Question: Assignment on Chapter 18, 19, 20-Due on Dec 2, 2023 #1. Zeinu Construction enters into a contract with a customer to build a warehouse

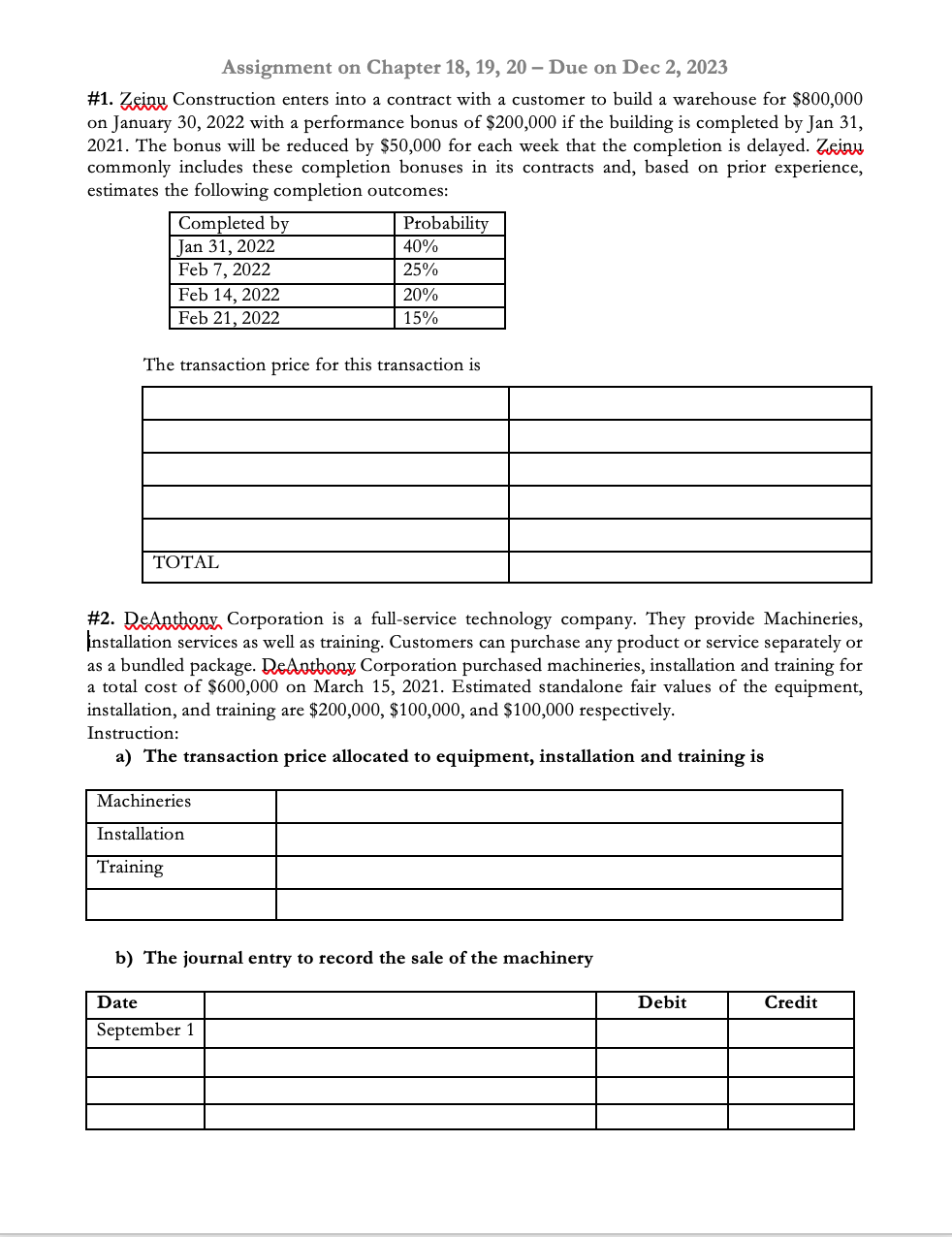

Assignment on Chapter 18, 19, 20-Due on Dec 2, 2023 #1. Zeinu Construction enters into a contract with a customer to build a warehouse for $800,000 on January 30, 2022 with a performance bonus of $200,000 if the building is completed by Jan 31, 2021. The bonus will be reduced by $50,000 for each week that the completion is delayed. Zeinu commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Jan 31, 2022 Feb 7, 2022 Feb 14, 2022 Feb 21, 2022 Probability 40% 25% 20% 15% The transaction price for this transaction is TOTAL #2. DeAnthony Corporation is a full-service technology company. They provide Machineries, Installation services as well as training. Customers can purchase any product or service separately or as a bundled package. DeAusbany Corporation purchased machineries, installation and training for a total cost of $600,000 on March 15, 2021. Estimated standalone fair values of the equipment, installation, and training are $200,000, $100,000, and $100,000 respectively. Instruction: a) The transaction price allocated to equipment, installation and training is Machineries Installation Training b) The journal entry to record the sale of the machinery Date September 1 Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts