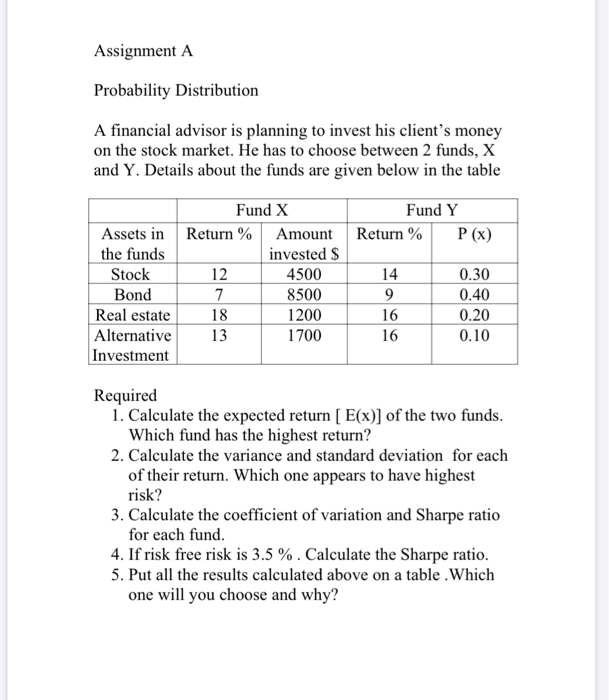

Question: Assignment A Probability Distribution A financial advisor is planning to invest his client's money on the stock market. He has to choose between 2 funds,

Assignment A Probability Distribution A financial advisor is planning to invest his client's money on the stock market. He has to choose between 2 funds, X and Y. Details about the funds are given below in the table Fund Y Return % P(x) Fund X Assets in Return % Amount the funds invested $ Stock 12 4500 Bond 7 8500 Real estate 18 1200 Alternative 13 1700 Investment 14 9 16 16 0.30 0.40 0.20 0.10 Required 1. Calculate the expected return [E(x)] of the two funds. Which fund has the highest return? 2. Calculate the variance and standard deviation for each of their return. Which one appears to have highest risk? 3. Calculate the coefficient of variation and Sharpe ratio for each fund. 4. If risk free risk is 3.5%. Calculate the Sharpe ratio. 5. Put all the results calculated above on a table .Which one will you choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts