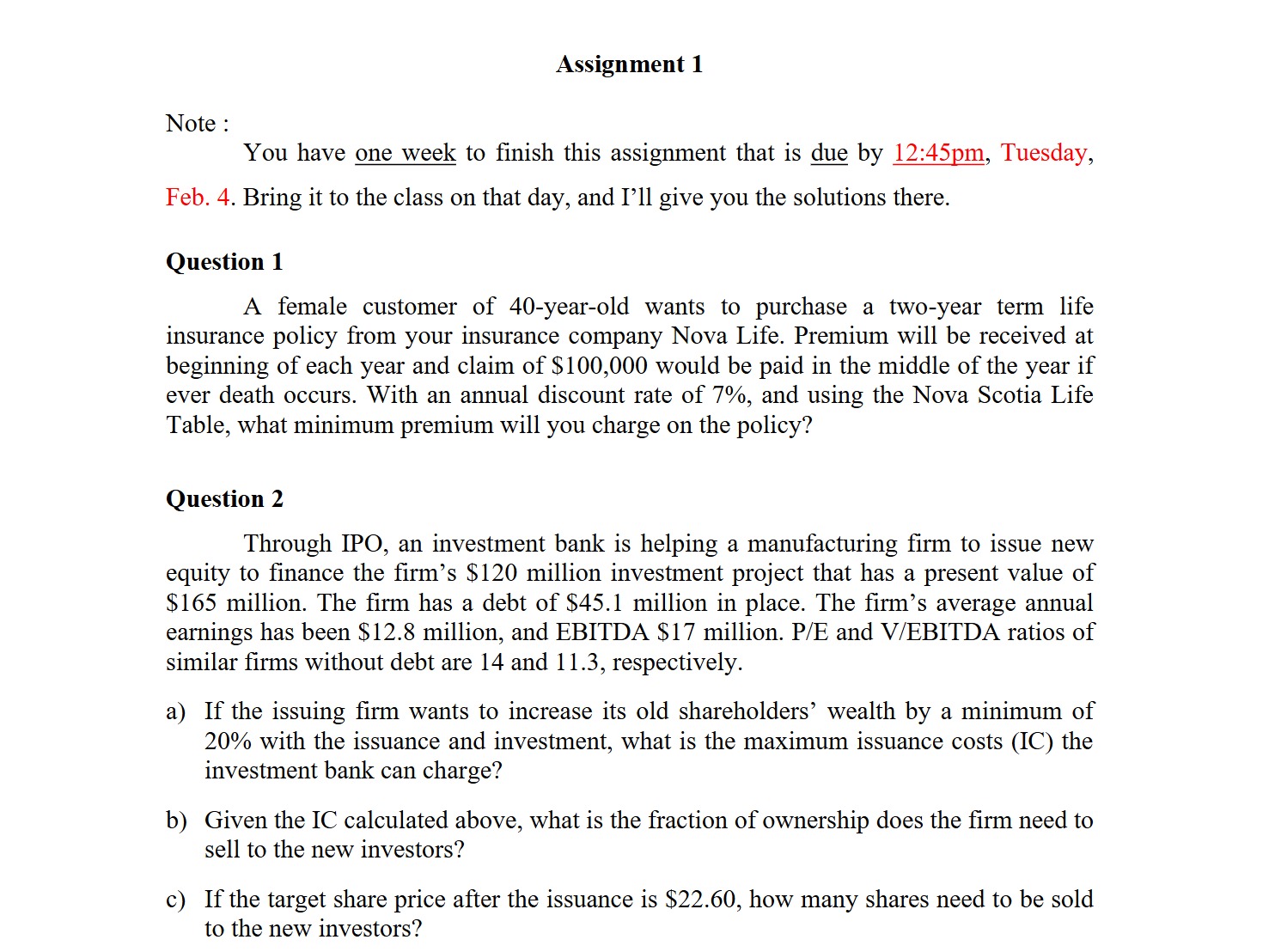

Question: Assignment 1 Note : You have one week to finish this assignment that is due by ( 1 2 : 4 5 mathrm

Assignment

Note :

You have one week to finish this assignment that is due by : mathrmpm Tuesday, Feb. Bring it to the class on that day, and I'll give you the solutions there.

Question

A female customer of yearold wants to purchase a twoyear term life insurance policy from your insurance company Nova Life. Premium will be received at beginning of each year and claim of $ would be paid in the middle of the year if ever death occurs. With an annual discount rate of and using the Nova Scotia Life Table, what minimum premium will you charge on the policy?

Question

Through IPO, an investment bank is helping a manufacturing firm to issue new equity to finance the firm's $ million investment project that has a present value of $ million. The firm has a debt of $ million in place. The firm's average annual earnings has been $ million, and EBITDA $ million. PE and VEBITDA ratios of similar firms without debt are and respectively.

a If the issuing firm wants to increase its old shareholders' wealth by a minimum of with the issuance and investment, what is the maximum issuance costs IC the investment bank can charge?

b Given the IC calculated above, what is the fraction of ownership does the firm need to sell to the new investors?

c If the target share price after the issuance is $ how many shares need to be sold to the new investors?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock