Question: . Assignment - 4 DUE ON August 2nd, 2020 (6% IN THE FINAL) PROBLEM:1 Roxy Gymnastics purchased new equipment for $175,000. It is estimated that

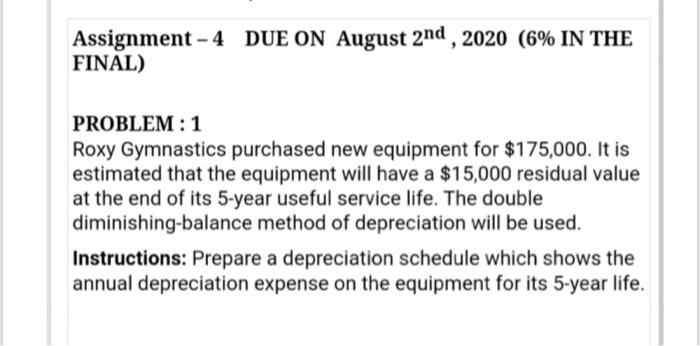

. Assignment - 4 DUE ON August 2nd, 2020 (6% IN THE FINAL) PROBLEM:1 Roxy Gymnastics purchased new equipment for $175,000. It is estimated that the equipment will have a $15,000 residual value at the end of its 5-year useful service life. The double diminishing-balance method of depreciation will be used. Instructions: Prepare a depreciation schedule which shows the annual depreciation expense on the equipment for its 5-year life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts