Question: Assignment 6 - Exotic Option Valuation using Monte Carlo simulation A European Digital option is an option that pays a fixed amount of an asset

Assignment 6 - Exotic Option Valuation using Monte Carlo simulation

A European Digital option is an option that pays a fixed amount of an asset price fixes above (in the case of a Call option) or below (in the case of a Put option).

Assume that the stock price follows Geometric Brownian Motion.

It is common to assume that:

The solution of this stochastic differential equation is

Wherezis a standard normal random variable (mean zero and standard deviation equal to one).

Build a European Digital option pricing model using by:

1)simulating future asset prices

2)determining the future option payoff

3)computing the expected value of the future option payoff

4)discounting this expected future payoff value back to the valuation date.

Your simulation model may be built in VBA, MATLAB or R (or indeed any programming language you are comfortable with).

European Digital Options are described as Binary Options in Hull's book on Options Futures and Other Derivative Securities (Section 26.10)

Monte Carlo Simulation is described in Hull's book (Section 21.6).

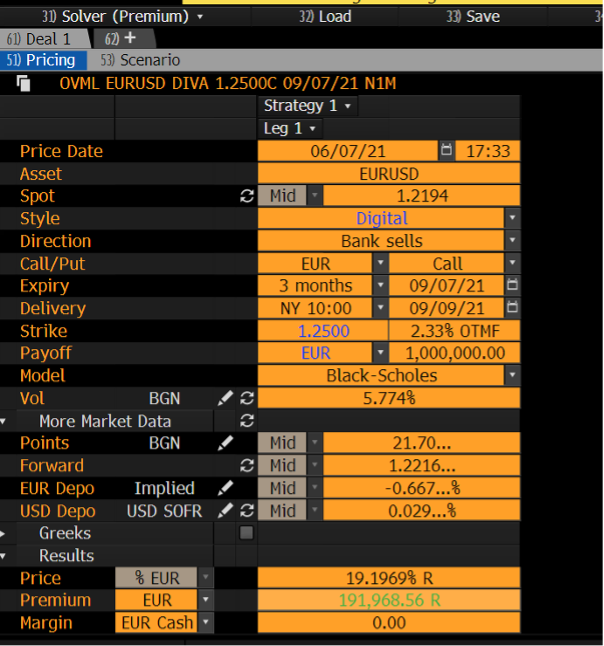

apply the valuation model to a three-month EUR-USD European Digital call option that pays out ?1,000,000 if EURUSD is at or above 1.2500 in three month's time.

Assume a spot rate of 1.2194, a volatility value of 5.78%, a Euro interest rate of -0.67% and a US dollar interest rate of 0.03%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts