Question: Assignment: Case Study--Pricing: Light Bulb Industry You are the marketing manager for Acme Lamp Company. Acme specializes in the manufacture of lamps (light bulbs) for

Assignment: Case Study--Pricing: Light Bulb Industry

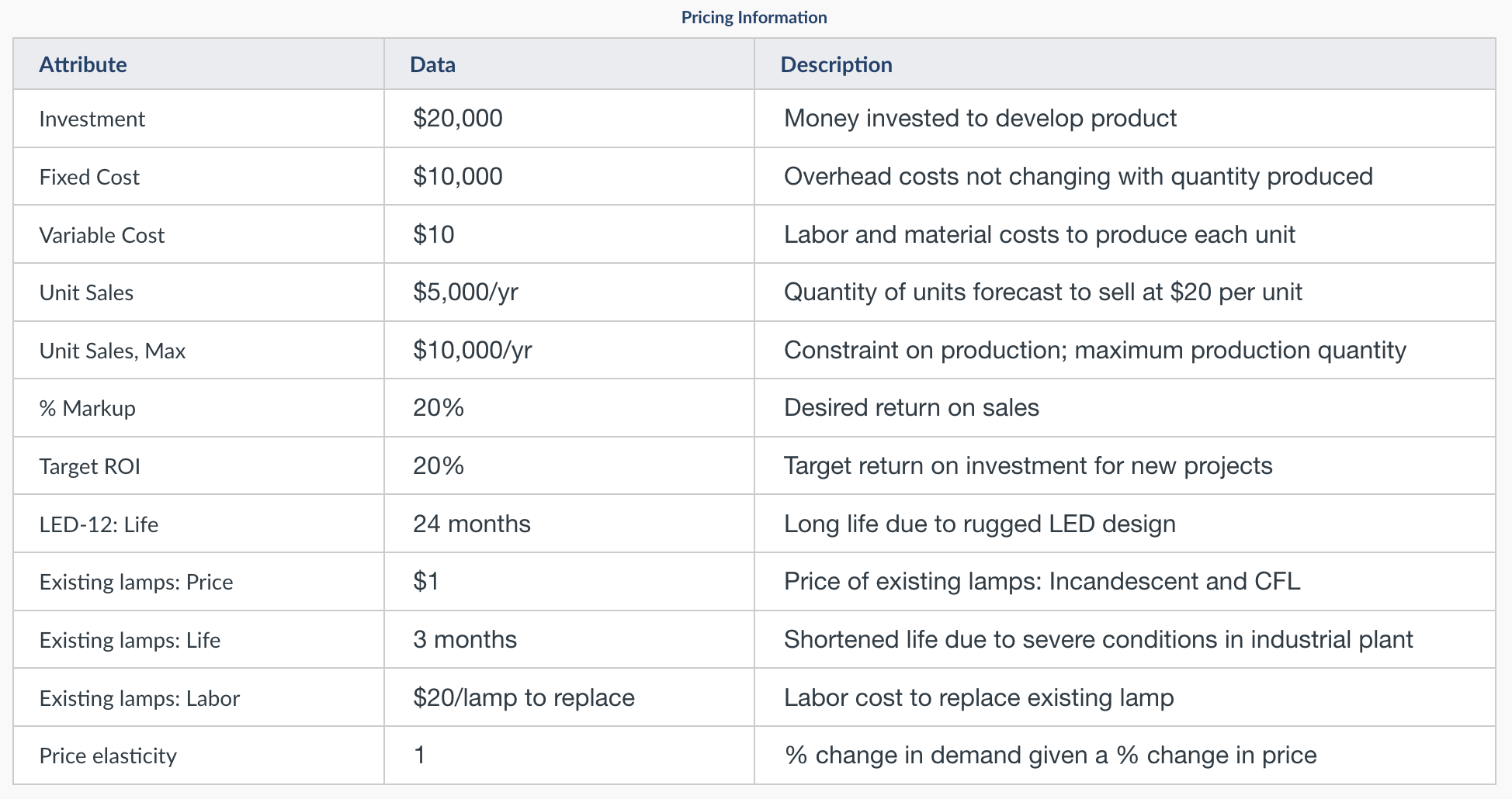

You are the marketing manager for Acme Lamp Company. Acme specializes in the manufacture of lamps (light bulbs) for industrial applications. You are in charge of launching Acmes new LED-12 light emitting diode (LED) lamp. The LED-12 uses an array of 12 high-intensity LEDs to replace a standard medium-base incandescent lamp. As part of the launch plan, you must select a price. You have the data shown in the table below.

Questions:

1. Answer the questions below using Markup/Cost-Plus pricing techniques.

a. What is the Unit Cost?

b. What is the Markup Price?

2. Answer the questions below using Target Return pricing techniques.

a. What is the Unit Cost?

b. What is the Target Return Price?

3. Answer the questions below using Value-In-Use pricing techniques. Assume that the industrial plant uses 100 light bulbs.

a. What is the current cost related to light bulbs?

b. What is the Value in Use price?

4. Calculate the target price to maximize profit based on the price elasticity of demand. Conduct an Internet search for "Optimal Price Analysis Tool" or use the Optimal Price Analysis tool available on the Marketing Analytics course page of StephanSorger.com

Pricing Information \begin{tabular}{|l|l|l|} \hline Attribute & Data & Description \\ \hline Investment & $20,000 & Money invested to develop product \\ \hline Fixed Cost & $10,000 & Overhead costs not changing with quantity produced \\ \hline Variable Cost & $10 & Labor and material costs to produce each unit \\ \hline Unit Sales & $5,000/yr & Quantity of units forecast to sell at $20 per unit \\ \hline Unit Sales, Max & $10,000/yr & Constraint on production; maximum production quantity \\ \hline% Markup & 20% & Desired return on sales \\ \hline Target ROI & 20% & Target return on investment for new projects \\ \hline LED-12: Life & 24 months & Long life due to rugged LED design \\ \hline Existing lamps: Price & $1 & Price of existing lamps: Incandescent and CFL \\ \hline Existing lamps: Life & 3 months & Shortened life due to severe conditions in industrial plant \\ \hline Existing lamps: Labor & $20/ lamp to replace & Labor cost to replace existing lamp \\ \hline Price elasticity & 1 & \% change in demand given a \% change in price \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts