Question: ASSIGNMENT #4-VERSION G SCENARIO FOR VALUATION QUESTIONS: ou are interested in purchasing a widget business. The business is 5 years old and has seen steady

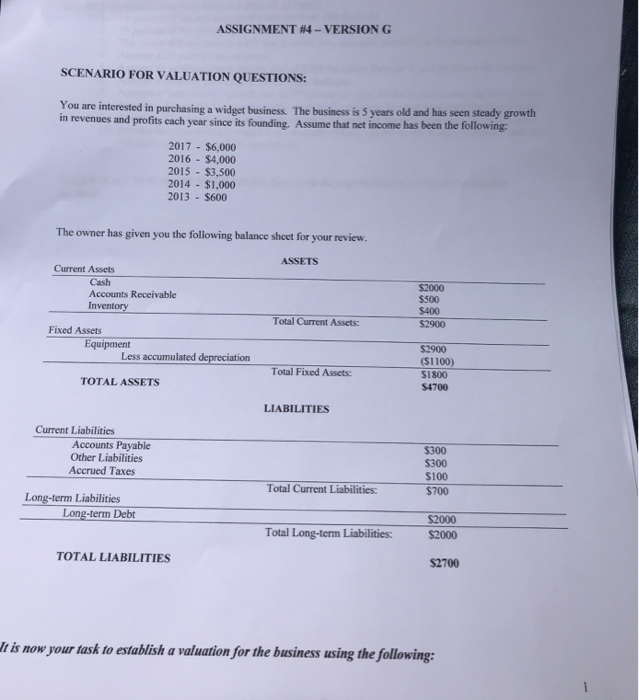

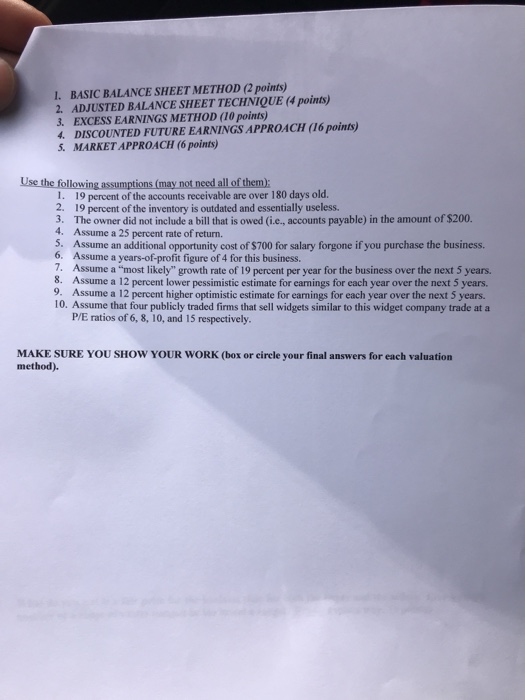

ASSIGNMENT #4-VERSION G SCENARIO FOR VALUATION QUESTIONS: ou are interested in purchasing a widget business. The business is 5 years old and has seen steady growth in revenues and profits each year since its founding. Assume that net income has been the following 2017 $6,000 2016 $4,000 2015 $3,500 2014 $1,000 2013 $600 The owner has given you the following balance sheet for your review. ASSETS Current Assets Cash Accounts Receivable Inventory S2000 $500 $400 $2900 Total Current Assets: Fixed Assets Equipment $2900 ($1100) $1800 S4700 Less accumulated depreciation Total Fixed Assets: TOTAL ASSETS LIABILITIES Current Liabilities Accounts Payable Other Liabilities Accrued Taxes $300 S300 $100 $700 Total Current Liabilities: Long-term Liabilities Long-term Debt $2000 $2000 Total Long-term Liabilities: TOTAL LIABILITIES $2700 t is now your lask to establish a valuation for the business using the following ASSIGNMENT #4-VERSION G SCENARIO FOR VALUATION QUESTIONS: ou are interested in purchasing a widget business. The business is 5 years old and has seen steady growth in revenues and profits each year since its founding. Assume that net income has been the following 2017 $6,000 2016 $4,000 2015 $3,500 2014 $1,000 2013 $600 The owner has given you the following balance sheet for your review. ASSETS Current Assets Cash Accounts Receivable Inventory S2000 $500 $400 $2900 Total Current Assets: Fixed Assets Equipment $2900 ($1100) $1800 S4700 Less accumulated depreciation Total Fixed Assets: TOTAL ASSETS LIABILITIES Current Liabilities Accounts Payable Other Liabilities Accrued Taxes $300 S300 $100 $700 Total Current Liabilities: Long-term Liabilities Long-term Debt $2000 $2000 Total Long-term Liabilities: TOTAL LIABILITIES $2700 t is now your lask to establish a valuation for the business using the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts