Question: Assignment Communication ( Weight: 1 0 % ) In 2 0 2 4 , Natasha Dale had employment income of $ 1 0 5 ,

Assignment

Communication Weight:

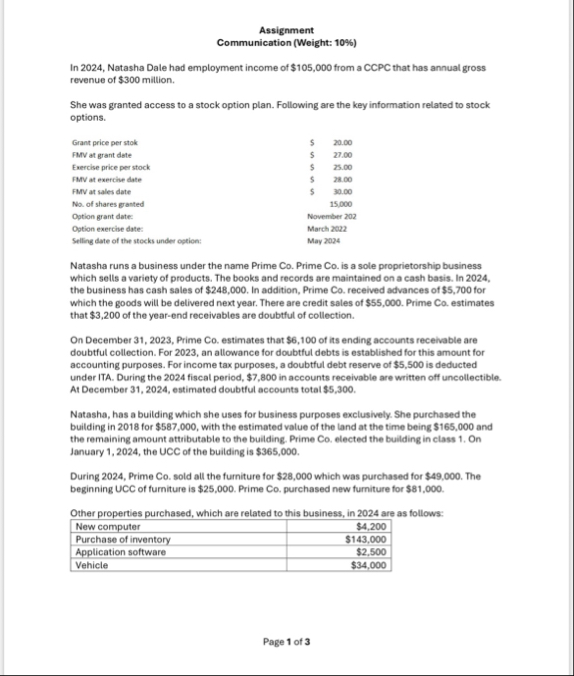

In Natasha Dale had employment income of $ from a CCPC that has annual gross revenue of $ million.

She was granted access to a stock option plan. Following are the key information related to stock options.

tableGrant price per stok,$FMV at grant date,$Exercise price per stock,$FMV at exercise date,$FMV at sales date,$No of shares granted,,Option grant date:,November Option exercise date:,March Selling date of the stocks under option:,May

Natasha runs a business under the name Prime Co Prime Co is a sole proprietorship business which sells a variety of products. The books and records are maintained on a cash basis. In the business has cash sales of $ In addition, Prime Co received advances of $ for which the goods will be delivered next year. There are credit sales of $ Prime Co estimates that $ of the yearend receivables are doubtful of collection.

On December Prime Co estimates that $ of its ending accounts receivable are doubtful collection. For an allowance for doubtful debts is established for this amount for accounting purposes. For income tax purposes, a doubtful debt reserve of $ is deducted under ITA. During the fiscal period, $ in accounts receivable are written off uncollectible. At December estimated doubtful accounts total $

Natasha, has a building which she uses for business purposes exclusively. She purchased the building in for $ with the estimated value of the land at the time being $ and the remaining amount attributable to the building. Prime Co elected the building in class On January the UCC of the building is $

During Prime Co sold all the furniture for $ which was purchased for $ The beginning UCC of furniture is $ Prime Co purchased new furniture for $

Other properties purchased, which are related to this business, in are as follows:

tableNew computer,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock