Question: Assignment: Blackberry's Mobile Phone Strategy Question: What strategy does your team think is most beneficial at this time in BlackBerrys strategic planning? Instructions (Using the

Assignment: Blackberry's Mobile Phone Strategy

Question: What strategy does your team think is most beneficial at this time in BlackBerrys strategic planning?

Instructions (Using the Case Study Analysis Format):

In this case you will read (below) about the mobile phone maker BlackBerry. Their device, using the text craze, and the security features of the phone, was very popular among working professionals. It was also very popular with non-professionals as a personal mobile device. The device had many competitors that were mentioned in the case. Creating and implementing an effective strategy involves using the analysis tools present in chapter 6. This holds true for any business, whether they are in the start-up phase or the maturity phase, or in this case, the survival and turnaround phase. It is even more important for businesses that must seek to continually innovate to remain competitive in an ever-changing technical world.

It is not certain if Chens strategy team should put forward a cost leadership strategic alternative or if they should concentrate on some kind of differentiation strategy.

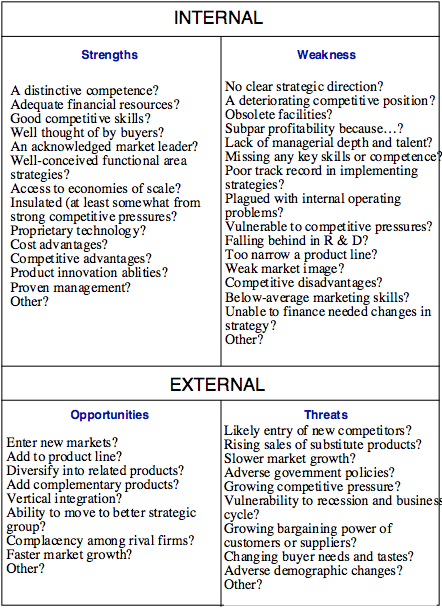

Utilizing the Case Study Analysis Format as an organizing tool, perform a SWOT analysis and consider and discuss Porters Five Industry Forces, (Exhibit 5.7 - page 100 in text) as possibly the next step in the strategic development process. What strategy does your team think is most beneficial at this time in BlackBerrys strategic planning?

BLACKBERRYS MOBILE PHONE STRATEGY

Waterloo, Ontario. When BlackBerry announced that CEO Thorsten Heins would be replaced by John Chen, the companys stock fell 16 percent in one day. This is despite the announcement at the same time that Fairfax Financial (which owns 10 percent of BlackBerry) would invest $1 billion in the company. The strategy group at BlackBerry have to finish their assessment of what the company strategy will be for 2014, 2015, and beyond. They will have to come up with several strategic alternatives for the company to choose from in order to save the company and turn it around in an increasingly competitive market. Certainly BlackBerry has had some tough moments in the past year.

The growth of the 20- to 35-year-old demographic is showing continual signs that they are going to stay on the mobile communications bandwagon (including social networking, web searching, and mobile applications). However, many analysts say that BlackBerry made a mistake by trying to replicate and mimic what their rivals were doing, and what they really needed to do was look at the core customer basepeople in government and business that want a secure transmission for their communications. These corporate customers and prosumers seem to be the correct target for BlackBerry to focus on.

The world seems to have embraced the new cultural aspect of information and communication all the time and everywhere. Technology is racing to keep up, with all sorts of open source, proprietary, and market available software and hardware becoming available all over the world. The illegal copying of technology in some parts of the world has been more sharply controlled by governments, and the political climate seems to be more open in China and India, both of which have great potential as future growth markets.

BlackBerry has not been doing well. Despite a robust patent portfolio, their loyal cadre of CrackBerry users, and a cash reserve of $2.3 billion they have been losing unsustainable amounts of money. In late 2013, BlackBerry had its steepest round of continuing job cuts yetlaying off 4,500 employees (40 percent of its work force). Their newest smart phones, the Q10 and Z10 were not a success, and BlackBerry was forced to take a $1 billion write down on unsold inventory of the Z10 (which critics slammed because it had a touchscreen-only as the first device on the BlackBerry 10 operating system, rather than the Q10, which has a QWERTY keyboarda main selling point for the BlackBerry faithful).

The strategy team has done a quick assessment of the strengths and weaknesses of the firm, but they know that the opportunities and threats are a much more important aspect to concentrate on. Additionally, they are going to be presenting a VRIN based on BlackBerrys Valuable resources, the Rareness of their capabilities, the Imperfect Imitations available for their service and their products, as well as trying to determine what BlackBerrys Non-substitutable organization capabilities and resources will have to be in order to exploit any kind of a turnaround strategy. What can they put forward that will continue to be distinctive? What can they suggest as a core capability? The team is certain that they will use the BCG matrix, but they dont know if it is software they are selling or advertising, security, or just actual devices.

The fast-changing world of cellular phones includes new phones and applications from Apple with their constantly upgraded iPhones; Google with their Android phones; and Microsoft, with their Windows Phones. All of these competitors have leapt into the fray with BlackBerry. And this is on top of the already well entrenched Nokia and Motorola, who also have large shares of the mobile and smart device market. The rivalry between firms is very high and new entrants seem to be coming into the market every few months on a worldwide basis. The customer is a bit ambiguous as well. Is the customer the end-using public, or is it the Internet service providers (ISPs) or the network cell phone providers such as Rogers, Telus, and Bell Mobility? The suppliers of the actual phones do not seem to have much bargaining power as most of the large firms have their phones manufactured off-shore, primarily in China. It is not hard to think of what would be substituted for the BlackBerry Q10 and Z10, but just how fickle is the consumer, and how much bargaining power does the buyer actually have in the way of switching costs?

It is not certain if Chens strategy team should put forward a cost leadership strategic alternative or if they should concentrate on some kind of differentiation strategy. The new areas of revenue might just be in advertising. Certainly Google has a strong lead in all Internet advertising, and it is anyones guess how aggressively they might pursue the advertising market. Apple now has several years of experience with their iAds and has ongoing contracts with many leading global brands (including LOreal, Renault, Louis Vuitton, and others in Europe). BlackBerrys own advertising service was launched several years ago, and Microsoft has also landed several large customers with their advertising platform. Is this the area of strategic growth? Is the advertising market a suitable focus to base the future survival and possible growth of the company on, or is it merely another service to offer in the mobile market?

However, to paraphrase Twain: the reports of the companys death have been greatly exaggerated. Things are not impossible, even though most students might not remember: Apple and IBM were turnaround stories once as well. And John Chen has experience; when Chen took over Sybase, his former company, Sybases stock had fallen below $5 a share, having lost 90 percent of its value over the previous four years (BlackBerrys stock has also lost about 90 percent of its value from its 2009 high). SAP, the German software giant, eventually bought Sybase for $5.8 billion, or $65 a share in 2010.

The strategy team will put together their ideas using (the SWOT analysis attached to News Notice and found above), Exhibit 5.5 (the BCG matrix), and Exhibit 5.7 (Porters industry forces analysis) and try to utilize Exhibit 5.9 (the direct competition framework). However, they still are not certain if they are going to be swimming in a red ocean or a blue ocean. At any rate, they know that they have to have at least three different strategic approaches for Chen and his senior executives to review at their upcoming retreat, and they know that all of the strategies need to be presented with their various advantages and disadvantages.

IMPORTANT CONSIDERATIONS FOR SWOT ANALYSIS:

INTERNAL Strengths Weakness A distinctive competence? Adequate financial resources? Good competitive skills? Well thought of by buyers? An acknowledged market leader? Well-conceived functional area strategies? Access to economies of scale? Insulated (at least somewhat from strong competitive pressures? Proprietary technology? Cost advantages? Competitive advantages? Product innovation ablities? Proven management? Other? No clear strategic direction? A deteriorating competitive position? Obsolete facilities? Subpar profitability because...? Lack of managerial depth and talent? Missing any key skills or competence Poor track record in implementing strategies? Plagued with internal operating problems? Vulnerable to competitive pressures? Falling behind in R & D? Too narrow a product line? Weak market image? Competitive disadvantages? Below-average marketing skills? Unable to finance needed changes in strategy? Other? EXTERNAL Opportunities Enter new markets? Add to product line? Diversify into related products? Add complementary products? Vertical integration? Ability to move to better strategic group? Complacency among rival firms? Faster market growth? Other? Threats Likely entry of new competitors? Rising sales of substitute products? Slower market growth? Adverse govemment policies? Growing competitive pressure? Vulnerability to recession and busines cycle? Growing bargaining power of customers or suppliers? Changing buyer needs and tastes? Adverse demographic changes? Other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts