Question: Assignment #3 (7 points) Jim Jacobs is negotiating with a Venture Capital Fund for ( $ 4 mathrm{MIL} ) financing for his new venture. Jim

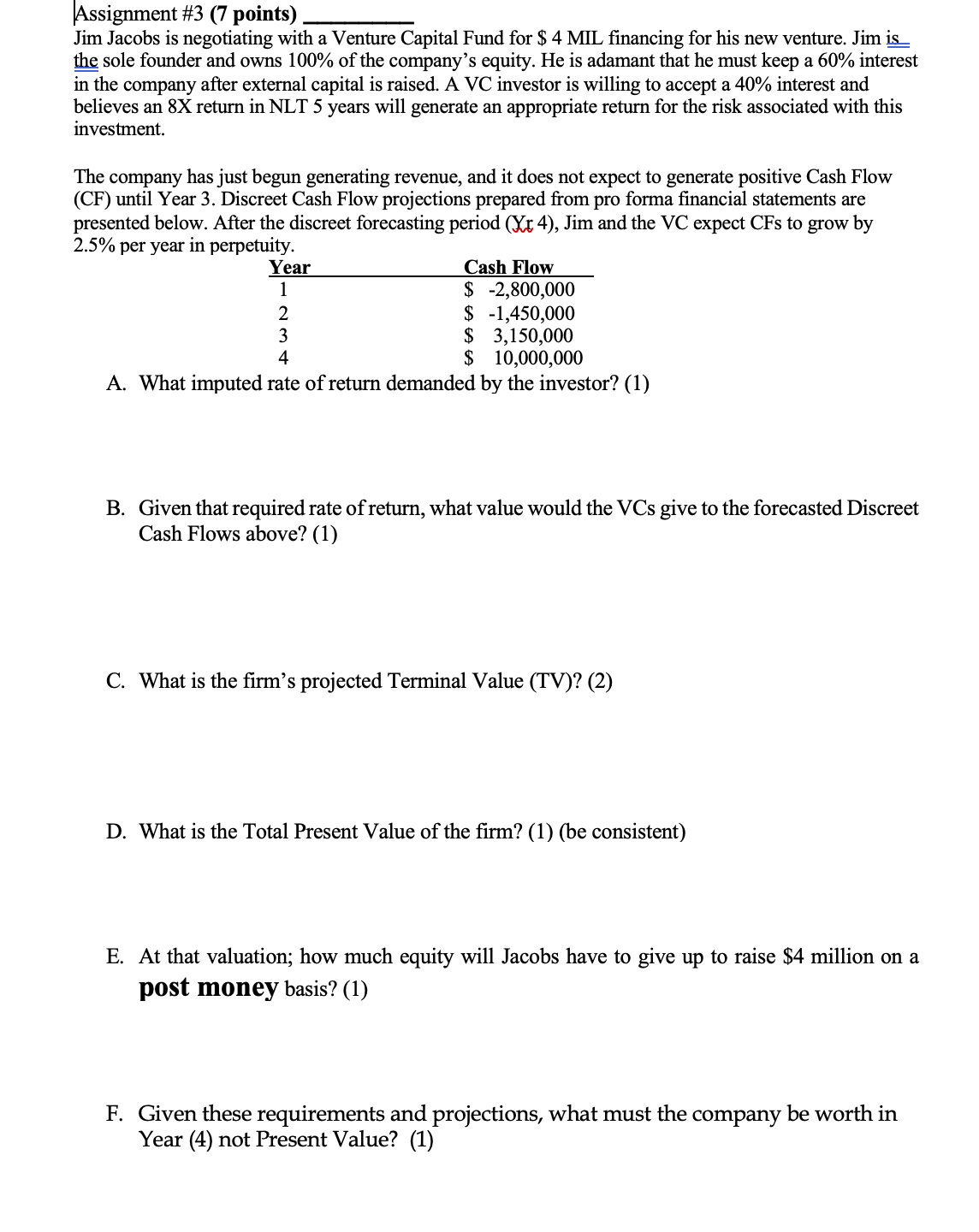

Assignment \\#3 (7 points) Jim Jacobs is negotiating with a Venture Capital Fund for \\( \\$ 4 \\mathrm{MIL} \\) financing for his new venture. Jim is the sole founder and owns \100 of the company's equity. He is adamant that he must keep a \60 interest in the company after external capital is raised. A VC investor is willing to accept a \40 interest and believes an 8X return in NLT 5 years will generate an appropriate return for the risk associated with this investment. The company has just begun generating revenue, and it does not expect to generate positive Cash Flow (CF) until Year 3. Discreet Cash Flow projections prepared from pro forma financial statements are presented below. After the discreet forecasting period ( \\( \\mathrm{Xr} \\mathrm{4)} \\), Jim and the VC expect CFs to grow by \2.5 per year in perpetuity. A. What imputed rate of return demanded by the investor? (1) B. Given that required rate of return, what value would the VCs give to the forecasted Discreet Cash Flows above? (1) C. What is the firm's projected Terminal Value (TV)? (2) D. What is the Total Present Value of the firm? (1) (be consistent) E. At that valuation; how much equity will Jacobs have to give up to raise \\( \\$ 4 \\) million on a post money basis? (1) F. Given these requirements and projections, what must the company be worth in Year (4) not Present Value? (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts