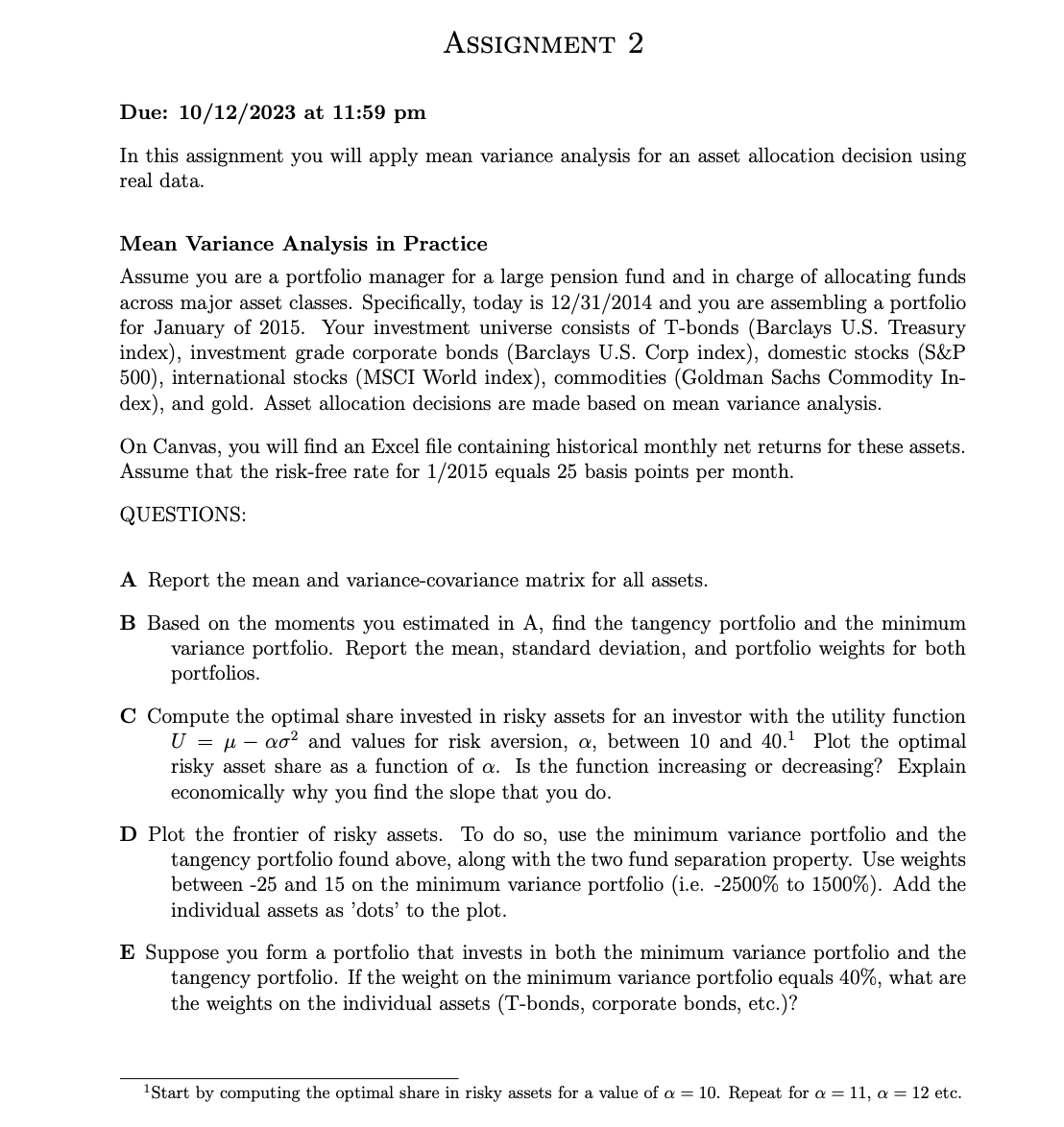

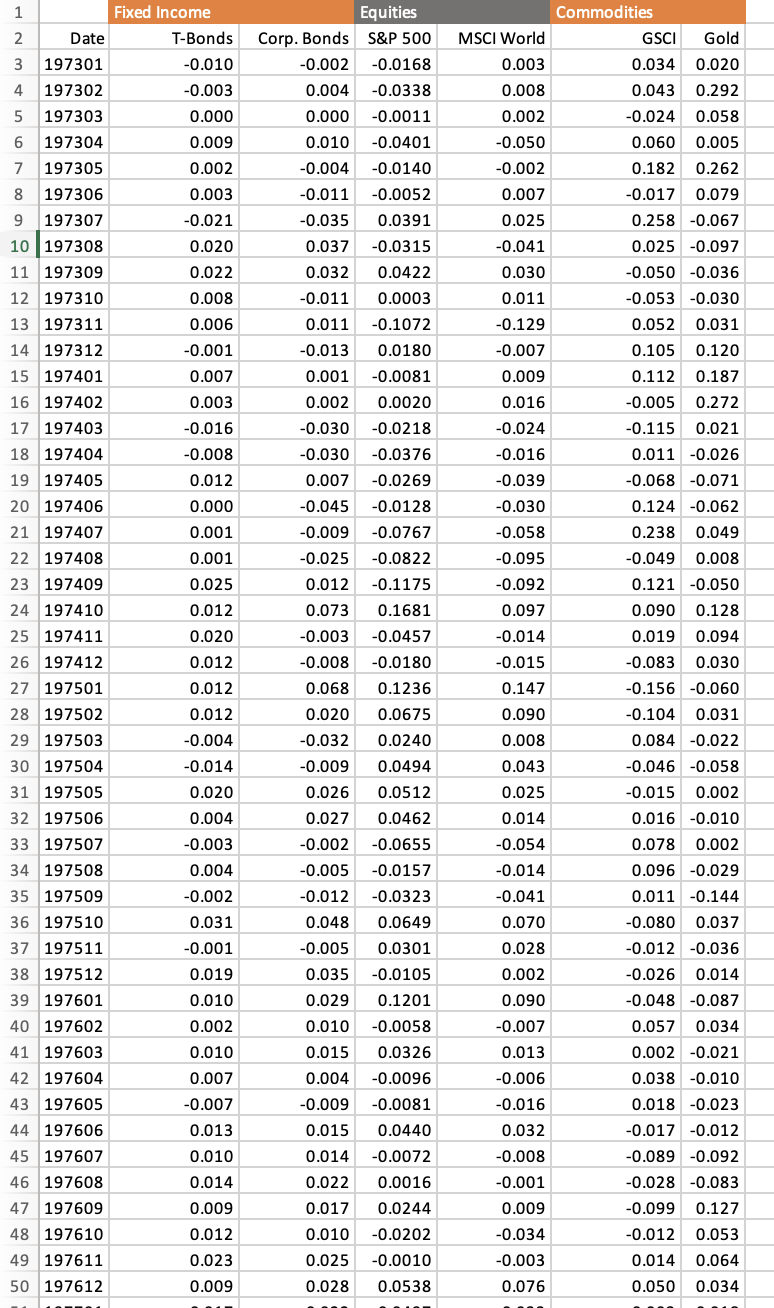

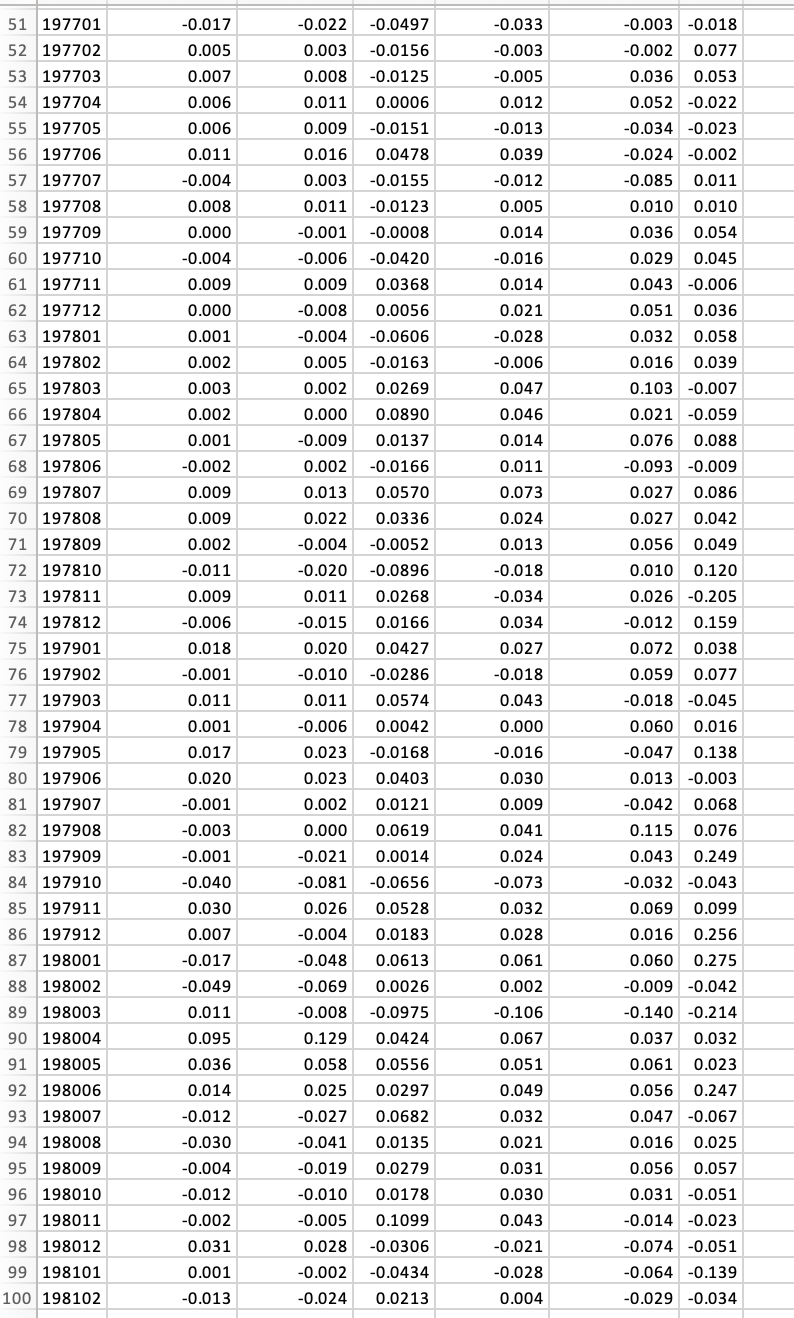

Question: ASSIGNMENT 2 Due: 10/12/2023 at 11:59 pm In this assignment you will apply mean variance analysis for an asset allocation decision using real data. Mean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts