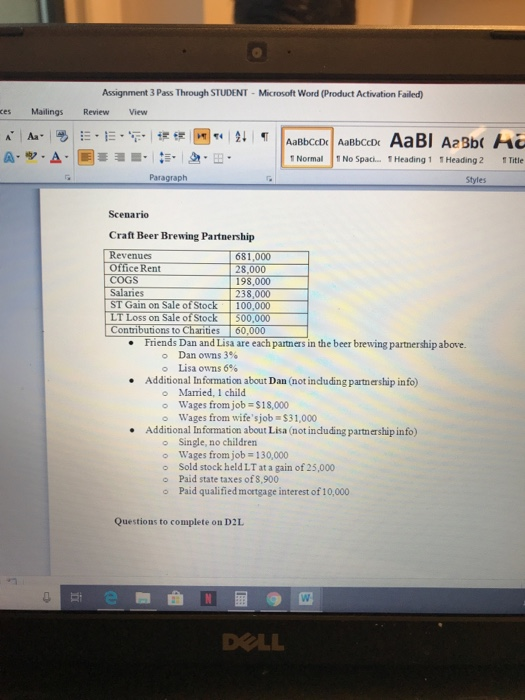

Question: Assignment 3 Pass Through STUDENT-Microsoft Word (Product Activation Failed) ces Mailings Review View Normal No Spaci... Heading 1 Heading 2 Title Paragraph Styles Scenario Craft

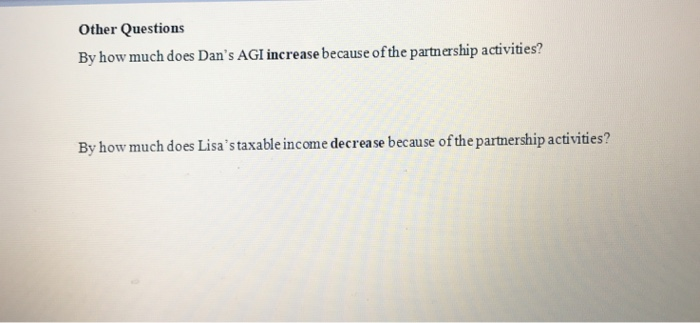

Assignment 3 Pass Through STUDENT-Microsoft Word (Product Activation Failed) ces Mailings Review View Normal No Spaci... Heading 1 Heading 2 Title Paragraph Styles Scenario Craft Beer Brewing Partnership Revenues Office Rent COGS Salaries ST Gain on Sale of Stock 100,000 LT Loss on Sale o Contributions to Charities 681,000 193,000 fStock 500 60,000 Friends Dan and Lisa are each partmers in the beer brewing partnership above. Dan owns 3% Lisa owns 6% Additional Information about Dan (not induding partnership info o Married, 1 child o Wages from job S18,000 o Wages from wife'sjob $31,000 .Additional Information about Lisa (not including partnership info) o Single, no children o Wages from job-130,000 o Sold stock held LT at a gain of 25,000 o Paid state taxes of S,900 o Paid qualified mortgage interest of 10,000 Questions to complete on D2L OLL Other Questions By how much does Dan's AGI increase because of the partnership activities By how much does Lisa's taxable income decrease because of the partnership activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts