Question: Critically evaluate how the competitive advantage of a resource can be measured by the FOUR(4) Tests of Resource's Competitive Power C-180 PART 2 Cases in

Critically evaluate how the competitive advantage of a resource can be measured by the FOUR(4) Tests of Resource's Competitive Power

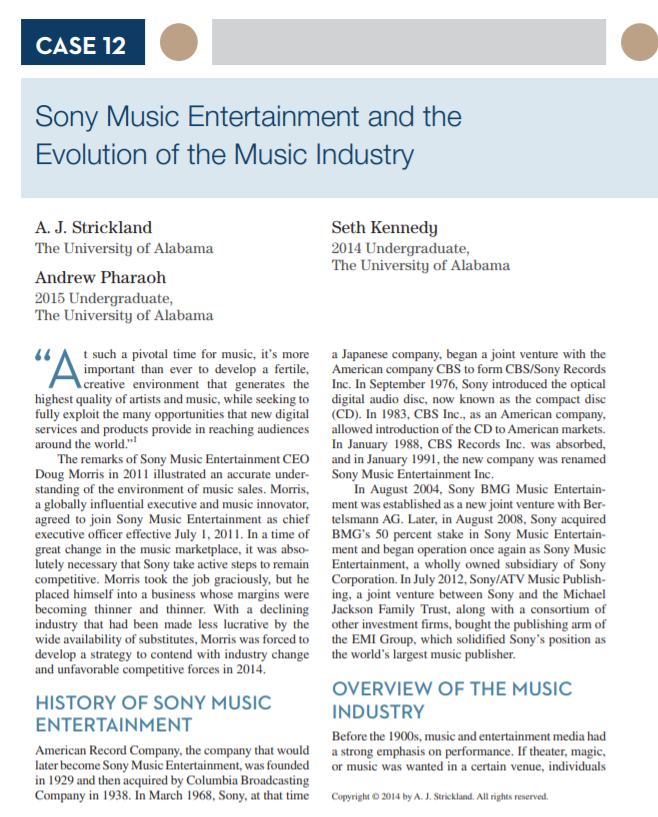

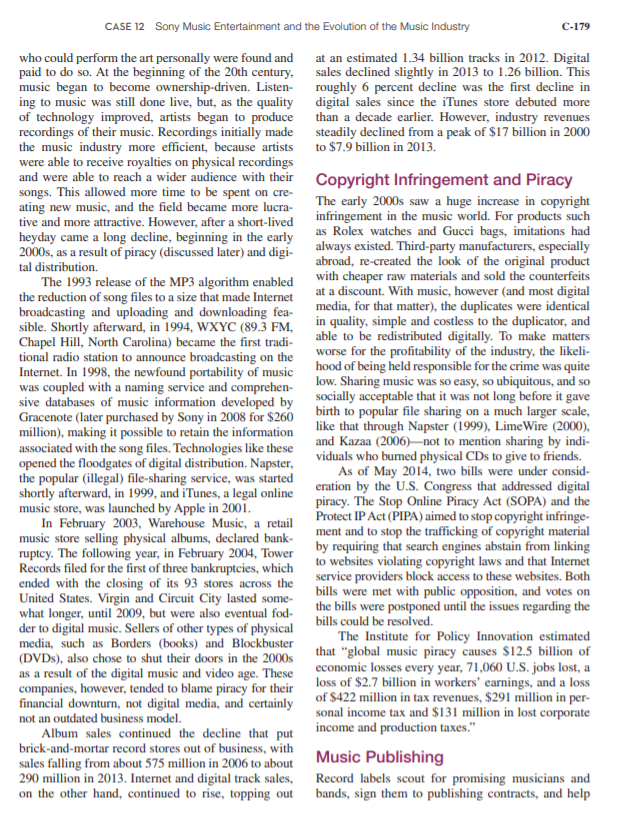

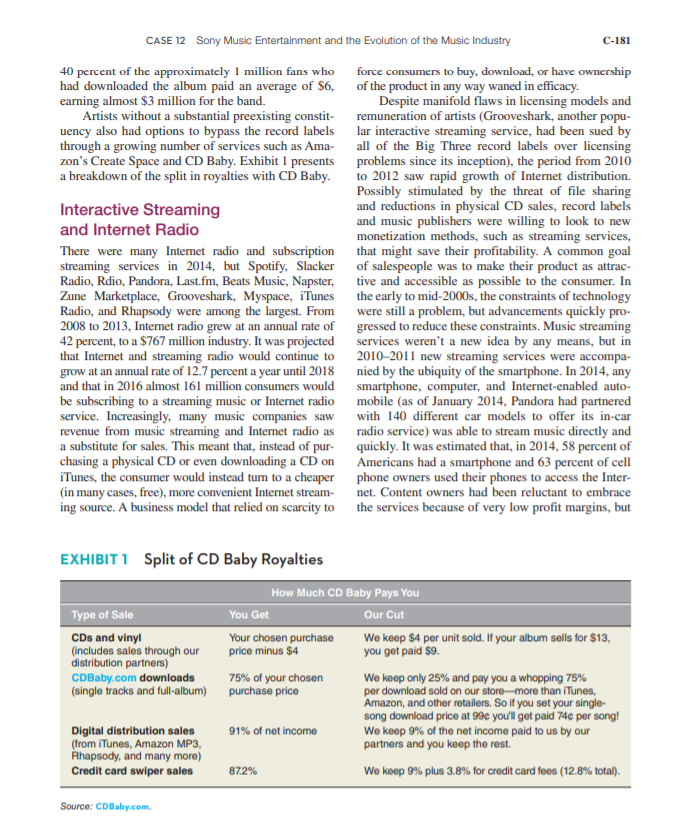

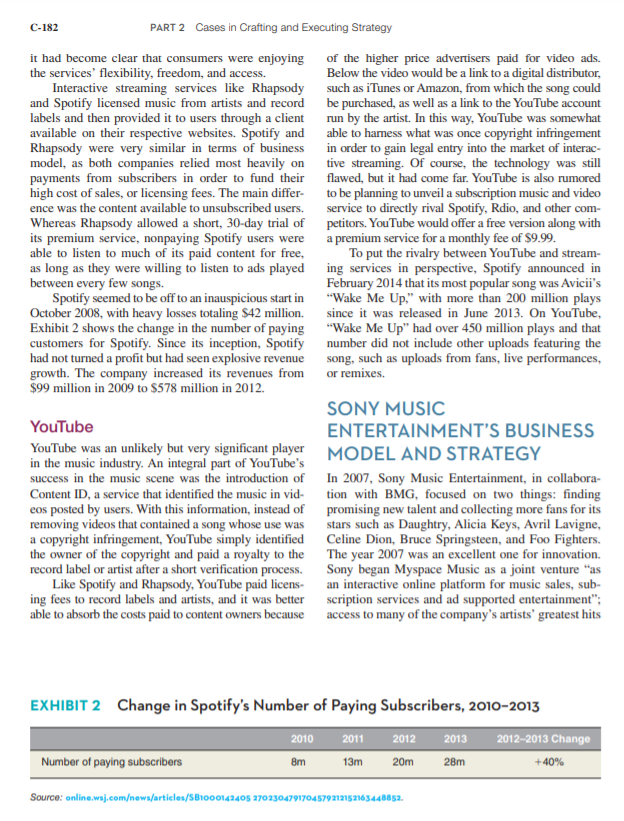

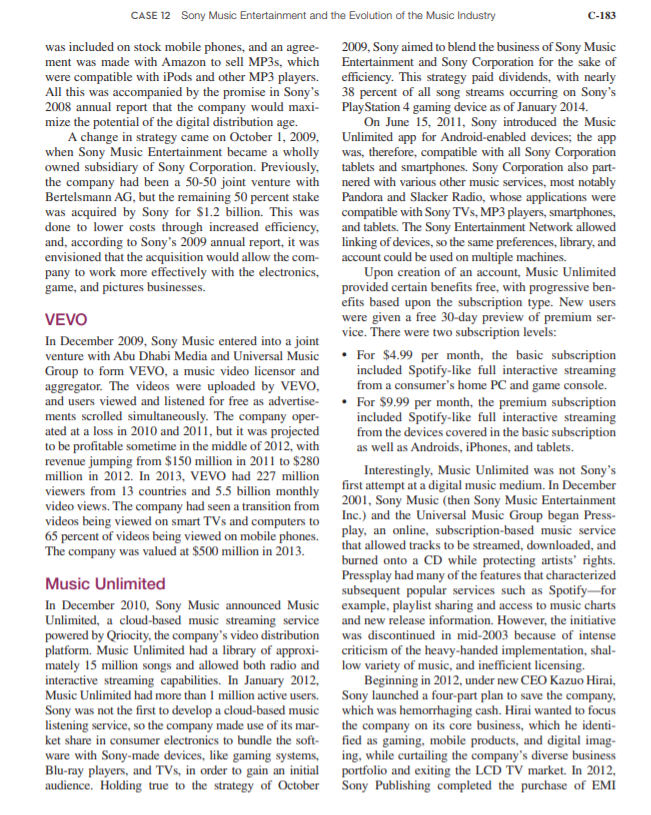

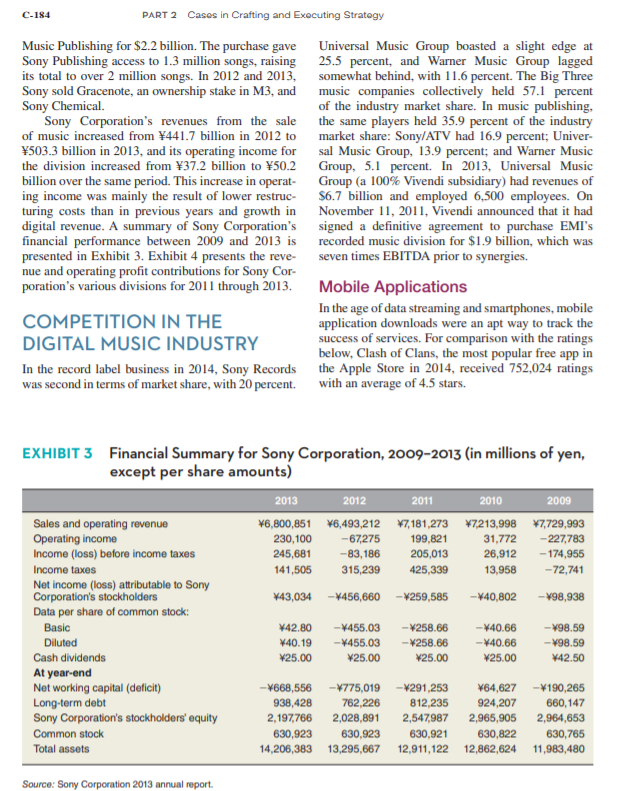

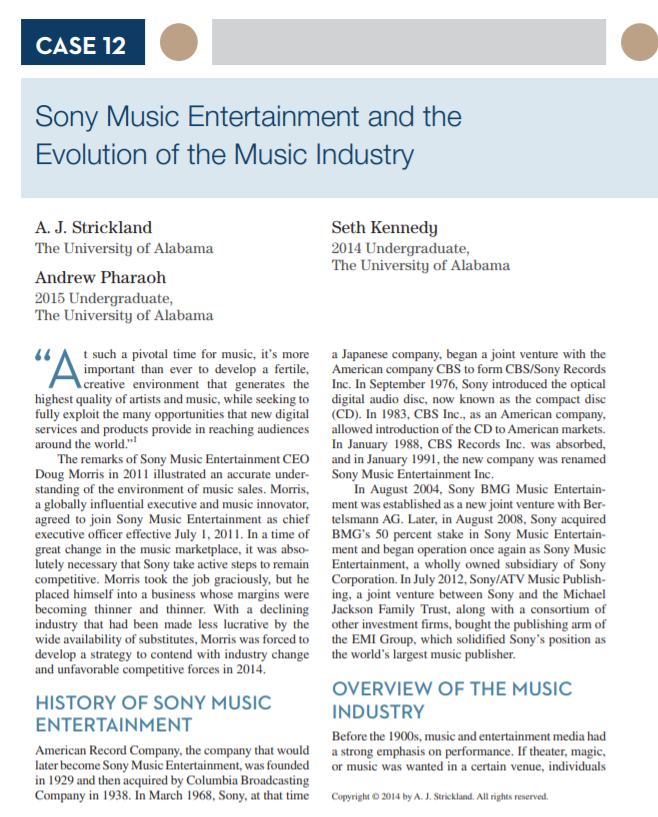

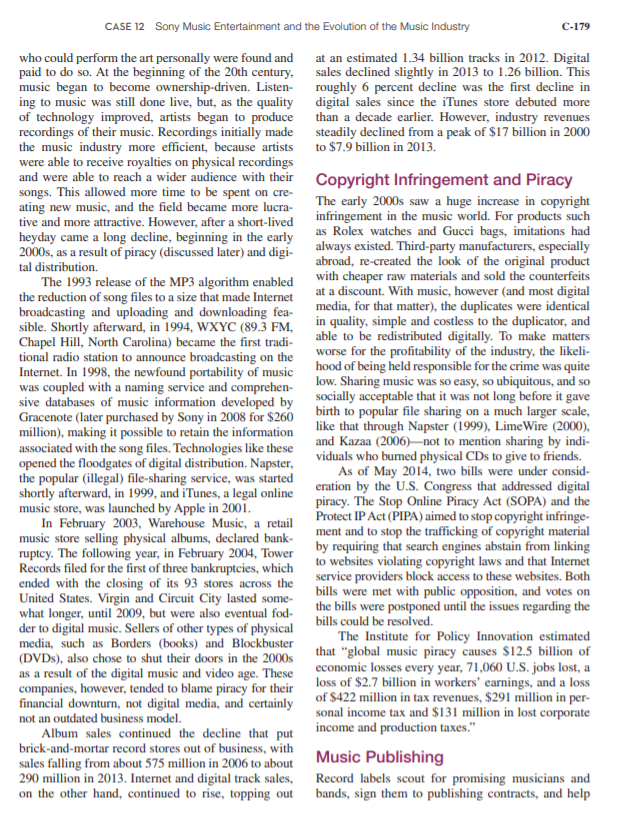

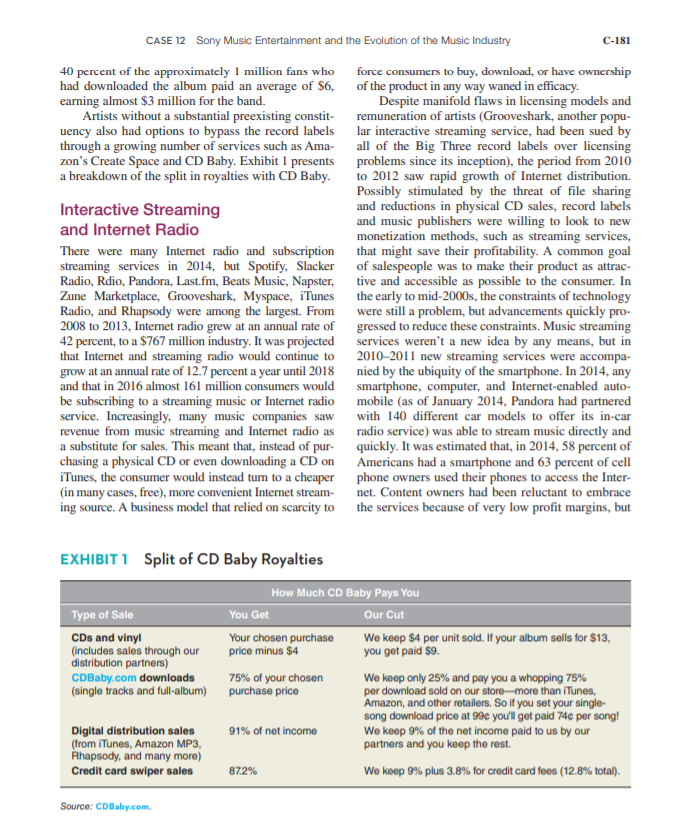

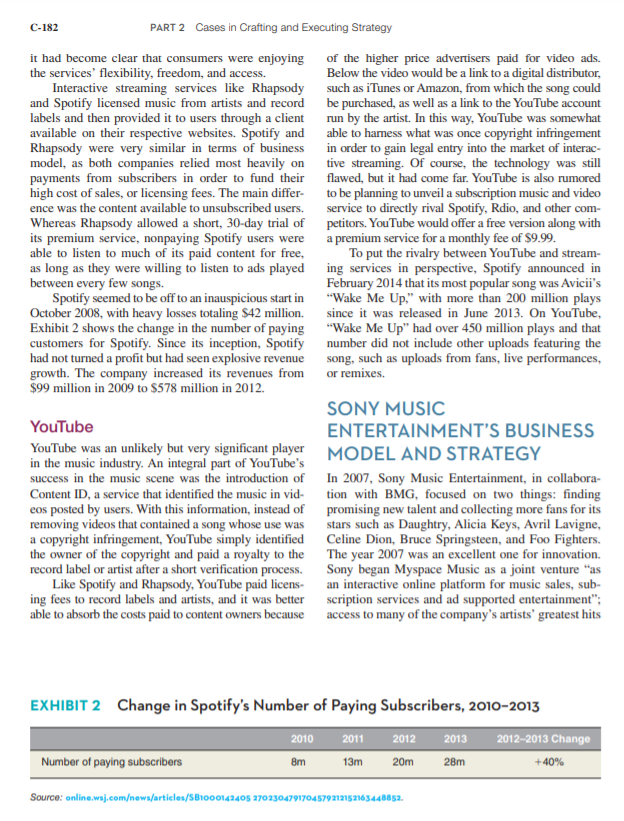

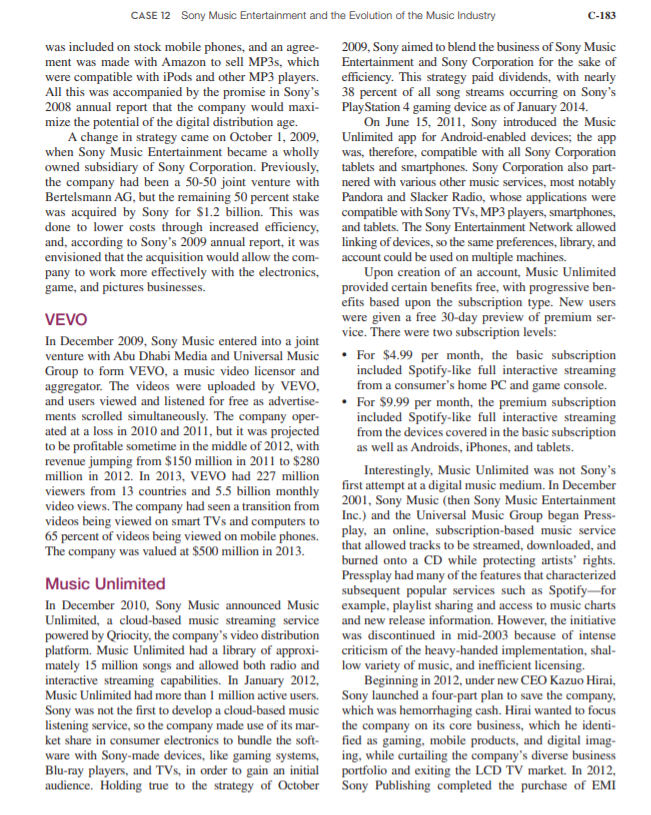

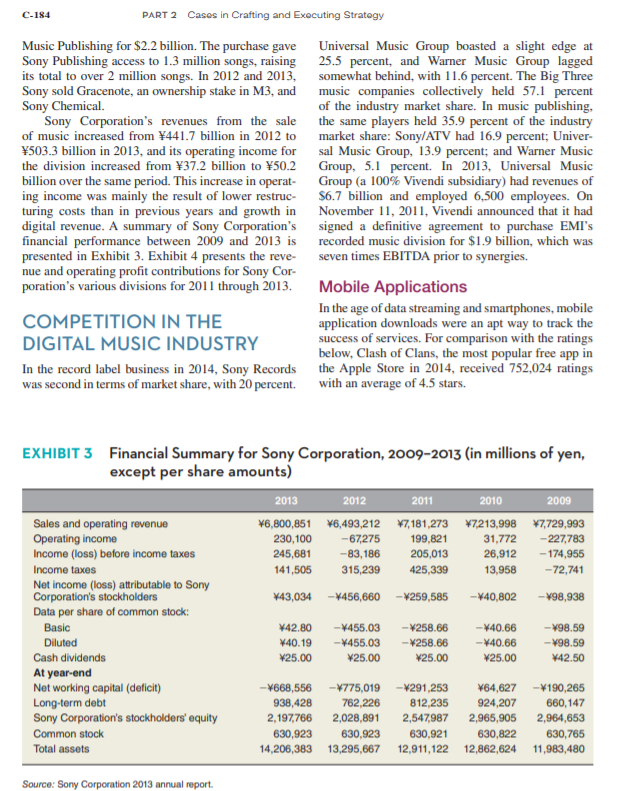

C-180 PART 2 Cases in Crafting and Executing Strategy them through the process of creating and marketing of the same parent company. Publishers also helped their music. Record labels (or the artists themselves) to market recordings and performed services for a will typically own all rights to the master recordings musician much as a bank did for a businessperson, tiat deir artists produce and then compensate the providing advances and loans willi future income as artists according to the amount of sales that the spe- collateral. cific sound recording produces. Labels record the music of artists in studios, manufacture recordings, DIGITAL MUSIC and promote and distribute that music by various means to the consumer. Through copyrights, labels DISTRIBUTION IN 2014 are responsible for the protection of the music and In 2014, there were three main methods of digital artists they sponsor There was an increasing simplicity to digital music distribution: digital download, Internet radio, music distribution, and it was becoming easier and and interactive streaming. For the digital purchases easier for artists to record, publish, and promote of music, iTunes was the clear leader, accounting their music themselves without the help of corpora- for 63 percent of digital music sales in 2013, and it tions. The trend of using the Internet and technology had facilitated over $25 billion in digital music sales that was more accessible than ever had initiated a since its inception. According to Apple's 2013 10-K bypass of the middlemen and was a difficult obsta- report, filed October 30, 2013, the iTunes Store gen- cle for music companies to overcome. erated a total of $9.3 billion in net sales during 2013, In January 2014, Sony Music Entertainment representing a 24 percent increase over 2012 sales. was the second-largest record label, with 20 percent The iTunes sales figure included digital music down- of total industry market share. In terms of total loads through iTunes, purchases through the App album sales, Sony Music Entertainment was posi- Store, and purchases on iBooks. In September 2013, tioned with 30.4 percent of market share, behind the iTunes had launched its own free Internet radio ser- leader Universal by 7.3 percent; however, Sony's vice, iTunes Radio. The service tailored radio sta- artist Justin Timberlake was the top-selling artist tions on the basis of users' iTunes libraries and user in 2013. In digital sales, Sony still lagged behind input. The service was available in Australia and the Universal by 6.2 and 9.5 percent in album sales United States and boasted over 20 million users. and individual-track sales, respectively. Sony/ATV Music Publishing was the largest music publisher. Self-Publishing in the Music Industry with 16.9 percent of the total market share. The same technologies and social environment that Whereas record companies owned the physi- facilitated the rise in digital distribution through cal sound recording, publishers (or the artists services like iTunes and Amazon were also facili- themselves) typically owned the rights to license tating self-publishing, and in 2014 the allure to and collect royalties on the specific melody, lyr- an artist was strong. The creator had control over ics, rhythm, and so on, every time they were used. the creation; the profit margin was much higher A "use" of a song was typically classified as fall- and paid monthly, in contrast to the annual roy- ing under one of three "rights" controlled by a pub alty remuneration typical of labels; and the whole lisher: Mechanical rights represented the ability of process was completed much faster. Avoiding the an owner to collect royalties when the song was dig. 30 percent cut that distributors like iTunes and itally downloaded; performing arts royalties were Amazon took was an incentive in and of itself, if collected when a song was played on the radio, and avoiding the typical 10 percent cut to record labels synchronization royalties would be collected when wasn't enough a song was used in a movie or commercial. Pub- For example, the band Radiohead digitally self- lishers typically worked closely with record labels published two albums, In Rainbows (October 2007) in the same way that a hardware store might have and King of Limbs (February 2011), by means of worked with a carpenter or plumber. In the case of the band's website, radiohead.com. Additionally, Sony Music Entertainment and the other two lead- In Rainbows was released on a donation-based sys- ing music industry giants, both the publisher and tem, which effectively allowed fans to download the label were vertically integrated as subsidiaries the album free. In the first month after its release, CASE 12 Sony Music Entertainment and the Evolution of the Music Industry C-181 40 percent of the approximately 1 million fans who force consumers to buy, download, or have ownership had downloaded the album paid an average of $6, of the product in any way waned in efficacy. earning almost $3 million for the band. Despite manifold flaws in licensing models and Artists without a substantial preexisting constit- remuneration of artists (Grooveshark, another popu- uency also had options to bypass the record labels lar interactive streaming service, had been sued by through a growing number of services such as Ama- all of the Big Three record labels over licensing zon's Create Space and CD Baby. Exhibit 1 presents problems since its inception), the period from 2010 a breakdown of the split in royalties with CD Baby. to 2012 saw rapid growth of Internet distribution. Possibly stimulated by the threat of file sharing Interactive Streaming and reductions in physical CD sales, record labels and Internet Radio and music publishers were willing to look to new monetization methods, such as streaming services, There were many Intemet radio and subscription that might save their profitability. A common goal streaming services in 2014, but Spotify, Slacker of salespeople was to make their product as attrac- Radio, Rdio, Pandora, Last.fm, Beats Music, Napster, tive and accessible as possible to the consumer. In Zune Marketplace, Grooveshark, Myspace, iTunes the early to mid-2000s, the constraints of technology Radio, and Rhapsody were among the largest . From were still a problem, but advancements quickly pro- 2008 to 2013, Internet radio grew at an annual rate of gressed to reduce these constraints. Music Streaming 42 percent, to a $767 million industry. It was projected services weren't a new idea by any means, but in that Internet and streaming radio would continue to 2010-2011 new streaming services were accompa- grow at an annual rate of 12.7 percent a year until 2018 nied by the ubiquity of the smartphone. In 2014, any and that in 2016 almost 161 million consumers would smartphone, computer, and Internet-enabled auto- be subscribing to a streaming music or Internet radio mobile (as of January 2014, Pandora had partnered service. Increasingly, many music companies saw with 140 different car models to offer its in-car revenue from music streaming and Internet radio as radio service) was able to stream music directly and a substitute for sales. This meant that, instead of pur- quickly. It was estimated that, in 2014, 58 percent of chasing a physical CD or even downloading a CD on Americans had a smartphone and 63 percent of cell iTunes, the consumer would instead tum to a cheaper phone owners used their phones to access the Inter- (in many cases, free), more convenient Internet stream- net. Content owners had been reluctant to embrace ing source. A business model that relied on scarcity to the services because of very low profit margins, but EXHIBIT 1 Split of CD Baby Royalties How Much CD Baby Pays You Type of Sale You Get Our Cut CDs and vinyl Your chosen purchase We keep $4 per unit sold. If your album sells for $13, (includes sales through our price minus $4 you get paid $9. distribution partners) CDBaby.com downloads 75% of your chosen We keep only 25% and pay you a whopping 75% (single tracks and full-album) purchase price per download sold on our store-more than iTunes, Amazon, and other retailers. So if you set your single- song download price at 99 you'll get paid 74 per song! Digital distribution sales 91% of net income We keep 9% of the net income paid to us by our (from iTunes, Amazon MP3, partners and you keep the rest. Rhapsody, and many more) Credit card swiper sales 87.2% We keep 9% plus 3.8% for credit card fees (12.8% total). Source: CDBaby.com. C-182 PART 2 Cases in Crafting and Executing Strategy it had become clear that consumers were enjoying of the higher price advertisers paid for video ads. the services' flexibility, freedom, and access. Below the video would be a link to a digital distributor, Interactive streaming services like Rhapsody such as iTunes or Amazon, from which the song could and Spotify licensed music from artists and record be purchased, as well as a link to the YouTube account labels and then provided it to users through a client run by the artist. In this way, YouTube was somewhat available on their respective websites. Spotify and able to hamess what was once copyright infringement Rhapsody were very similar in terms of business in order to gain legal entry into the market of interac- model, as both companies relied most heavily on tive streaming. Of course, the technology was still payments from subscribers in order to fund their flawed, but it had come far. YouTube is also rumored high cost of sales, or licensing fees. The main differ- to be planning to unveil a subscription music and video ence was the content available to unsubscribed users. service to directly rival Spotify, Rdio, and other com- Whereas Rhapsody allowed a short, 30-day trial of petitors. YouTube would offer a free version along with its premium service, nonpaying Spotify users were a premium service for a monthly fee of $9.99. able to listen to much of its paid content for free, To put the rivalry between YouTube and stream- as long as they were willing to listen to ads played ing services in perspective, Spotify announced in between every few songs. February 2014 that its most popular song was Avicii's Spotify seemed to be off to an inauspicious start in Wake Me Up," with more than 200 million plays October 2008, with heavy losses totaling $42 million. since it was released in June 2013. On YouTube, Exhibit 2 shows the change in the number of paying "Wake Me Up" had over 450 million plays and that customers for Spotify. Since its inception, Spotify number did not include other uploads featuring the had not turned a profit but had seen explosive revenue song, such as uploads from fans, live performances, growth. The company increased its revenues from or remixes. $99 million in 2009 to $578 million in 2012. SONY MUSIC YouTube ENTERTAINMENT'S BUSINESS YouTube was an unlikely but very significant player MODEL AND STRATEGY in the music industry. An integral part of YouTube's success in the music scene was the introduction of In 2007, Sony Music Entertainment, in collabora- Content ID, a service that identified the music in vid- tion with BMG, focused on two things: finding eos posted by users. With this information, instead of promising new talent and collecting more fans for its removing videos that contained a song whose use was stars such as Daughtry, Alicia Keys, Avril Lavigne, a copyright infringement, YouTube simply identified Celine Dion, Bruce Springsteen, and Foo Fighters. the owner of the copyright and paid a royalty to the The year 2007 was an excellent one for innovation. record label or artist after a short verification process. Sony began Myspace Music as a joint venture "as Like Spotify and Rhapsody, YouTube paid licens- an interactive online platform for music sales, sub- ing fees to record labels and artists, and it was better scription services and ad supported entertainment"; able to absorb the costs paid to content owners because access to many of the company's artists' greatest hits EXHIBIT 2 Change in Spotify's Number of Paying Subscribers, 2010-2013 2010 2011 2012 2013 2012-2013 Change Number of paying subscribers 8m 13m 20m 28m +40% Source: online waj.comews/articles/SB1000142405 2702304791704579212152163448852. C-184 PART 2 Cases in Crafting and Executing Strategy Music Publishing for $2.2 billion. The purchase gave Universal Music Group boasted a slight edge at Sony Publishing access to 1.3 million songs, raising 25.5 percent, and Warner Music Group lagged its total to over 2 million songs. In 2012 and 2013, somewhat behind, with 11.6 percent. The Big Three Sony sold Gracenote, an ownership stake in M3, and music companies collectively held 57.1 percent Sony Chemical of the industry market share. In music publishing, Sony Corporation's revenues from the sale the same players held 35.9 percent of the industry of music increased from 441.7 billion in 2012 to market share: Sony/ATV had 16.9 percent; Univer- 503.3 billion in 2013, and its operating income for sal Music Group, 13.9 percent; and Warner Music the division increased from 37.2 billion to 50.2 Group, 5.1 percent. In 2013, Universal Music billion over the same period. This increase in operat- Group (a 100% Vivendi subsidiary) had revenues of ing income was mainly the result of lower restruc- $6.7 billion and employed 6,500 employees. On turing costs than in previous years and growth in November 11, 2011, Vivendi announced that it had digital revenue. A summary of Sony Corporation's signed a definitive agreement to purchase EMI's financial performance between 2009 and 2013 is recorded music division for $1.9 billion, which was presented in Exhibit 3. Exhibit 4 presents the reve- seven times EBITDA prior to synergies. nue and operating profit contributions for Sony Cor- poration's various divisions for 2011 through 2013. Mobile Applications In the age of data streaming and smartphones, mobile COMPETITION IN THE application downloads were an apt way to track the DIGITAL MUSIC INDUSTRY success of services. For comparison with the ratings below, Clash of Clans, the most popular free app in In the record label business in 2014, Sony Records the Apple Store in 2014, received 752,024 ratings was second in terms of market share, with 20 percent. with an average of 4.5 stars. EXHIBIT 3 Financial Summary for Sony Corporation, 2009-2013 (in millions of yen, except per share amounts) 2013 2012 2011 2010 2009 Sales and operating revenue 6,800,851 46,493,212 47,181,273 47,213,998 7,729,993 Operating income 230,100 -67,275 199,821 31,772 - 227,783 Income (loss) before income taxes 245,681 -83,186 205,013 26,912 - 174,955 Income taxes 141,505 315,239 425,339 13,958 - 72,741 Net income (loss) attributable to Sony Corporation's stockholders 43,034 -4456,660 - 259,585 -440,802 -Y98,938 Data per share of common stock: Basic 42.80 -455.03 - 258.66 -Y40.66 -V98.59 Diluted 40.19 -4455.03 -258.66 -Y40.66 -V98.59 Cash dividends 125.00 25.00 25.00 25.00 42.50 At year-end Net working capital (deficit) - 668,556 - 775,019-4291,253 64,627 - 190,265 Long-term debt 938,428 762.226 812,235 924,207 660,147 Sony Corporation's stockholders' equity 2,197,766 2,028,891 2,547,987 2,965,905 2,964,653 Common stock 630,923 630,923 630,921 630,822 630,765 Total assets 14,206,383 13,295,667 12,911,122 12,862,624 11,983,480 Source: Sony Corporation 2013 annual report. CASE 12 Sony Music Entertainment and the Evolution of the Music Industry C-185 Pandora. Pandora received 811,124 ratings with . Spotify Spotify had 303,200 ratings with an aver- an average of 4 stars at the Apple Store and age of 4.5 stars at the Apple Store and 568,870 1,428,724 ratings with an average of 4.5 stars at ratings with an average of 4 stars at Google Play Google Play in 2013. As of the first quarter of in 2013. It was estimated that Spotify had been 2014, Pandora had over 250 million registered downloaded more than 100 million times by 2014. users, who listened to 4.8 billion hours of music, In May 2014, Spotify had over 24 million active and had total revenue of $194.3 million. Pandora users, 5 million of whom were paying for the inter- had been downloaded more than 1 billion times active streaming service. The company was based and claimed 73.6 percent of the market share of in Sweden and operated globally in 56 countries. streaming Internet radio listening in 2013. The bulk of an average band's or artist's income Music Unlimited. At $9.99 per month, Music in 2013 came from live performancesthis was true Unlimited was far less popular than Pandora. It even for a band like Radiohead, which was able to received 688 ratings with an average of 3 stars at self-publish a CD that earned almost $3 million. the Apple Store and 24,029 ratings with an average Under such circumstances, the publishing industry of 3.7 stars at Google Play. Music Unlimited had still continued to struggle with monetizing stream- approximately 10 million downloads by 2014. ing music and saw an average annual growth of EXHIBIT 4 Sony Corporation's Revenues and Operating Income, by Division, 2012-2013 (in millions of yen) 2013 2012 Sales and operating revenue Mobile Products & Communications 1,257,618 622,677 Game 707,078 804,966 Imaging Products & Solutions 756,201 785, 116 Home Entertainment & Sound 994,827 1,286,261 Devices 848,575 1,026,568 Pictures 732,739 657,721 Music 441,708 442,789 Financial Services 1,002,389 868,661 All other, corporate and eliminations 59,716 -1,547 Consolidated 6,800,851 46,493,212 Operating income Mobile Products & Communications - 97,170 7,246 Game 1,735 29,302 Imaging Products & Solutions 1,442 19,641 Home Entertainment & Sound -84,315 - 199,461 Devices 43,895 -22, 126 Pictures 47,800 34,130 Music 37,218 36,887 Financial Services 142,209 129,283 All other, corporate and eliminations 137,286 -102,177 Consolidated 230,100 - 67,275 Source: Sony Corporation 2013 annual report. C-186 PART 2 Cases in Crafting and Executing Strategy negative 3.8 percent from 2008 to 2013. This was However, despite the downside risk of the shift only slightly better than the performance of its big- in the way that music was monetized, subscription brother industry, record labels, which recorded a services still represented significant opportunity. negative 4.3 percent growth rate from 2009 to 2014. They were much more accessible and convenient to Prior to CD duplication and digital distribution, con- the consumer than was purchasing an MP3, and such sumers either paid the price to hear the entire album convenience represented an addition in value. Addi- (even if they liked only five songs on it) or didn't tions in value were typically commensurate with an hear the music at all. In the same scenario in 2014, increase in demand and therefore an increase in rev- consumers were likely to simply download the enue, and most agreed that an increase in the "rev- music illegally from a file sharing site. The small enue pie" of the industry would help solve problems. number of people who purchased music legitimately Subscription services also proved to be helpful to would buy only the five songs they liked. new bands whose focus was more on promotion and Whatever the model of access to music, some- development of a fan base than on immediate profit. thing that seemingly was dropped by the wayside Exploring new music on a Pandora radio station or was remuneration of artists. In an industry where through the Related Artists feature on Spotify was the consumer was becoming increasingly important, much more accessible, as it was not necessary to it was equally important for record labels like Sony purchase each individual song. Streaming had also Music Entertainment to keep in mind that with proved to be an excellent medium for advertising and out the promise of profitability, sustainability, and publicity for concerts, downloads, and merchandise. means of financial support, artists might return to Rhapsody, a subscription service available only their roots, heavily focused on live performances, in the United States, had been around for nearly whereby the product was much harder to steal. The 10 years and had experienced slow, steady growth. stimulation and motivation for an artist to record a Rhapsody had been stagnant at 800,000 subscribers song decreased significantly if there was no way to for several years, but in December 2011, the com- support oneself financially, and, although the world pany experienced tremendous growth, hitting 1 mil- would never stop making music, profitability incen- lion paying customers for the first time. Since the tives and disincentives were just as real in the music large increase, Rhapsody made only incremental industry as they were in any other industry that pro- gains, reaching an estimated 1.2 million subscribers duced a product for sale. in 2013. With Spotify and other streaming services Although the way of the future seemed to be posting wild growth increases, the only question interactive streaming and Internet radio funded by was the sustainability of such increases. subscription or advertisements, there was much According to David Hyman, CEO of Beats debate in the music community about the effects that Music and former CEO of MOG (a popular interac- such a shift would have on the industry. Streaming tive streaming service that shut down in 2014), an services were growing very rapidly, as evidenced by average iTunes user spent $40 a year on music, the the success of a wide variety of new services and average American spent $17 a year on music, and the continued decreases in physical and digital CD premium subscribers to MOG paid $120. Hyman sales. While these services were growing rapidly, in attested, "When it comes to individual deals between 2014 they still represented only 6.6 percent of the artists and labels, I do know that the content owners, total revenue to labels and even less to the average the labels and the publishers are getting a lot more artist. A subscriber had no idea where his or her money out of these subscription services than they're $9.99 subscription went, but it certainly didn't go getting from iTunes." Like iTunes, MOG had for- straight to the artist. Label agreements with artists warded an average of 65 percent of income to labels. were traditionally confidential, so it was difficult to In another interesting use of technology to mon- discern exactly how much money was being trans- etize music, Denison Witmer, a solo artist who got his ferred to the original creators of the product, that start playing with Sufjan Stevens, began what he called is, the music. This was why many popular artists, an "Everywhere at Once" tour in 2012. By paying $25 such as Coldplay, Adele, and the Black Keys, at his website, fans were able to order a personal show resisted or even denied access to their music through of one to two songs played by Witmer himself live subscription-based services. from his kitchen over Skype or Apple's FaceTime. C-187 CASE 12 Sony Music Entertainment and the Evolution of the Music Industry In terms of forecasting the future of the music In the words of Sony founder Masaru Ibuka, Cre- industry, the movie industry offered some clues, ativity comes from looking for the unexpected and step- especially with services like VEVO and YouTube ping outside your own experience."2 Sony as a company blurring the line between video and music. Quite showed great innovation and clever execution in the recently, Netflix superseded physical DVD stores, past, earning a significant market share in many diffuse driving companies like Blockbuster and Movie Gal- markets, both in terms of geography and in terms of lery to Chapter 11 bankruptcy in September 2010 products. The question of the future was always: How and February 2010, respectively. would the current position be used to press forward? ENDNOTES As quoted in a Sony Corporation press release, March 2, 2011 Quote from Masaru ibuka at quotes.lifehack .org C-180 PART 2 Cases in Crafting and Executing Strategy them through the process of creating and marketing of the same parent company. Publishers also helped their music. Record labels (or the artists themselves) to market recordings and performed services for a will typically own all rights to the master recordings musician much as a bank did for a businessperson, tiat deir artists produce and then compensate the providing advances and loans willi future income as artists according to the amount of sales that the spe- collateral. cific sound recording produces. Labels record the music of artists in studios, manufacture recordings, DIGITAL MUSIC and promote and distribute that music by various means to the consumer. Through copyrights, labels DISTRIBUTION IN 2014 are responsible for the protection of the music and In 2014, there were three main methods of digital artists they sponsor There was an increasing simplicity to digital music distribution: digital download, Internet radio, music distribution, and it was becoming easier and and interactive streaming. For the digital purchases easier for artists to record, publish, and promote of music, iTunes was the clear leader, accounting their music themselves without the help of corpora- for 63 percent of digital music sales in 2013, and it tions. The trend of using the Internet and technology had facilitated over $25 billion in digital music sales that was more accessible than ever had initiated a since its inception. According to Apple's 2013 10-K bypass of the middlemen and was a difficult obsta- report, filed October 30, 2013, the iTunes Store gen- cle for music companies to overcome. erated a total of $9.3 billion in net sales during 2013, In January 2014, Sony Music Entertainment representing a 24 percent increase over 2012 sales. was the second-largest record label, with 20 percent The iTunes sales figure included digital music down- of total industry market share. In terms of total loads through iTunes, purchases through the App album sales, Sony Music Entertainment was posi- Store, and purchases on iBooks. In September 2013, tioned with 30.4 percent of market share, behind the iTunes had launched its own free Internet radio ser- leader Universal by 7.3 percent; however, Sony's vice, iTunes Radio. The service tailored radio sta- artist Justin Timberlake was the top-selling artist tions on the basis of users' iTunes libraries and user in 2013. In digital sales, Sony still lagged behind input. The service was available in Australia and the Universal by 6.2 and 9.5 percent in album sales United States and boasted over 20 million users. and individual-track sales, respectively. Sony/ATV Music Publishing was the largest music publisher. Self-Publishing in the Music Industry with 16.9 percent of the total market share. The same technologies and social environment that Whereas record companies owned the physi- facilitated the rise in digital distribution through cal sound recording, publishers (or the artists services like iTunes and Amazon were also facili- themselves) typically owned the rights to license tating self-publishing, and in 2014 the allure to and collect royalties on the specific melody, lyr- an artist was strong. The creator had control over ics, rhythm, and so on, every time they were used. the creation; the profit margin was much higher A "use" of a song was typically classified as fall- and paid monthly, in contrast to the annual roy- ing under one of three "rights" controlled by a pub alty remuneration typical of labels; and the whole lisher: Mechanical rights represented the ability of process was completed much faster. Avoiding the an owner to collect royalties when the song was dig. 30 percent cut that distributors like iTunes and itally downloaded; performing arts royalties were Amazon took was an incentive in and of itself, if collected when a song was played on the radio, and avoiding the typical 10 percent cut to record labels synchronization royalties would be collected when wasn't enough a song was used in a movie or commercial. Pub- For example, the band Radiohead digitally self- lishers typically worked closely with record labels published two albums, In Rainbows (October 2007) in the same way that a hardware store might have and King of Limbs (February 2011), by means of worked with a carpenter or plumber. In the case of the band's website, radiohead.com. Additionally, Sony Music Entertainment and the other two lead- In Rainbows was released on a donation-based sys- ing music industry giants, both the publisher and tem, which effectively allowed fans to download the label were vertically integrated as subsidiaries the album free. In the first month after its release, CASE 12 Sony Music Entertainment and the Evolution of the Music Industry C-181 40 percent of the approximately 1 million fans who force consumers to buy, download, or have ownership had downloaded the album paid an average of $6, of the product in any way waned in efficacy. earning almost $3 million for the band. Despite manifold flaws in licensing models and Artists without a substantial preexisting constit- remuneration of artists (Grooveshark, another popu- uency also had options to bypass the record labels lar interactive streaming service, had been sued by through a growing number of services such as Ama- all of the Big Three record labels over licensing zon's Create Space and CD Baby. Exhibit 1 presents problems since its inception), the period from 2010 a breakdown of the split in royalties with CD Baby. to 2012 saw rapid growth of Internet distribution. Possibly stimulated by the threat of file sharing Interactive Streaming and reductions in physical CD sales, record labels and Internet Radio and music publishers were willing to look to new monetization methods, such as streaming services, There were many Intemet radio and subscription that might save their profitability. A common goal streaming services in 2014, but Spotify, Slacker of salespeople was to make their product as attrac- Radio, Rdio, Pandora, Last.fm, Beats Music, Napster, tive and accessible as possible to the consumer. In Zune Marketplace, Grooveshark, Myspace, iTunes the early to mid-2000s, the constraints of technology Radio, and Rhapsody were among the largest . From were still a problem, but advancements quickly pro- 2008 to 2013, Internet radio grew at an annual rate of gressed to reduce these constraints. Music Streaming 42 percent, to a $767 million industry. It was projected services weren't a new idea by any means, but in that Internet and streaming radio would continue to 2010-2011 new streaming services were accompa- grow at an annual rate of 12.7 percent a year until 2018 nied by the ubiquity of the smartphone. In 2014, any and that in 2016 almost 161 million consumers would smartphone, computer, and Internet-enabled auto- be subscribing to a streaming music or Internet radio mobile (as of January 2014, Pandora had partnered service. Increasingly, many music companies saw with 140 different car models to offer its in-car revenue from music streaming and Internet radio as radio service) was able to stream music directly and a substitute for sales. This meant that, instead of pur- quickly. It was estimated that, in 2014, 58 percent of chasing a physical CD or even downloading a CD on Americans had a smartphone and 63 percent of cell iTunes, the consumer would instead tum to a cheaper phone owners used their phones to access the Inter- (in many cases, free), more convenient Internet stream- net. Content owners had been reluctant to embrace ing source. A business model that relied on scarcity to the services because of very low profit margins, but EXHIBIT 1 Split of CD Baby Royalties How Much CD Baby Pays You Type of Sale You Get Our Cut CDs and vinyl Your chosen purchase We keep $4 per unit sold. If your album sells for $13, (includes sales through our price minus $4 you get paid $9. distribution partners) CDBaby.com downloads 75% of your chosen We keep only 25% and pay you a whopping 75% (single tracks and full-album) purchase price per download sold on our store-more than iTunes, Amazon, and other retailers. So if you set your single- song download price at 99 you'll get paid 74 per song! Digital distribution sales 91% of net income We keep 9% of the net income paid to us by our (from iTunes, Amazon MP3, partners and you keep the rest. Rhapsody, and many more) Credit card swiper sales 87.2% We keep 9% plus 3.8% for credit card fees (12.8% total). Source: CDBaby.com. C-182 PART 2 Cases in Crafting and Executing Strategy it had become clear that consumers were enjoying of the higher price advertisers paid for video ads. the services' flexibility, freedom, and access. Below the video would be a link to a digital distributor, Interactive streaming services like Rhapsody such as iTunes or Amazon, from which the song could and Spotify licensed music from artists and record be purchased, as well as a link to the YouTube account labels and then provided it to users through a client run by the artist. In this way, YouTube was somewhat available on their respective websites. Spotify and able to hamess what was once copyright infringement Rhapsody were very similar in terms of business in order to gain legal entry into the market of interac- model, as both companies relied most heavily on tive streaming. Of course, the technology was still payments from subscribers in order to fund their flawed, but it had come far. YouTube is also rumored high cost of sales, or licensing fees. The main differ- to be planning to unveil a subscription music and video ence was the content available to unsubscribed users. service to directly rival Spotify, Rdio, and other com- Whereas Rhapsody allowed a short, 30-day trial of petitors. YouTube would offer a free version along with its premium service, nonpaying Spotify users were a premium service for a monthly fee of $9.99. able to listen to much of its paid content for free, To put the rivalry between YouTube and stream- as long as they were willing to listen to ads played ing services in perspective, Spotify announced in between every few songs. February 2014 that its most popular song was Avicii's Spotify seemed to be off to an inauspicious start in Wake Me Up," with more than 200 million plays October 2008, with heavy losses totaling $42 million. since it was released in June 2013. On YouTube, Exhibit 2 shows the change in the number of paying "Wake Me Up" had over 450 million plays and that customers for Spotify. Since its inception, Spotify number did not include other uploads featuring the had not turned a profit but had seen explosive revenue song, such as uploads from fans, live performances, growth. The company increased its revenues from or remixes. $99 million in 2009 to $578 million in 2012. SONY MUSIC YouTube ENTERTAINMENT'S BUSINESS YouTube was an unlikely but very significant player MODEL AND STRATEGY in the music industry. An integral part of YouTube's success in the music scene was the introduction of In 2007, Sony Music Entertainment, in collabora- Content ID, a service that identified the music in vid- tion with BMG, focused on two things: finding eos posted by users. With this information, instead of promising new talent and collecting more fans for its removing videos that contained a song whose use was stars such as Daughtry, Alicia Keys, Avril Lavigne, a copyright infringement, YouTube simply identified Celine Dion, Bruce Springsteen, and Foo Fighters. the owner of the copyright and paid a royalty to the The year 2007 was an excellent one for innovation. record label or artist after a short verification process. Sony began Myspace Music as a joint venture "as Like Spotify and Rhapsody, YouTube paid licens- an interactive online platform for music sales, sub- ing fees to record labels and artists, and it was better scription services and ad supported entertainment"; able to absorb the costs paid to content owners because access to many of the company's artists' greatest hits EXHIBIT 2 Change in Spotify's Number of Paying Subscribers, 2010-2013 2010 2011 2012 2013 2012-2013 Change Number of paying subscribers 8m 13m 20m 28m +40% Source: online waj.comews/articles/SB1000142405 2702304791704579212152163448852. C-184 PART 2 Cases in Crafting and Executing Strategy Music Publishing for $2.2 billion. The purchase gave Universal Music Group boasted a slight edge at Sony Publishing access to 1.3 million songs, raising 25.5 percent, and Warner Music Group lagged its total to over 2 million songs. In 2012 and 2013, somewhat behind, with 11.6 percent. The Big Three Sony sold Gracenote, an ownership stake in M3, and music companies collectively held 57.1 percent Sony Chemical of the industry market share. In music publishing, Sony Corporation's revenues from the sale the same players held 35.9 percent of the industry of music increased from 441.7 billion in 2012 to market share: Sony/ATV had 16.9 percent; Univer- 503.3 billion in 2013, and its operating income for sal Music Group, 13.9 percent; and Warner Music the division increased from 37.2 billion to 50.2 Group, 5.1 percent. In 2013, Universal Music billion over the same period. This increase in operat- Group (a 100% Vivendi subsidiary) had revenues of ing income was mainly the result of lower restruc- $6.7 billion and employed 6,500 employees. On turing costs than in previous years and growth in November 11, 2011, Vivendi announced that it had digital revenue. A summary of Sony Corporation's signed a definitive agreement to purchase EMI's financial performance between 2009 and 2013 is recorded music division for $1.9 billion, which was presented in Exhibit 3. Exhibit 4 presents the reve- seven times EBITDA prior to synergies. nue and operating profit contributions for Sony Cor- poration's various divisions for 2011 through 2013. Mobile Applications In the age of data streaming and smartphones, mobile COMPETITION IN THE application downloads were an apt way to track the DIGITAL MUSIC INDUSTRY success of services. For comparison with the ratings below, Clash of Clans, the most popular free app in In the record label business in 2014, Sony Records the Apple Store in 2014, received 752,024 ratings was second in terms of market share, with 20 percent. with an average of 4.5 stars. EXHIBIT 3 Financial Summary for Sony Corporation, 2009-2013 (in millions of yen, except per share amounts) 2013 2012 2011 2010 2009 Sales and operating revenue 6,800,851 46,493,212 47,181,273 47,213,998 7,729,993 Operating income 230,100 -67,275 199,821 31,772 - 227,783 Income (loss) before income taxes 245,681 -83,186 205,013 26,912 - 174,955 Income taxes 141,505 315,239 425,339 13,958 - 72,741 Net income (loss) attributable to Sony Corporation's stockholders 43,034 -4456,660 - 259,585 -440,802 -Y98,938 Data per share of common stock: Basic 42.80 -455.03 - 258.66 -Y40.66 -V98.59 Diluted 40.19 -4455.03 -258.66 -Y40.66 -V98.59 Cash dividends 125.00 25.00 25.00 25.00 42.50 At year-end Net working capital (deficit) - 668,556 - 775,019-4291,253 64,627 - 190,265 Long-term debt 938,428 762.226 812,235 924,207 660,147 Sony Corporation's stockholders' equity 2,197,766 2,028,891 2,547,987 2,965,905 2,964,653 Common stock 630,923 630,923 630,921 630,822 630,765 Total assets 14,206,383 13,295,667 12,911,122 12,862,624 11,983,480 Source: Sony Corporation 2013 annual report. CASE 12 Sony Music Entertainment and the Evolution of the Music Industry C-185 Pandora. Pandora received 811,124 ratings with . Spotify Spotify had 303,200 ratings with an aver- an average of 4 stars at the Apple Store and age of 4.5 stars at the Apple Store and 568,870 1,428,724 ratings with an average of 4.5 stars at ratings with an average of 4 stars at Google Play Google Play in 2013. As of the first quarter of in 2013. It was estimated that Spotify had been 2014, Pandora had over 250 million registered downloaded more than 100 million times by 2014. users, who listened to 4.8 billion hours of music, In May 2014, Spotify had over 24 million active and had total revenue of $194.3 million. Pandora users, 5 million of whom were paying for the inter- had been downloaded more than 1 billion times active streaming service. The company was based and claimed 73.6 percent of the market share of in Sweden and operated globally in 56 countries. streaming Internet radio listening in 2013. The bulk of an average band's or artist's income Music Unlimited. At $9.99 per month, Music in 2013 came from live performancesthis was true Unlimited was far less popular than Pandora. It even for a band like Radiohead, which was able to received 688 ratings with an average of 3 stars at self-publish a CD that earned almost $3 million. the Apple Store and 24,029 ratings with an average Under such circumstances, the publishing industry of 3.7 stars at Google Play. Music Unlimited had still continued to struggle with monetizing stream- approximately 10 million downloads by 2014. ing music and saw an average annual growth of EXHIBIT 4 Sony Corporation's Revenues and Operating Income, by Division, 2012-2013 (in millions of yen) 2013 2012 Sales and operating revenue Mobile Products & Communications 1,257,618 622,677 Game 707,078 804,966 Imaging Products & Solutions 756,201 785, 116 Home Entertainment & Sound 994,827 1,286,261 Devices 848,575 1,026,568 Pictures 732,739 657,721 Music 441,708 442,789 Financial Services 1,002,389 868,661 All other, corporate and eliminations 59,716 -1,547 Consolidated 6,800,851 46,493,212 Operating income Mobile Products & Communications - 97,170 7,246 Game 1,735 29,302 Imaging Products & Solutions 1,442 19,641 Home Entertainment & Sound -84,315 - 199,461 Devices 43,895 -22, 126 Pictures 47,800 34,130 Music 37,218 36,887 Financial Services 142,209 129,283 All other, corporate and eliminations 137,286 -102,177 Consolidated 230,100 - 67,275 Source: Sony Corporation 2013 annual report. C-186 PART 2 Cases in Crafting and Executing Strategy negative 3.8 percent from 2008 to 2013. This was However, despite the downside risk of the shift only slightly better than the performance of its big- in the way that music was monetized, subscription brother industry, record labels, which recorded a services still represented significant opportunity. negative 4.3 percent growth rate from 2009 to 2014. They were much more accessible and convenient to Prior to CD duplication and digital distribution, con- the consumer than was purchasing an MP3, and such sumers either paid the price to hear the entire album convenience represented an addition in value. Addi- (even if they liked only five songs on it) or didn't tions in value were typically commensurate with an hear the music at all. In the same scenario in 2014, increase in demand and therefore an increase in rev- consumers were likely to simply download the enue, and most agreed that an increase in the "rev- music illegally from a file sharing site. The small enue pie" of the industry would help solve problems. number of people who purchased music legitimately Subscription services also proved to be helpful to would buy only the five songs they liked. new bands whose focus was more on promotion and Whatever the model of access to music, some- development of a fan base than on immediate profit. thing that seemingly was dropped by the wayside Exploring new music on a Pandora radio station or was remuneration of artists. In an industry where through the Related Artists feature on Spotify was the consumer was becoming increasingly important, much more accessible, as it was not necessary to it was equally important for record labels like Sony purchase each individual song. Streaming had also Music Entertainment to keep in mind that with proved to be an excellent medium for advertising and out the promise of profitability, sustainability, and publicity for concerts, downloads, and merchandise. means of financial support, artists might return to Rhapsody, a subscription service available only their roots, heavily focused on live performances, in the United States, had been around for nearly whereby the product was much harder to steal. The 10 years and had experienced slow, steady growth. stimulation and motivation for an artist to record a Rhapsody had been stagnant at 800,000 subscribers song decreased significantly if there was no way to for several years, but in December 2011, the com- support oneself financially, and, although the world pany experienced tremendous growth, hitting 1 mil- would never stop making music, profitability incen- lion paying customers for the first time. Since the tives and disincentives were just as real in the music large increase, Rhapsody made only incremental industry as they were in any other industry that pro- gains, reaching an estimated 1.2 million subscribers duced a product for sale. in 2013. With Spotify and other streaming services Although the way of the future seemed to be posting wild growth increases, the only question interactive streaming and Internet radio funded by was the sustainability of such increases. subscription or advertisements, there was much According to David Hyman, CEO of Beats debate in the music community about the effects that Music and former CEO of MOG (a popular interac- such a shift would have on the industry. Streaming tive streaming service that shut down in 2014), an services were growing very rapidly, as evidenced by average iTunes user spent $40 a year on music, the the success of a wide variety of new services and average American spent $17 a year on music, and the continued decreases in physical and digital CD premium subscribers to MOG paid $120. Hyman sales. While these services were growing rapidly, in attested, "When it comes to individual deals between 2014 they still represented only 6.6 percent of the artists and labels, I do know that the content owners, total revenue to labels and even less to the average the labels and the publishers are getting a lot more artist. A subscriber had no idea where his or her money out of these subscription services than they're $9.99 subscription went, but it certainly didn't go getting from iTunes." Like iTunes, MOG had for- straight to the artist. Label agreements with artists warded an average of 65 percent of income to labels. were traditionally confidential, so it was difficult to In another interesting use of technology to mon- discern exactly how much money was being trans- etize music, Denison Witmer, a solo artist who got his ferred to the original creators of the product, that start playing with Sufjan Stevens, began what he called is, the music. This was why many popular artists, an "Everywhere at Once" tour in 2012. By paying $25 such as Coldplay, Adele, and the Black Keys, at his website, fans were able to order a personal show resisted or even denied access to their music through of one to two songs played by Witmer himself live subscription-based services. from his kitchen over Skype or Apple's FaceTime. C-187 CASE 12 Sony Music Entertainment and the Evolution of the Music Industry In terms of forecasting the future of the music In the words of Sony founder Masaru Ibuka, Cre- industry, the movie industry offered some clues, ativity comes from looking for the unexpected and step- especially with services like VEVO and YouTube ping outside your own experience."2 Sony as a company blurring the line between video and music. Quite showed great innovation and clever execution in the recently, Netflix superseded physical DVD stores, past, earning a significant market share in many diffuse driving companies like Blockbuster and Movie Gal- markets, both in terms of geography and in terms of lery to Chapter 11 bankruptcy in September 2010 products. The question of the future was always: How and February 2010, respectively. would the current position be used to press forward? ENDNOTES As quoted in a Sony Corporation press release, March 2, 2011 Quote from Masaru ibuka at quotes.lifehack .org