Question: Assignment #1 - Chapter Review Problem 7-1. Fast the information betow and follow the inaructions. Taxpayer Information: Emily and Jacob met in university and married

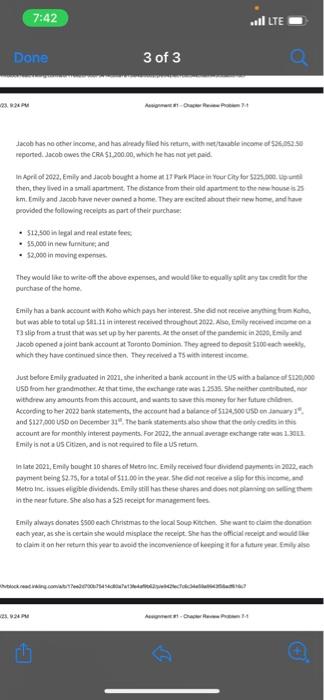

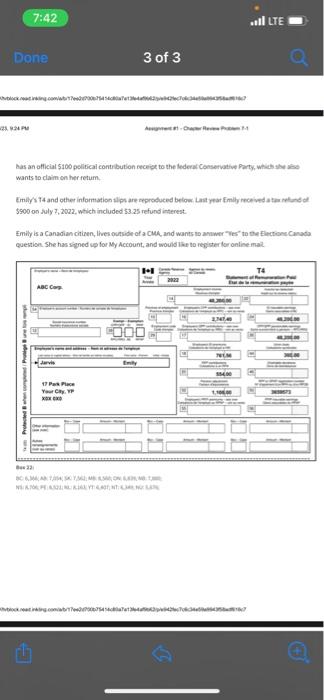

Assignment \#1 - Chapter Review Problem 7-1. Fast the information betow and follow the inaructions. Taxpayer Information: Emily and Jacob met in university and married in 2002. Imily has dways beem active in her lokal commanity, poltica, and noently warsed ineatine fimly completed her three year program in 2521, and found enployment fult sime at Aac Copn in the fall of 2022. 7:42 .HI LTE Done 3 of 3 22, 924\% Bas an official $100 politicai contribution receise to the lederak Conservative Party, whish she ifse wants to claim on her retum. Emilys 14 and other information slips are reprofuced below. Last year fmily received a tam refone d. $900 on July 2,2022 , which included $3.25 refund interest. quention she has signed sp for My Accoount, and would the to regicter for online mal. Bas 22 reported. Jacob owes the CRI $1.250.00, which he bas not ret paid. km. Emily and dacob have never owhed a home. They are escited about their new home, and tave peovided the following receipts as part of their purchase: - 512,500 in legal and real estant lees: - $5,000 in new furriture, and - $2.000 in moving experues. They would like to weite oft the above expenses, and would the to equally aplit ary tracindit for the purchase of the home. Emily han a bank sccount with Noho which pays her incerest. She did not receive aryoning tom Koha. T3 slip frem a trust that was set up by her parents. As the onset of the pandemit in atak, finly and which they have concinued since then. They receiced a ts with interest incame. Acconding to her 2022 bark statements, the account had a bilante of 5124,500 us5 en janciary 1. and $127,000 usb on December 31", The bark statements abs shew that the torty condes in this account are for monthly interest poyments. For 2022, the annasi merage exchange rate was 1.3911 Emily is not a US Citizen, and is not required to file a US retum. In late 2021, Emly bought 10 shares of Metro inc. Emily received four dinidend parmenes in 2om2, raxth in the near future. She aso has a 525 receipt formanaperment fees. Emily always donates $500 each Christinas to the local 50 op Kechen. She want to claim the donacion each year, as she is certain she would misplace the receipt. she has the official receigt and eould tiat Assignment \#1 - Chapter Review Problem 7-1. Fast the information betow and follow the inaructions. Taxpayer Information: Emily and Jacob met in university and married in 2002. Imily has dways beem active in her lokal commanity, poltica, and noently warsed ineatine fimly completed her three year program in 2521, and found enployment fult sime at Aac Copn in the fall of 2022. 7:42 .HI LTE Done 3 of 3 22, 924\% Bas an official $100 politicai contribution receise to the lederak Conservative Party, whish she ifse wants to claim on her retum. Emilys 14 and other information slips are reprofuced below. Last year fmily received a tam refone d. $900 on July 2,2022 , which included $3.25 refund interest. quention she has signed sp for My Accoount, and would the to regicter for online mal. Bas 22 reported. Jacob owes the CRI $1.250.00, which he bas not ret paid. km. Emily and dacob have never owhed a home. They are escited about their new home, and tave peovided the following receipts as part of their purchase: - 512,500 in legal and real estant lees: - $5,000 in new furriture, and - $2.000 in moving experues. They would like to weite oft the above expenses, and would the to equally aplit ary tracindit for the purchase of the home. Emily han a bank sccount with Noho which pays her incerest. She did not receive aryoning tom Koha. T3 slip frem a trust that was set up by her parents. As the onset of the pandemit in atak, finly and which they have concinued since then. They receiced a ts with interest incame. Acconding to her 2022 bark statements, the account had a bilante of 5124,500 us5 en janciary 1. and $127,000 usb on December 31", The bark statements abs shew that the torty condes in this account are for monthly interest poyments. For 2022, the annasi merage exchange rate was 1.3911 Emily is not a US Citizen, and is not required to file a US retum. In late 2021, Emly bought 10 shares of Metro inc. Emily received four dinidend parmenes in 2om2, raxth in the near future. She aso has a 525 receipt formanaperment fees. Emily always donates $500 each Christinas to the local 50 op Kechen. She want to claim the donacion each year, as she is certain she would misplace the receipt. she has the official receigt and eould tiat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts