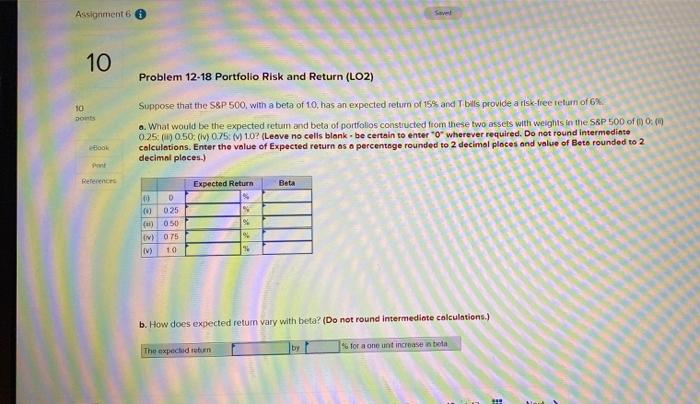

Question: Assignment 6 some 10 Problem 12-18 Portfolio Risk and Return (LO2) 10 Doints Suppose that the S&P 500, with a beta of 10, has an

Assignment 6 some 10 Problem 12-18 Portfolio Risk and Return (LO2) 10 Doints Suppose that the S&P 500, with a beta of 10, has an expected return of 15% and Tbilis provide a risk free return of 6% a. What would be the expected retum and beta of portfolios constructed from these two assets with weights in the SAP 50D of ) 0:00 0.25:0) 0.50. (V) 0.75: () 1.0 (Leave no cells blank.be certain to entero wherever required. Do not round intermedinte calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beto rounded to 2 decimal places.) Book References Expected Return Beta 339 D 025 ( 050 M) 0.75 10 3 b. How does expected return vary with beta? (Do not round intermediate calculations.) by The expected return for a one unit increase in tota

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts