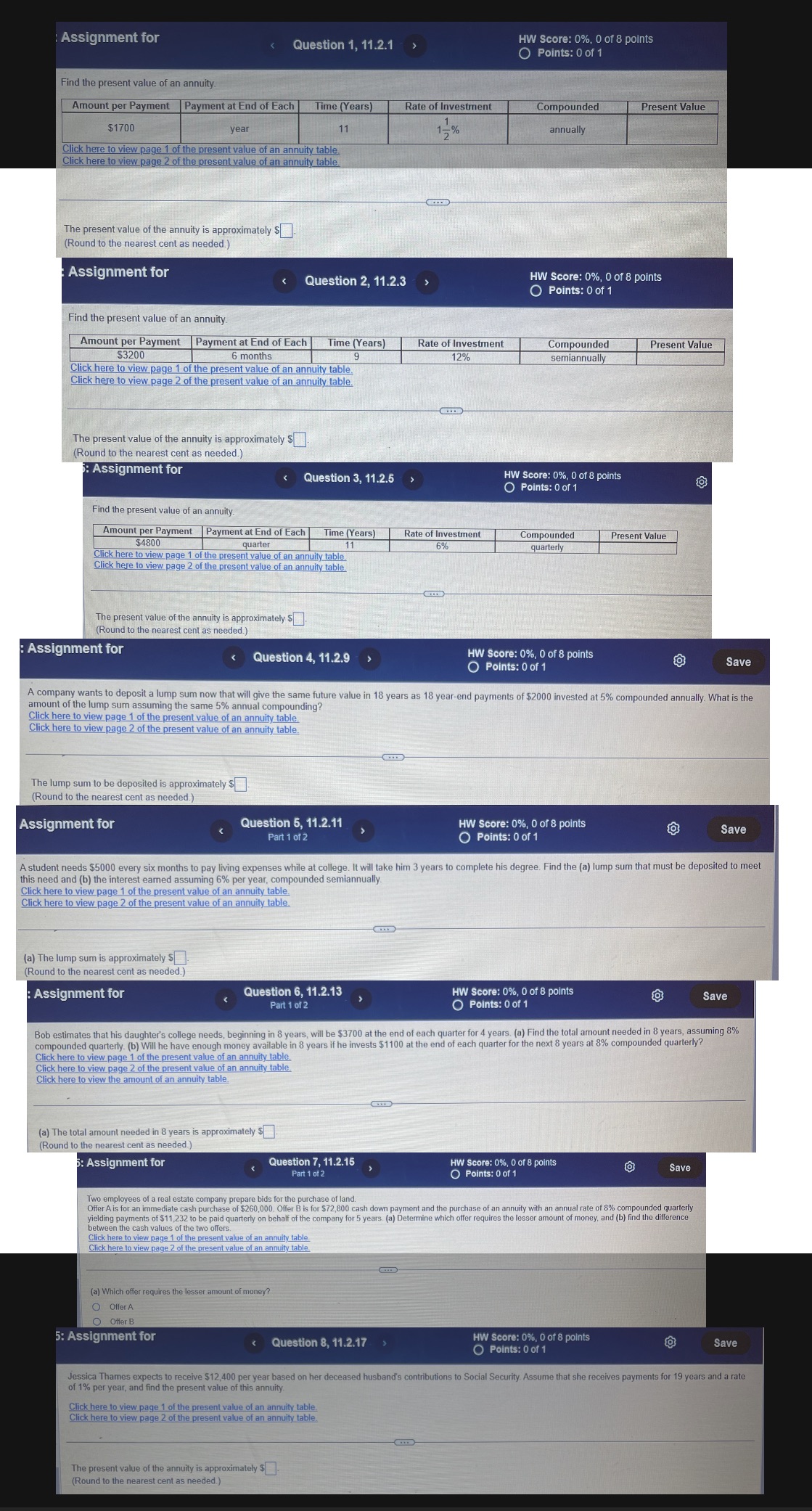

Question: Assignment for Question 1, 11.2.1 > HW Score: 0%, 0 of 8 points Points: 0 of 1 Find the present value of an annuity. Amount

Assignment for Question 1, 11.2.1 > HW Score: 0%, 0 of 8 points Points: 0 of 1 Find the present value of an annuity. Amount per Payment Payment at End of Each Time (Years) Rate of Investment Compounded Present Value $1700 year 11 15 % annually Click here to view page 1 of the present value of an annuity table Click here to view page 2 of the present value of an annuity table. The present value of the annuity is approximately $ (Round to the nearest cent as needed.) Assignment for HW Score: 0%, 0 of 8 points Points: 0 of 1 Find the present value of an annuity. Amount per Payment Payment at End of Each Time (Years) Rate of Investment Compounded $4800 Present Value quarter 6% quarterly Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table. The present value of the annuity is approximately $ (Round to the nearest cent as needed.) Assignment for Question 4, 11.2.9 HW Score: 0%, 0 of 8 points Points: 0 of 1 Save A company wants to deposit a lump sum now that will give the same future value in 18 years as 18 year-end payments of $2000 invested at 5% compounded annually. What is the amount of the lump sum assuming the same 5% annual compounding? Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table. The lump sum to be deposited is approximately $ (Round to the nearest cent as needed.) Assignment for Question 5, 11.2.11 HW Score: 0%, 0 of 8 points Part 1 of 2 Points: 0 of 1 Save A student needs $5000 every six months to pay living expenses while at college. It will take him 3 years to complete his degree. Find the (a) lump sum that must be deposited to meet this need and (b) the interest eared assuming 6% per year, compounded semiannually. Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table. (a) The lump sum is approximately $ (Round to the nearest cent as needed.) Assignment for Question 6, 11.2.13 HW Score: 0%, 0 of 8 points Save Part 1 of 2 Points: 0 of 1 Bob estimates that his daughter's college needs, beginning in 8 years, will be $3700 at the end of each quarter for 4 years. (a) Find the total amount needed in 8 years, assuming 8% compounded quarterly. (b) Will he have enough money available in 8 years if he invests $1100 at the end of each quarter for the next 8 years at 8% compounded quarterly? Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table. Click here to view the amount of an annuity table. (a) The total amount needed in 8 years is approximately $ (Round to the nearest cent as needed.) : Assignment for Question 7, 11.2.15 HW Score: 0%, 0 of 8 points Part 1 of 2 Points: 0 of 1 Save Two employees of a real estate company prepare bids for the purchase of land. Offer A is for an immediate cash purchase of $260,000. Offer B is for $72,800 cash down payment and the purchase of an annuity with an annual rate of 8% compounded quarterly yielding payments of $11,232 to be paid quarterly on behalf of the company for 5 years. (a) Determine which offer requires the lesser amount of money, and (b) find the difference between the cash values of the two offers. Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table. (a) Which offer requires the lesser amount of money? O Offer A Offer B 5: Assignment for Question 8, 11.2.17 HW Score: 0%, 0 of 8 points Points: 0 of 1 Save Jessica Thames expects to receive $12,400 per year based on her deceased husband's contributions to Social Security. Assume that she receives payments for 19 years and a rate of 1% per year, and find the present value of this annuity. Click here to view page 1 of the present value of an annuity table. Click here to view page 2 of the present value of an annuity table The present value of the annuity is approximately $ (Round to the nearest cent as needed.)