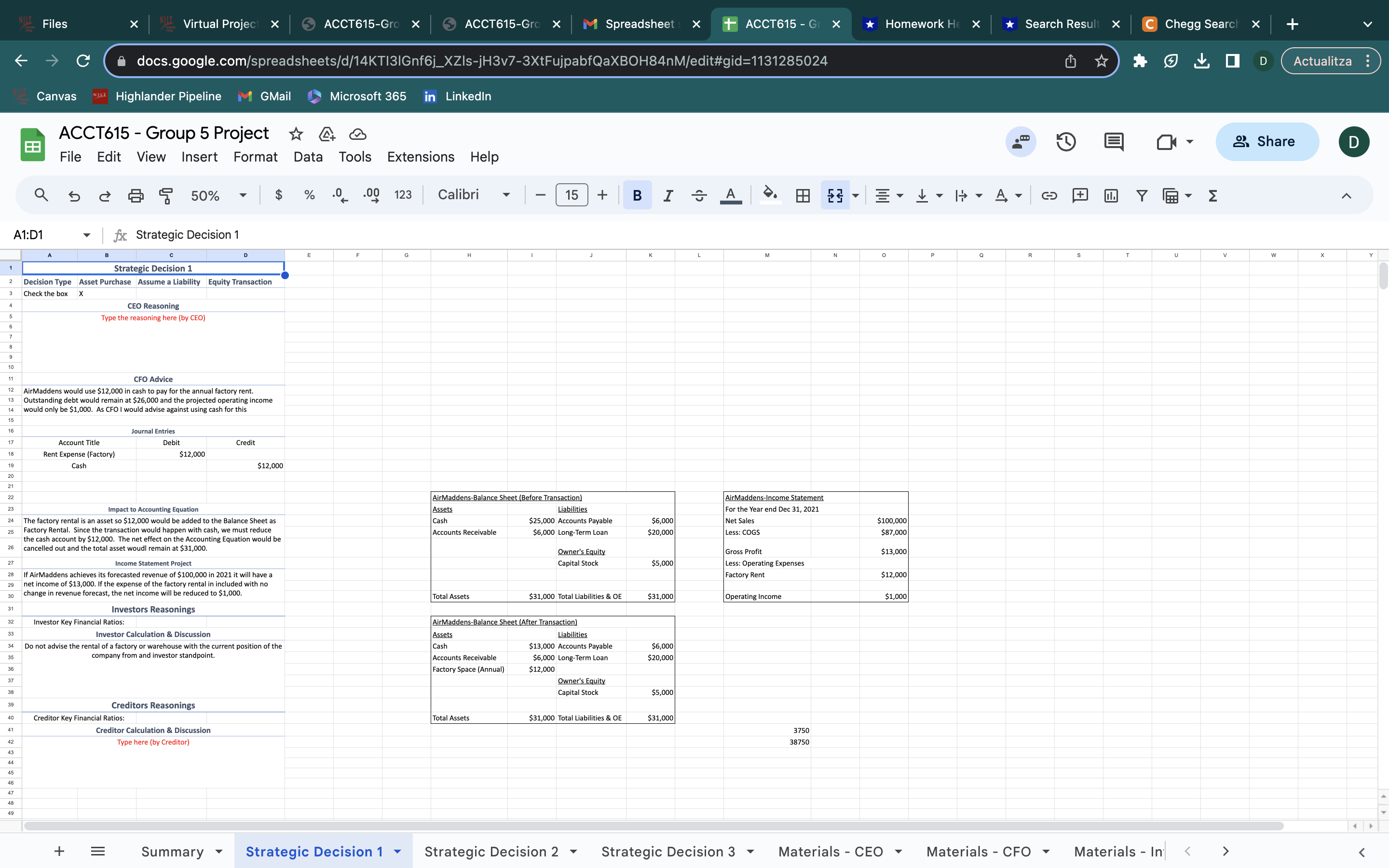

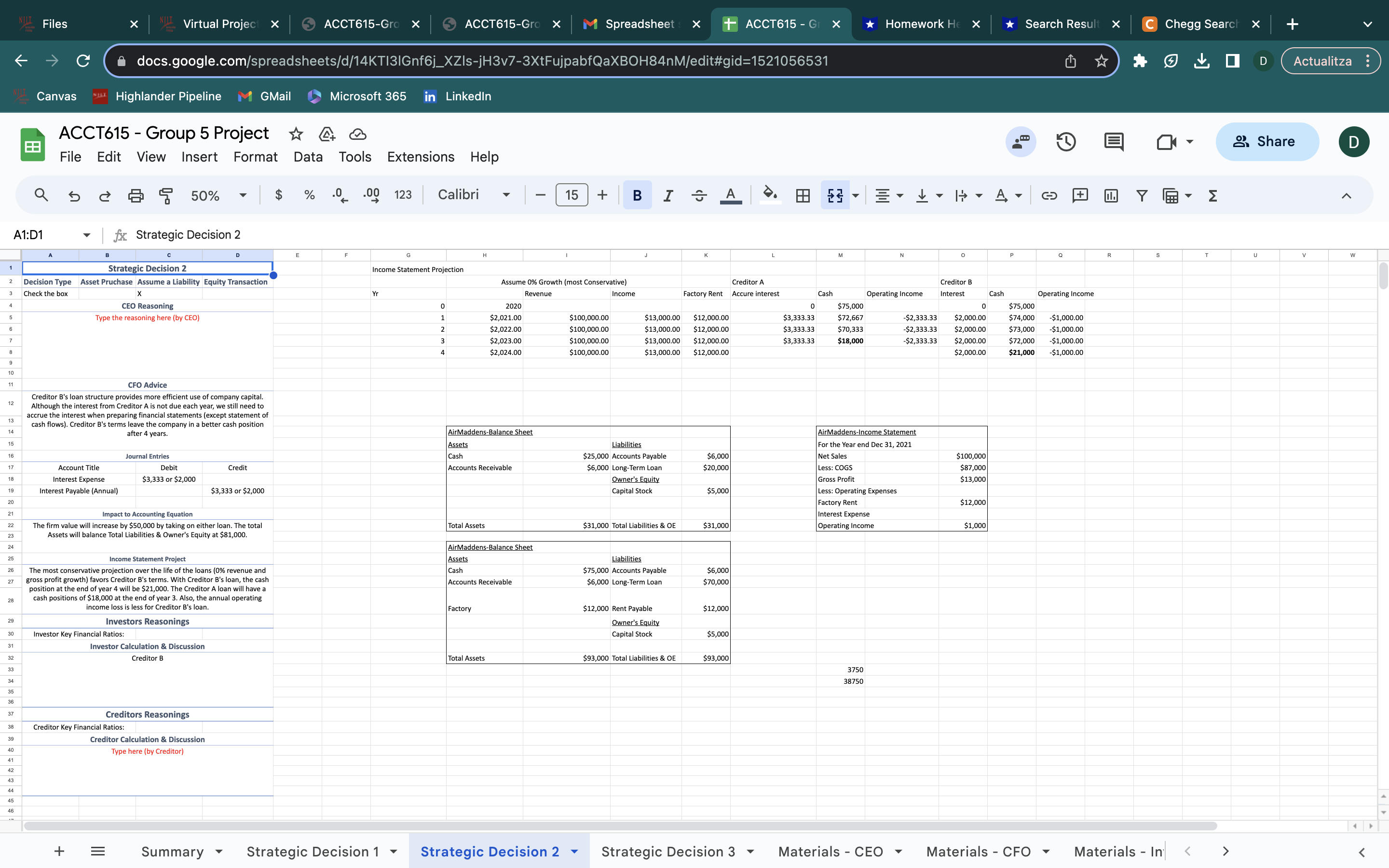

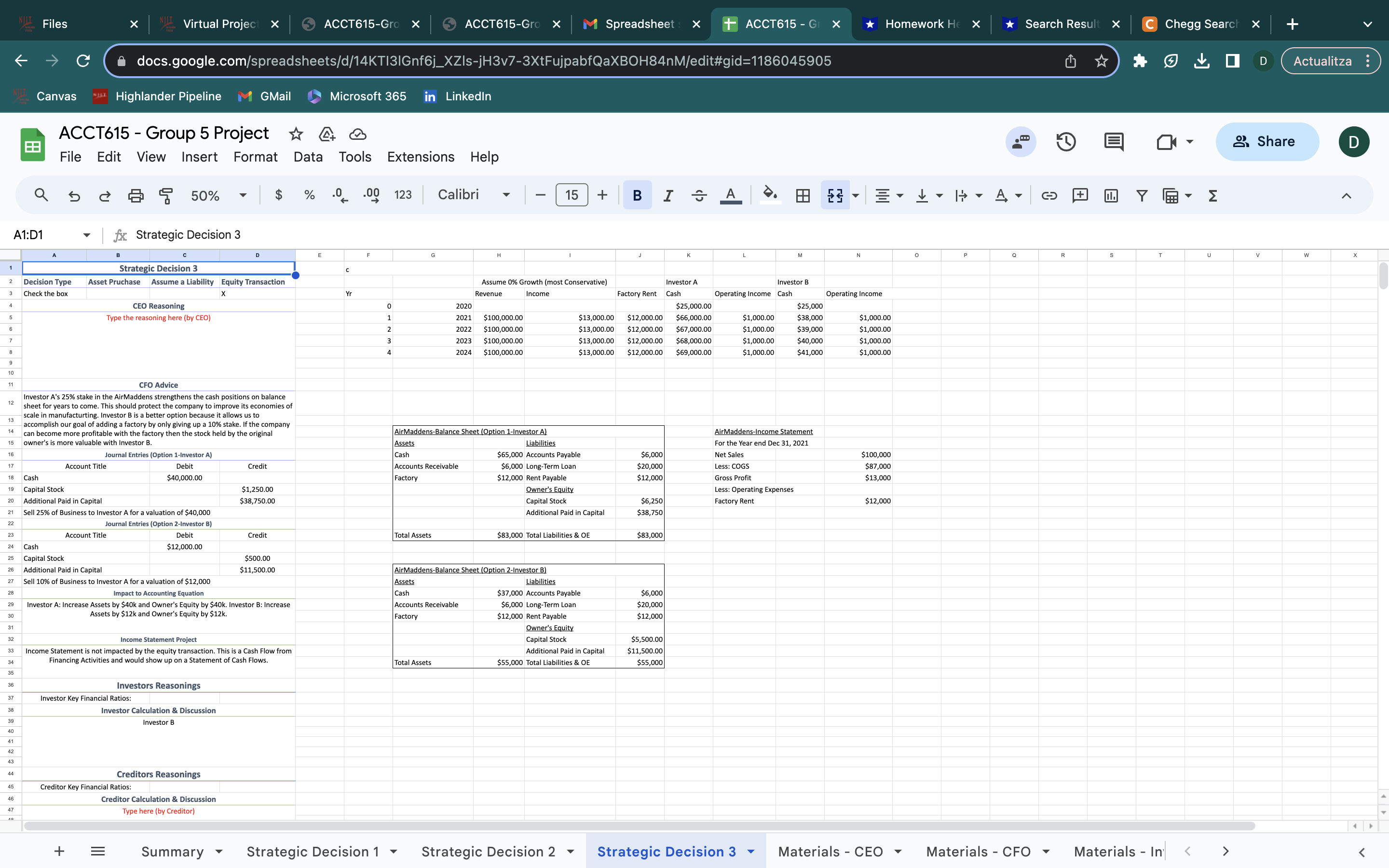

Files Virtual Project X ACCT615-Gro x ACCT615-Gro X MSpreadsheet : X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C Fitxer | /Users/david/Downloads/ACCT615-Group%20Project%20Instruction%20v3.pdf Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615-Group Project Instruction v3.pdf 1 / 3 94% + Grump Project Group Project ACCT615 Group Project Presentation Assignment 1 ACCT 615 Overview Each group has been tasked with strategically directing the business activities of one of the following local businesses for the coming year: Wahoo!, AirMaddens, FreshSprings. In your groups, elect one member for each of the roles in the business: CEO, CFO, or external financial statement user. If your group is comprised of 3 students, then one student will act as both a potential investor and a potential creditor. If your group is comprised of 4 students, then one student will be a potential investor, while another is a potential creditor. Each group member will be responsible for specific tasks relating to their representative roles as follows Chief Executive Officer (CEO) The CEO is tasked with making key financial and strategy decisions for the business. The CEO should analyze key management accounting information of the company including its business practices, its industry, and its forecasts for future profits when making decisions. CEO's are tasked with making operational decisions as well as navigating potential investment opportunities and external financing decisions. Chief Financial Officer (CEO) The CFO is involved in all record keeping transactions for the business and advising the CEO about the current financial health of the business and the forecasts of future profits. The CFO should understand 3 how to value the business, the importance of raising capital (i.e. acquiring cash flows from external parties), and be able to assess whether transactions with external parties would be beneficial or harmful to the business. Potential Investor Potential investors are expected to perform due diligence of any company interested in obtaining equity financing from the investor. The investor should analyze the financial statements throughout the process to understand if the company is a worthwhile investment. Important factors for an equity investor is the percentage ownership stake the company's management is willing to give up, the forecasted future profits of the business, and the potential for company's management to pay dividends.Virtual Proje ACCTS'IS-Gt Canvas ' \" Microsoft 365 ACCT615-Group Proiect Instruction v3.pdf X ACCT615-Gi ct%20|nstruc in Linkedln x ' Spreadshee x 'I- ACCT615-t x t Homework! x '- Search Rest X Group Project ACCT61 5 Activig Instructions As a group, you must make one strategic decision about your business from each of the three categories: Asset Purchase, Assume a Liability, Equity Transaction All decisions should be discussed amongst the group and documented on the Student Worksheets for each strategic decision, taking into consideration the company's business operations, industry, and future goals. Your ndings will then be presented virtually through a pre-recorded presentation, Following each decision: The CEO should write her/his thought process in making the decision, This response should involve critically thinking about the business' operations and the goals of the board of directors. The CEO should then seek advice thin the CFO about the ability for the company to nancially handle the transaction In this response, he sure to highlight the key management accounting information utilized in the decision makingprocess and the pros and cons that led to the decision made. The CFO should prepare all journal entries necessary to record the strategic decisions of the business and describe how this transaction impacts the company's Accounting Equation. The CFO should then prepare an adjusted Balance Sheet for the company immediately following the transaction as well as a _year over year trend for future revenues expenses and net incomes for the following two years. The potential investors and creditors should prepare two key financial ratios relevant to their important factors outlined previously, including why they chose these ratios These nancial ratios should be analyzed both before and aer the strategic decision is made. For each analysis, discuss the due diligence (i.e. why) as to whether the company represents a good investment for the external user and how the strategic decision inuenced their willingness to invest in or provide a loan to the company. (Note: The potential investors and creditors here are not the same as those mentioned in the strategic decisions below.) Strategic Decisions Assets Purchases Fresh Springs 7 Purchase $3,000 of merchandise inventory to be resold to customers (Yes/No) AirMaddens 7 Rent a factory or warehouse for $12,000 to start future production (If current cash does not cover the costs, this choice is contingent on obtaining either an equity investment or from the proceeds of a loan.) (Yes/No) Wahoo! 7 Pay an independent contractor $6,000 to build/update your company's website (The amount billed by the contractor will be classied as an asset rst) (Yes/No) Assume a Liabilig 1. Get a $50,000 loan from potential creditorA with repayment terms of 860.000 due in 3 years. C Chegg Sear x + v un- i'r nos Virtual Proje ACCTS'IS-Gt Canvas ' \" Microsoft 365 ACCT615-Group Proiect Instruction v3.pdf X ACCT615-Gi ct%20|nstruc in Linkedln x ' Spreadshee x 'I- ACCT615-t x t Homework! x '- Search Rest X Group Project ACCT61 5 Activig Instructions As a group, you must make one strategic decision about your business from each of the three categories: Asset Purchase, Assume a Liability, Equity Transaction All decisions should be discussed amongst the group and documented on the Student Worksheets for each strategic decision, taking into consideration the company's business operations, industry, and future goals. Your ndings will then be presented virtually through a pre-recorded presentation, Following each decision: The CEO should write her/his thought process in making the decision, This response should involve critically thinking about the business' operations and the goals of the board of directors. The CEO should then seek advice thin the CFO about the ability for the company to nancially handle the transaction In this response, he sure to highlight the key management accounting information utilized in the decision makingprocess and the pros and cons that led to the decision made. The CFO should prepare all journal entries necessary to record the strategic decisions of the business and describe how this transaction impacts the company's Accounting Equation. The CFO should then prepare an adjusted Balance Sheet for the company immediately following the transaction as well as a _year over year trend for future revenues expenses and net incomes for the following two years. The potential investors and creditors should prepare two key financial ratios relevant to their important factors outlined previously, including why they chose these ratios These nancial ratios should be analyzed both before and aer the strategic decision is made. For each analysis, discuss the due diligence (i.e. why) as to whether the company represents a good investment for the external user and how the strategic decision inuenced their willingness to invest in or provide a loan to the company. (Note: The potential investors and creditors here are not the same as those mentioned in the strategic decisions below.) Strategic Decisions Assets Purchases Fresh Springs 7 Purchase $3,000 of merchandise inventory to be resold to customers (Yes/No) AirMaddens 7 Rent a factory or warehouse for $12,000 to start future production (If current cash does not cover the costs, this choice is contingent on obtaining either an equity investment or from the proceeds of a loan.) (Yes/No) Wahoo! 7 Pay an independent contractor $6,000 to build/update your company's website (The amount billed by the contractor will be classied as an asset rst) (Yes/No) Assume a Liabilig 1. Get a $50,000 loan from potential creditorA with repayment terms of 860.000 due in 3 years. C Chegg Sear x + v un- i'r nos Files Virtual Project X ACCT615-Gro x ACCT615-Gro X MSpreadsheet : X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C Fitxer | /Users/david/Downloads/ACCT615-Group%20Project%20Instruction%20v3.pdf Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615-Group Project Instruction v3.pdf 2 / 3 94% transaction. In this response, be sure to highlight the key management accounting information utilized in the decision making process and the pros and cons that led to the decision made. Grump Project The CFO should prepare all journal entries necessary to record the strategic decisions of the business ACCTCIS and describe how this transaction impacts the company's Accounting Equation. The CFO should then prepare an adjusted Balance Sheet for the company immediately following the transaction as well as a year over year trend for future revenues, expenses, and net incomes for the following two years. The potential investors and creditors should prepare two key financial ratios relevant to their important factors outlined previously, including why they chose these ratios. These financial ratios should be analyzed both before and after the strategic decision is made. For each analysis, discuss the due diligence (i.e. why) as to whether the company represents a good investment for the external user and how the strategic decision influenced their willingness to invest in or provide a loan to the company. (Note: The potential investors and creditors here are not the same as those mentioned in the strategic decisions below. Strategic Decisions Assets Purchases Fresh Springs - Purchase $3,000 of merchandise inventory to be resold to customers (Yes/No) AirMaddens - Rent a factory or warehouse for $12,000 to start future production (If current cash does not cover the costs, this choice is contingent on obtaining either an equity investment or from the proceeds of a loan.) (Yes/No) 2 Wahoo! - Pay an independent contractor $6,000 to build/update your company's website (The amount billed by the contractor will be classified as an asset first.) (Yes/No) Assume a Liability 1. Get a $50,000 loan from potential creditor A with repayment terms of $60,000 due in 3 years. 2. Get a $50,000 loan from potential creditor B with $50,000 due in 4 years and $2,000 in interest payments due each year until the loan is fully paid. Equity Transaction 1. Sell 25% of the business to potential investor A for a valuation of $40,000. 3 2. Sell 10% of the business to potential investor B for a valuation of $12,000.Files Virtual Project X ACCT615-Gro x ACCT615-Gro X MSpreadsheet : X + ACCT615 - GI X Homework He X Search Result X C Chegg Search X C Fitxer | /Users/david/Downloads/ACCT615-Group%20Project%20Instruction%20v3.pdf Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615-Group Project Instruction v3.pdf 3 / 3 94% + Group Project ACCT615 ACCT CIS Equity Transaction Example If company C's common stock account balance was 100,000 (10,000 shares) and it sells 10% of the business to potential investor D for a valuation of $50,000, this will involve journal entries below: Debi Credit March 1 Cash 50,000 Capital Stock (par value $10 per share) 10,000 Additional Paid in Capital 40,000 Sale of 1,000 shares of stock at $50 per share. Both Capital Stock account and Additional Paid in Capital account is Stockholders' equity account. (Have normal credit balances.) The Capital Stock account and Additional Paid in Capital account balance after the journal entry is made. Capital Stock March 1 $ 100,000 March 1 $10,000 Bal. $ 110,000 Additional Paid in Capital Mar 1 $ 40,000 Bal. $ 40,000 3Files Virtual Project X ACCT615-Gro X ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C Fitxer | /Users/david/Downloads/ACCT615-Group%20Project%20Presentation%20Rubric.pdf Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin E ACCT615-Group Project Presentation Rubric.pdf 1 / 1 101% + Group Project Presentation Assignment - Presentation Instructions and Rubric Group Name: CEO: Company Name: CFO: Investor Creditor: In addition to the activities for this project, groups are expected to prepare visual Powerpoint presentations of their findings. Presentations should last between 5 - 10 minutes, and each group member is responsible for presenting their portion of the work performed. Presentations can be prepared in a virtual Webex/Zoom meeting room and recorded and uploaded to Canvas under the Group Project assignment in the Assignments Tab. Each member should provide the information outlined in the following rubric while sharing 1 set of PowerPoint slides for all members' presentations. Score Introduction Failed to introduce the Rarely presented information Presented some but not all Presented both information Effectively introduced the Company and provide an about the Company and the information about the about the Company and the Company and articulated the overview of the strategic strategic decision-making Company and the strategic strategic decision-making need for strategic decision- decision-making process process decision-making process process. making by the Company. CEO Failed to discuss management Rarely discuss management Often discuss management Always discuss management Effectively/articulately discuss accounting information and the accounting information and the accounting information and the accounting information and the management accounting role of the CEO in strategic role of the CEO in strategi role of the CEO in strategic role of the CEO in strategic information and the role of the decision-making decision-making. decision-making. decision-making CEO in strategic decision- making. CFO Failed to present journal Rarely present journal entries, Often present journal entries, Always present journal entries, Effectively/articulately present entries, balance sheet balance sheet information, and balance sheet information, and balance sheet information, and journal entries, balance sheet information, and future future financial expectations future financial expectations for future financial expectations information, and future financial expectations for the for the company the company for the company. financial expectations for the company. company. Investors Failed to present financial ratio Rarely present financial ratio Often present financial ratio Always present financial ratio Effectively/articulately present calculations and changes to calculations and changes to calculations and changes to calculations and changes to financial ratio calculations and ratios, reasoning for choice of ratios, reasoning for choice of ratios, reasoning for choice of ratios, reasoning for choice of changes to ratios, reasoning for key ratios, and evaluation of key ratios, and evaluation of key ratios, and evaluation of key ratios, and evaluation of choice of key ratios, and the company. the company. the company. the company. evaluation of the company. Creditors Failed to present financial ratio Rarely present financial ratio Often present financial ratio Always present financial ratio Effectively/articulately present calculations and changes to calculations and changes to alculations and changes to calculations and changes to financial ratio calculations and ratios, reasoning for choice of ratios, reasoning for choice of ratios, reasoning for choice of ratios, reasoning for choice of changes to ratios, reasoning for key ratios, and evaluation of key ratios, and evaluation of key ratios, and evaluation of key ratios, and evaluation of choice of key ratios, and the company. the company. the company. the company. evaluation of the company. Overall Failed to provide any Rarely provide information or Often provide information or Always provide information or Effectively/articulately provide information or analyses related analyses related to the analyses related to the nalyses related to the information or analyses related to the Company's strategic Company's strategic decision- Company's strategic decision- Company's strategic decision- to the Company's strategic decision- making. making. making. making. decision- making.Files Virtual Project X ACCT615-Gro x ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework He X Search Result X C Chegg Search X C docs.google.com/spreadsheets/d/14KT13IGnf6j_XZIs-jH3v7-3XtFujpabfQaXBOH84nM/edit#gid=0 Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615 - Group 5 Project * 4 & 2 Share D File Edit View Insert Format Data Tools Extensions Help 100% $ % .0 .00 Calibri Y - 15 + B ISAD. A1:B1 fx Group Project A B C D E F G H J K L Group Project 2 Name 3 Group Name Group 5 4 Company Name AirMaddens 5 6 CEO David Alcala Santiago 7 CFO Luke Mishrell 8 Investor Keegan Ford 9 Creditor Mohammed Alabass 10 Decision Type Decision Made 11 Strategic Decision 1 Asset Purchase 12 Strategic Decision 2 Assume a Liability 13 Strategic Decision 3 Equity Transaction 14 15 16 17 18 19 20 21 22 23 24 25 + Summary Strategic Decision 1 * Strategic Decision 2 . Strategic Decision 3 . Materials - CEO . Materials - CFO . Materials - Inv Files Virtual Project X ACCT615-Gro x ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C docs.google.com/spreadsheets/d/14KT13IGnf6j_XZIs-jH3v7-3XtFujpabfQaXBOH84nM/edit#gid=1131285024 Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615 - Group 5 Project * 4 & 2 Share D File Edit View Insert Format Data Tools Extensions Help Q 50% Y $ % .0 .00 Calibri 15 + B A1:D1 fx Strategic Decision 1 Strategic Decision 1 Decision Type Asset Purchase Assume a Liability Equity Transaction Check the box X CEO Reasoning Type the reasoning here (by CEO) 10 CFO Advice 12 AirMaddens would use $12,000 in cash to pay for the annual factory rent. 13 Outstanding debt would remain at $26,000 and the projected operating income would only be $1,000. As CFO I would advise against using cash for this 15 16 Journal Entries Account Title Debit Credit Rent Expense (Factory) $12,000 Cash $12,000 AirMaddens-Balance Sheet (Before Transaction) AirMaddens-Income Statement 23 Impact to Accounting Equation Assets Liabilities For the Year end Dec 31, 2021 ctory Rental, S 24 The factory rental is an asset so $12,000 would be added to the Balance Sheet as Cash $25,000 Accounts Payable $6,000 Net Sales $100,000 25 e transaction would happen with cash, we must reduce Accounts Receivable $6,000 Long-Term Loan 20,000 the cash account by $12,000. The net effect on the Accounting Equation would be Less: COGS $87,000 26 cancelled out and the total asset woudl remain at $31,000. Owner's Equity Gross Profit $13,000 27 Income Statement Project Capital Stock $5.000 Less: Operating Expenses If AirMaddens achieves its forecasted revenue of $100,000 in 2021 it will have a Factory Rent $12,000 29 net income of $13,000. If the expense of the factory rental in included with no change in revenue forecast, the net income will be reduced to $1,000. Total Assets $31,000 Total Liabilities & OE $31,000 Operating Income $1,000 31 Investors Reasoning 32 Investor Key Financial Ratios: AirMaddens-Balance Sheet (After Transaction 33 Investor Calculation & Discussion Asset Liabilities Do not advise the rental of a factory or warehouse with the current position of the Cash $13,000 Accounts Payable $6,00 35 company from and investor standpoint. Accounts Receivable $6,000 Long-Term Loan $20,000 Factory Space (Annual) $12,000 Owner's Equity Capital Stock $5.000 Creditors Reasonings Creditor Key Financial Ratios: Total Assets $31,000 Total Liabilities & OE $31,000 41 Creditor Calculation & Discussion 3750 42 Type here (by Creditor) 38750 43 46 + Summary Strategic Decision 1 . Strategic Decision 2 . Strategic Decision 3 . Materials - CEO . Materials - CFO . Materials - In Files Virtual Project X ACCT615-Gro x ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C docs.google.com/spreadsheets/d/14KT13IGnf6j_XZIs-jH3v7-3XtFujpabfQaXBOH84nM/edit#gid=1521056531 Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615 - Group 5 Project * 4 & 2 Share D File Edit View Insert Format Data Tools Extensions Help Q 50% Y $ % .00 Calibri 15 + B I SAD. E A1:D1 fx Strategic Decision 2 Strategic Decision 2 Income Statement Projection Decision Type Asset Pruchase Assume a Liability Equity Transaction Assume 0% Growth (most Conservative) Creditor A Creditor B Check the box X Revenue Income Factory Rent Accure interest Cash Operating Income nterest Cash Operating Income CEO Reasoning 2020 o $75,000 0 $75,000 Type the reasoning here (by CEO) $2,021.00 $100,000.0 $13,000.00 $12,000.00 $3,333.33 $72,66 $2,333.33 $2,000.0 $74,000 -$1,000.00 $2,022.00 $100,000.00 $13,000.00 $12,000.00 $3,333.33 $70,333 $2,333.33 $2,000.0 $73,000 -$1,000.00 $2,023.00 $100,000.00 $13,000.00 $12,000.0 $3,333.33 $18,000 -$2,333.33 $2,000.0 $72,000 -$1,000.00 $2,024.00 $100,000.00 $13,000.00 $12,000.00 $2,000.00 $21,000 -$1,000.00 CFO Advice 12 Creditor B's loan structure provides more efficient use of company capital. Although the interest from Creditor A is not due each year, we still need to 13 accrue the interest when preparing financial statements (except statement of cash flows). Creditor B's terms leave the company in a better cash position after 4 years. AirMaddens-Balance Sheet AirMaddens-Income Statement Assets Liabilities For the Year end Dec 31, 2021 Journal Entries Cash $25,000 Accounts Payable $6,00 Net Sales $100,000 Account Title Debit Credit Accounts Receivable $6,000 Long-Term Loan $20,000 Less: COG $87,000 Interest Expense $3,333 or $2,000 Owner's Equity Gross Profit $13,000 Interest Payable (Annual) $3,333 or $2,000 Capital Stock $5,000 Less: Operating Expenses 20 Factory Rent $12,000 21 Impact to Accounting Equation Interest Expense The firm value will increase by $50,000 by taking on either loan. The total Total Assets $31,000 Total Liabilities & OE $31,000 Operating Income $1,000 Assets will balance Total Liabilities & Owner's Equity at $81 AirMaddens-Balance Sheet 25 Income Statement Project Assets Liabilities 26 The most conservative projection over the life of the loans (0% revenue and Cash $75,000 Accounts Payable $6,000 27 gross profit growth) favors Creditor B's terms. With Creditor B's loan, the cash position at the end of year 4 will be $21,000. The Creditor A loan Accounts Receivable $6,000 Long-Term Loan $70,000 cash positions of $18,000 at the end of year 3. Also, the annual operating income loss is less for Creditor B's loan. Factory $12,000 Rent Payable $12,00 Investors Reasonings Owner's Equity Investor Key Financial Ratios: Capital Stock $5,000 Investor Calculation & Discussion Creditor B Total Assets $93,000 Total Liabilities & OE $93,00 3750 38750 Creditors Reasonings Creditor Key Financial Ratios: Creditor Calculation & Discussion Type here (by Creditor) 41 42 43 + Summary * Strategic Decision 1 Strategic Decision 2 . Strategic Decision 3 . Materials - CEO . Materials - CFO . Materials - InFiles Virtual Project X ACCT615-Gro x ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C docs.google.com/spreadsheets/d/14KT13IGnf6j_XZIs-jH3v7-3XtFujpabfQaXBOH84nM/edit#gid=1186045905 Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615 - Group 5 Project * 4 & 2 Share D File Edit View Insert Format Data Tools Extensions Help Q 50% Y $ .00 Calibri - 15 + B I SAD. E A1:D1 fx Strategic Decision 3 Strategic Decision 3 Decision Type Asset Pruchase Assume a Liability Equity Transaction Assume 0% Growth (most Conservative) Investor A Investor B Check the box Revenue Income Factory Rent Cash Operating Income Cash Operating Income CEO Reasoning 2020 $25,000.00 $25,000 Type the reasoning here (by CEO) 2021 $100,000.00 $13,000.00 $12,000.00 $66,000.00 $1,000.00 $38,000 $1,000.00 AWNHC 2022 $13,000.00 $12,000.00 $67,000.00 $1,000.00 $39,000 $1,000.0 2023 $100,000.00 $13,000.00 $12,000.00 $68,000.00 $1,000.00 $40,000 $1,000.00 2024 $100,000.00 $13,000.00 $12,000.00 $69,000.00 $1,000.00 $41,000 $1,000.00 CFO Advice 12 Investor A's 25% stake in the AirMaddens strengthens the cash positions on balance sheet for years to come. This should protect the company to improve its economies of scale in manufacturing. Investor B is a better option because it allows us to 14 accomplish our goal of adding a factory by only giving up a 10% stake. If the company can become more profitable with the factory then the stock held by the original AirMaddens-Balance Sheet (Option 1-Investor A) AirMaddens-Income Statement 15 owner's is more valuable with Investor B. Assets Liabilities For the Year end Dec 31, 2021 16 Journal Entries (Option 1-Investor A) Cash $65,000 Accounts Payable $6,000 Net Sales $100,000 Account Title Debit Credit Accounts Receivable $6,000 Long-Term Loan $20,000 Less: COGS $87,000 18 $40,000.00 Factory $12,000 Rent Payable $12,000 Gross Profit $13,000 19 Capital Stock $1,250.00 Owner's Equity Less: Operating Expenses 20 Additional Paid in Capital $38,750.00 Capital Stock $6,250 Factory Rent $12,000 21 Sell 25% of Business to Investor A for a valuation of $40,000 Additional Paid in Capital $38,750 22 Journal Entries (Option 2-Investor B) 23 Account Title Debit Credit Total Assets $83,000 Total Liabilities & OE $83,000 24 Cash $12,000.00 5 Capital Stock $500.00 26 Additional Paid in Capital $11,500.00 AirMaddens-Balance Sheet (Option 2-Investor B) 27 Sell 10% of Business to Investor A for a valuation of $12,000 |Assets Liabilities 28 Impact to Accounting Equation Cash $37,000 Accounts Payable $6,000 29 Investor A: Increase Assets by $40k and Owner's Equity by $40k. Investor B: Increase Accounts Receivable $6,000 Long-Term Loan $20,000 30 Assets by $12k and Owner's Equity by $12k. Factory $12,000 Rent Payable $12,000 Owner's Equity 32 Income Statement Project Capital Stock $5,500.00 Income Statement is not impacted by the equity transaction. This is a Cash Flow from Additional Paid in Capital $11,500.00 34 Financing Activities and would show up on a Statement of Cash Flows. Total Assets $55,000 Total Liabilities & OE $55,000 35 36 Investors Reasonings 37 Investor Key Financial Ratios: Investor Calculation & Discussion Investor B 42 43 44 Creditors Reasonings 45 Creditor Key Financial Ratios: Creditor Calculation & Discussion Type here (by Creditor) + Summary * Strategic Decision 1 > Strategic Decision 2 . Strategic Decision 3 . Materials - CEO . Materials - CFO . Materials - In Files Virtual Project X ACCT615-Gro x ACCT615-Gro x M Spreadsheet X + ACCT615 - GI X Homework HE X Search Result X C Chegg Search X C docs.google.com/spreadsheets/d/14KT13IGnf6j_XZIs-jH3v7-3XtFujpabfQaXBOH84nM/edit#gid=1600670216 Actualitza Canvas Highlander Pipeline M GMail Microsoft 365 in Linkedin ACCT615 - Group 5 Project * 4 & 2. Share D File Edit View Insert Format Data Tools Extensions Help Q 5 50% $ % .0 9 123 Defaul 10 + 041 fx List all information utilized for strategic decision making and investing/crediting decision making. + Summary * Strategic Decision 1 * Strategic Decision 2 . Strategic Decision 3 . Materials - CEO . Materials - CFO . Materials - In

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts