Question: Assignment 6 - Chapter 1 0 Question 1 of 4 1 2 0 View Policies Current Attempt in Progress Kingbird, CPAs, are preparing their service

Assignment Chapter

Question of

View Policies

Current Attempt in Progress

Kingbird, CPAs, are preparing their service revenue sales budget for Their practice is divided into three departments: auditing, tax, and consulting. Billable hours for each department, by quarter, are as follows:

tableDepartmentQuarter Quarter Quarter Quarter AuditingTaxConsulting

Average hourly billing rates are $ for auditing, $ for tax, and $ for consulting services.

Prepare the service revenue sales budget for by listing the departments and showing the billable hours, billable rate, and total revenue for each quarter and the year in total.

KINGBIRD, CPAs

Service Revenue Budget

For the Year Ending December

Quarter

Auditing:

Billable hours

Assignment Chapter

Question of

View Policies

Show Attempt History

Current Attempt in Progress

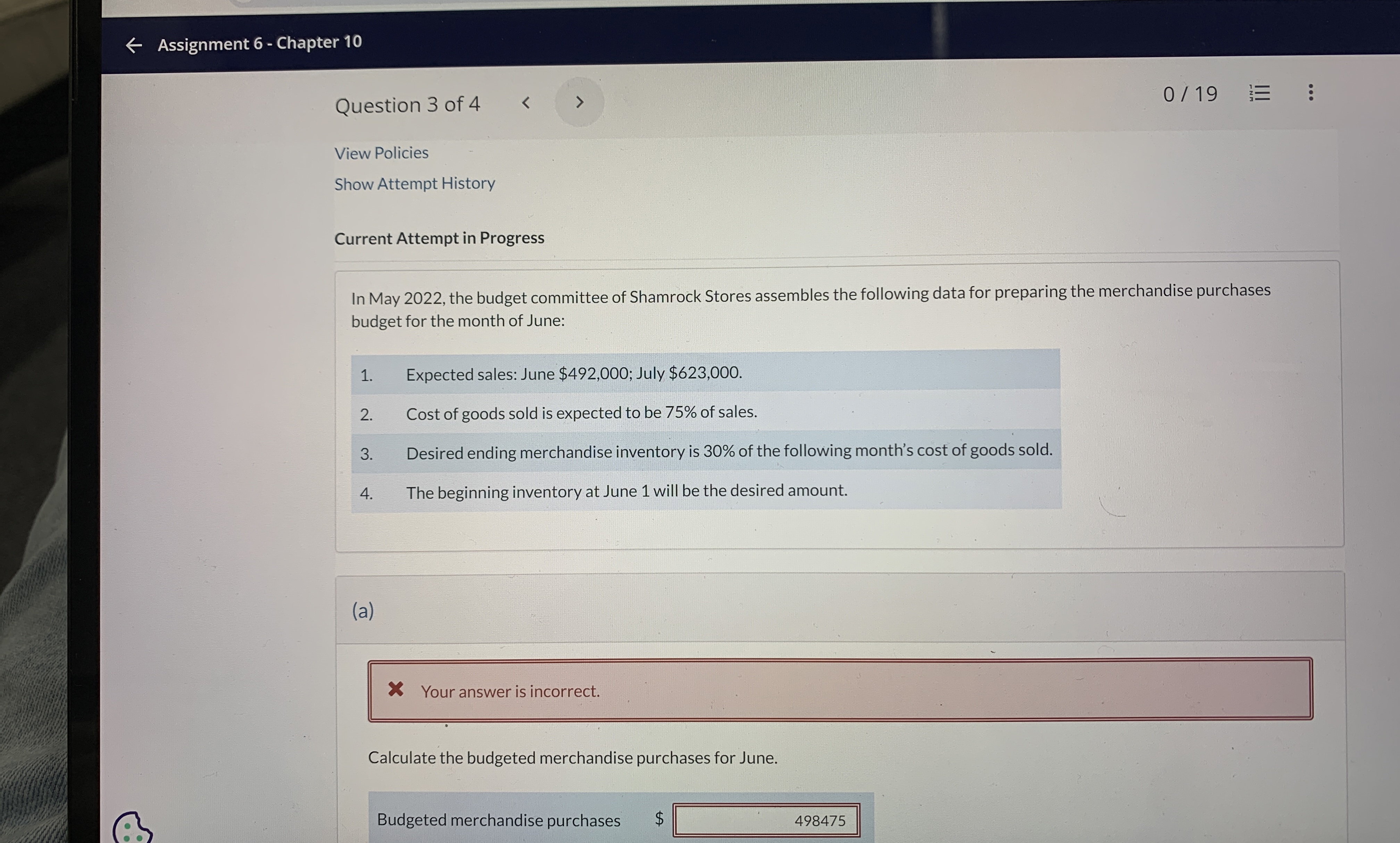

In May the budget committee of Shamrock Stores assembles the following data for preparing the merchandise purchases budget for the month of June:

Expected sales: June $; July $

Cost of goods sold is expected to be of sales.

Desired ending merchandise inventory is of the following month's cost of goods sold.

The beginning inventory at June will be the desired amount.

a

Your answer is incorrect.

Calculate the budgeted merchandise purchases for June.

Budgeted merchandise purchases

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock