Question: Assignment 5 - Chapter 29 (1) - Protected Vien - Saved - References Mailings Review View Help etnet can contain viruses. Unless you need to

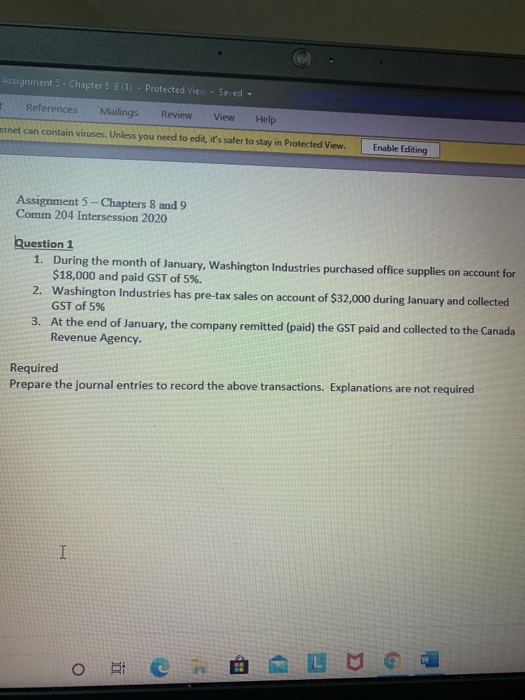

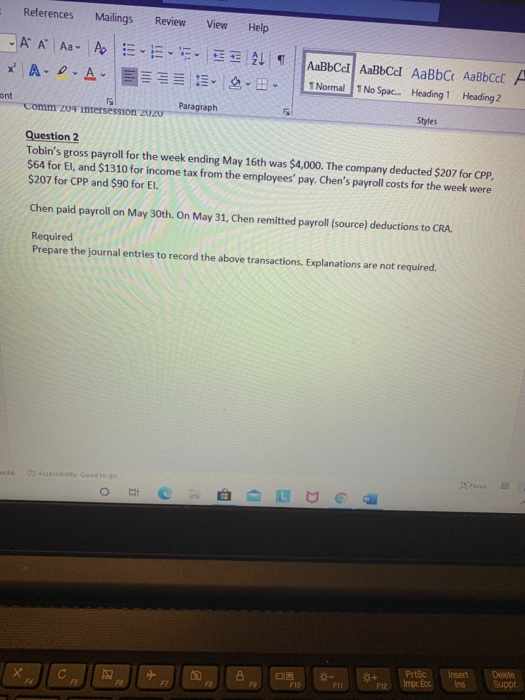

Assignment 5 - Chapter 29 (1) - Protected Vien - Saved - References Mailings Review View Help etnet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing Assignment 5 - Chapters 8 and 9 Comm 204 Intersession 2020 Question 1 1. During the month of January, Washington Industries purchased office supplies on account for $18,000 and paid GST of 5%. 2. Washington Industries has pre-tax sales on account of $32,000 during January and collected GST of 5% 3. At the end of January, the company remitted (paid) the GST paid and collected to the Canada Revenue Agency Required Prepare the journal entries to record the above transactions. Explanations are not required I O i References Mailings Review View Help A A A A E ALI * A-D-A- AaBbcd AaBbcd AaBbci AaBbcc T Normal 1 No Spac Heading 1 Heading 2 ont Comm 20 intersession 2020 Paragraph Styles Question 2 Tobin's gross payroll for the week ending May 16th was $4,000. The company deducted $207 for CPP, $64 for El, and $1310 for income tax from the employees' pay. Chen's payroll costs for the week were $207 for CPP and $90 for El. Chen paid payroll on May 30th. On May 31, Chen remitted payroll (source) deductions to CRA. Required Prepare the journal entries to record the above transactions. Explanations are not required. A Good to go C B PSC Imor. Ect. Insert F FO FT De Suppe FB F FIO F11 F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts