Question: PLASE HELP! Problem 3 (15 points) Jim Jacobs is negotiating with a Venture Capital Fund for $ 3 MIL financing for his new venture Jim

PLASE HELP!

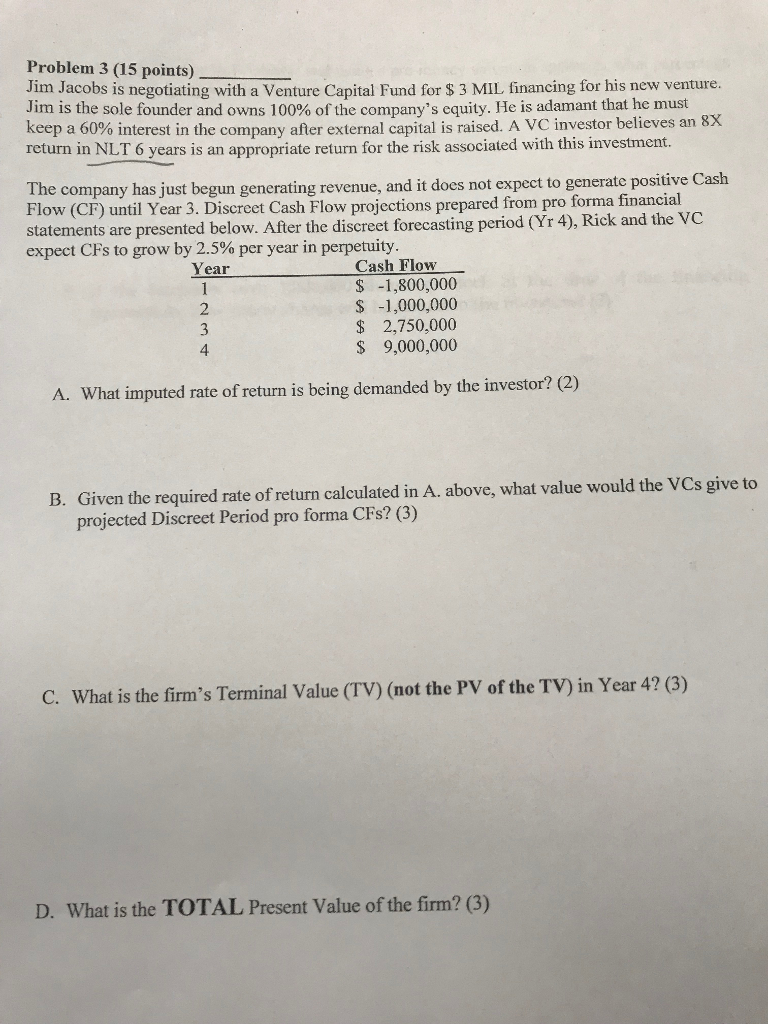

Problem 3 (15 points) Jim Jacobs is negotiating with a Venture Capital Fund for $ 3 MIL financing for his new venture Jim is the sole founder and owns 100% of the company's equity. He is adamant that he must keep a 60% interest in the company after external capital is raised. A VC investor believes an 8X return in NLT 6 years is an appropriate return for the risk associated with this investment. The company has just begun generating revenue, and it does not expect to generate positive Cash Flow (CF) until Year 3. Discrect Cash Flow projections prepared from pro forma financial statements are presented below. After the discreet forecasting period (Yr 4), Rick and the VC expect CFS to grow by 2.5% per year in perpetuity Cash Flow S -1,800,000 $ 1,000,000 Year 2,750,000 $ 9,000,000 4 A. What imputed rate of return is being demanded by the investor? (2) Given the required rate of return calculated in A. above, what value would the VCs give to projected Discreet Period pro forma CFs? (3) B. C. What is the firm's Terminal Value (TV) (not the PV of the TV) in Year 42 (3) D. What is the TOTAL Present Value of the firm? (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts