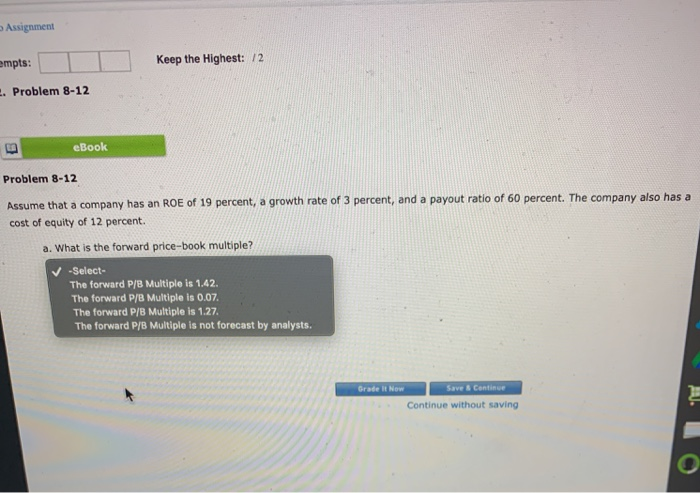

Question: Assignment Keep the Highest: 12 empts: 2. Problem 8-12 eBook Problem 8-12 Assume that a company has an ROE of 19 percent, a growth rate

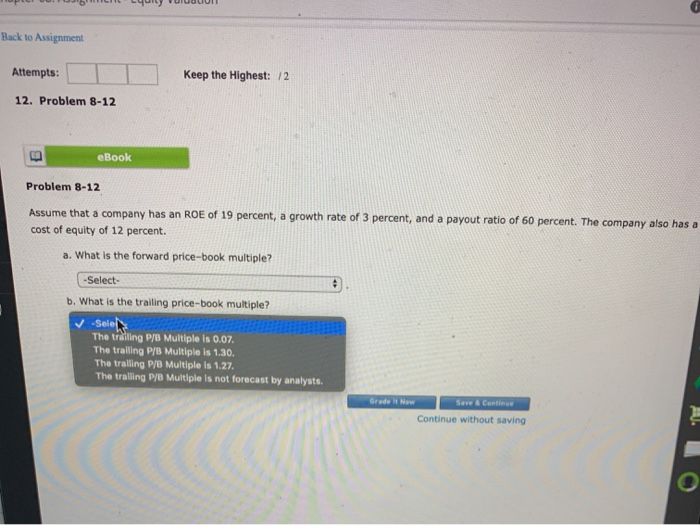

Assignment Keep the Highest: 12 empts: 2. Problem 8-12 eBook Problem 8-12 Assume that a company has an ROE of 19 percent, a growth rate of 3 percent, and a payout ratio of 60 percent. The company also has a cost of equity of 12 percent. a. What is the forward price-book multiple? -Select- The forward P/B Multiple is 1.42. The forward P/B Multiple is 0.07. The forward P/B Multiple is 1.27. The forward P/B Multiple is not forecast by analysts. Save & Continue Continue without saving - - - - - THIS LIMITED CUOI Back to Assignment Attempts: Keep the Highest: 12 12. Problem 8-12 eBook Problem 8-12 Assume that a company has an ROE of 19 percent, a growth rate of 3 percent, and a payout ratio of 60 percent. The company also has a cost of equity of 12 percent. a. What is the forward price-book multiple? -Select- A b. What is the trailing price-book multiple? Sele The trilling P/B Multiple is 0.07. The trailing P/B Multiple is 1.30. The trailing P/B Multiple is 1.27. The trailing P/B Multiple is not forecast by analysts. Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts