Question: Assignment 12: Chapter 12 End-of-Chapter Problems The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initlal after-tax cash outhow

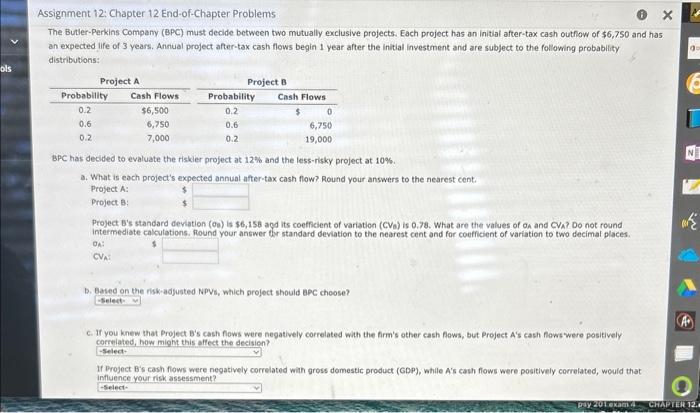

Assignment 12: Chapter 12 End-of-Chapter Problems The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each project has an initlal after-tax cash outhow of $6,750 and has an expected life of 3 years. Annual project after-tax cash flows begin 1 year after the initial investment and are subject to the following probability distributions: BPC has decided to evaluate the riskier project at 12% and the less-risky project at 10%. 3. What is each project's expected annual after-tax cash flow? Round your answers to the nearest cent. Project A: $ Project B: 5 Project B's standard devlation (OB) is $6,158 aod its coefficient of variation (CVO) is 0.78. What are the values of an and CVA ? Do not round intermediate calculations. fround your answer thr standard deviation to the nearest cent and for coefficient of variation to two decimal places. oACV D. Based on the risk-adgusted NPYs, which project should apc choose? c. If you knew that Project B's cash fows were negatively correlated with the firm's other cash flows, but Project A's cash fows were positively correiated. hnw miaht thie affert tha deecisian? If Project B's cash fows were negatively correlated with gross domestic product (GDP), whille A's cash flows were positively correlated, would that influence vour risk assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts