Question: Assignment 9B - Graded Assignment 9B - Graded Question 4 1 point Remaining Time: 04:51:30 A project requires an increase in inventories, accounts payable,

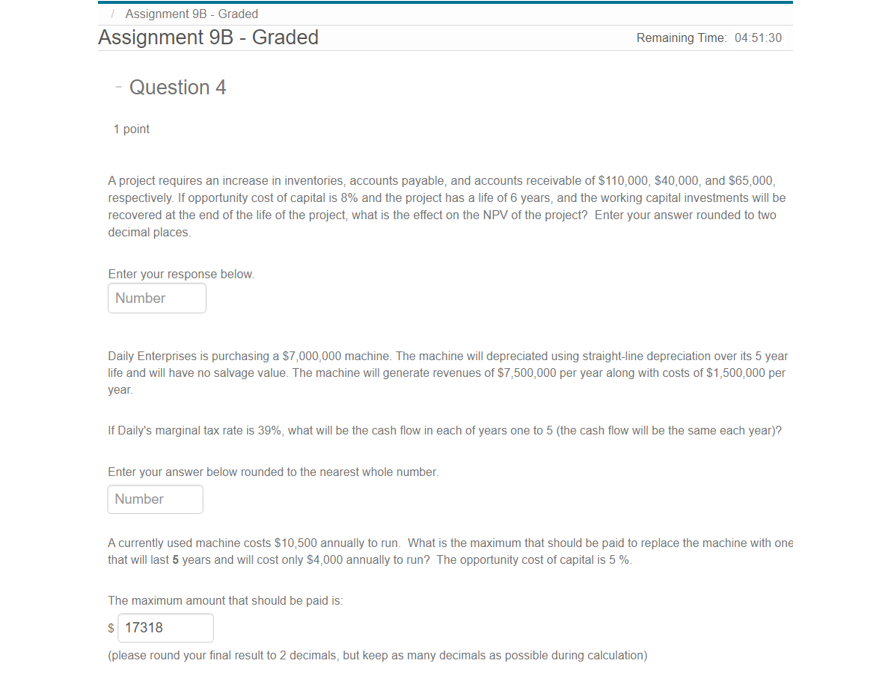

Assignment 9B - Graded Assignment 9B - Graded Question 4 1 point Remaining Time: 04:51:30 A project requires an increase in inventories, accounts payable, and accounts receivable of $110,000, $40,000, and $65,000, respectively. If opportunity cost of capital is 8% and the project has a life of 6 years, and the working capital investments will be recovered at the end of the life of the project, what is the effect on the NPV of the project? Enter your answer rounded to two decimal places. Enter your response below. Number Daily Enterprises is purchasing a $7,000,000 machine. The machine will depreciated using straight-line depreciation over its 5 year life and will have no salvage value. The machine will generate revenues of $7,500,000 per year along with costs of $1,500,000 per year. If Daily's marginal tax rate is 39%, what will be the cash flow in each of years one to 5 (the cash flow will be the same each year)? Enter your answer below rounded to the nearest whole number. Number A currently used machine costs $10,500 annually to run. What is the maximum that should be paid to replace the machine with one that will last 5 years and will cost only $4,000 annually to run? The opportunity cost of capital is 5%. The maximum amount that should be paid is: $ 17318 (please round your final result to 2 decimals, but keep as many decimals as possible during calculation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts