Question: Assignment One Due May 4th.pdf Adobe Reader View Window Help 8 / 14 75% TAGUMU QUESTION FOUR SEA Plc is a Zambian resident compariy that

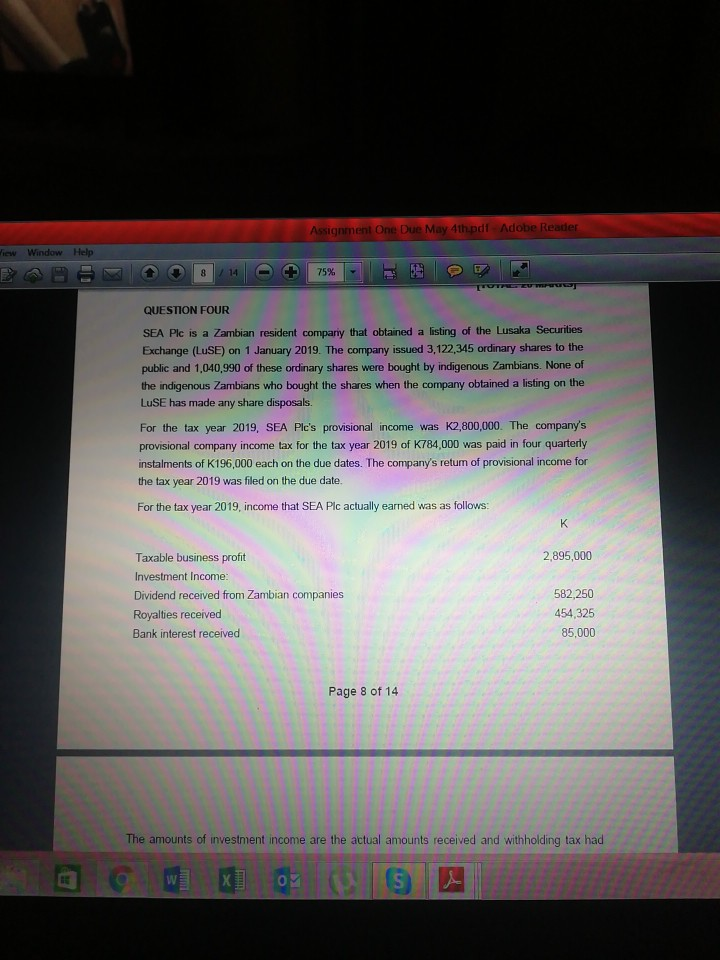

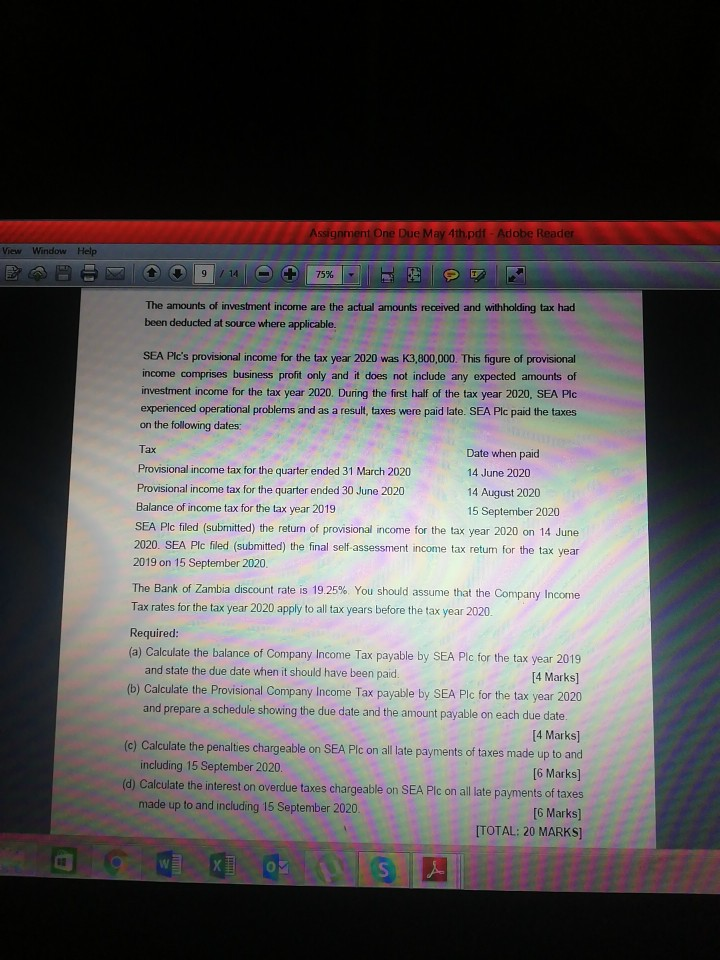

Assignment One Due May 4th.pdf Adobe Reader View Window Help 8 / 14 75% TAGUMU QUESTION FOUR SEA Plc is a Zambian resident compariy that obtained a listing of the Lusaka Securities Exchange (LUSE) on 1 January 2019. The company issued 3,122,345 ordinary shares to the public and 1,040,990 of these ordinary shares were bought by indigenous Zambians. None of the indigenous Zambians who bought the shares when the company obtained a listing on the LUSE has made any share disposals. For the tax year 2019, SEA Ple's provisional income was K2,800,000. The company's provisional company income tax for the tax year 2019 of K784,000 was paid in four quarterly instalments of K196,000 each on the due dates. The company's return of provisional income for the tax year 2019 was filed on the due date. For the tax year 2019, income that SEA Plc actually earned was as follows: 2,895,000 Taxable business profit Investment Income: Dividend received from Zambian companies Royalties received Bank interest received 582,250 454,325 85,000 Page 8 of 14 The amounts of investment income are the actual amounts received and withholding tax had w X OM Assignment One Due May 4th.pdf - Adobe Reader View Window Help 9 / 14 75% The amounts of investment income are the actual amounts received and withholding tax had been deducted at source where applicable. SEA Pic's provisional income for the tax year 2020 was K3,800,000. This figure of provisional income comprises business profit only and it does not include any expected amounts of investment income for the tax year 2020. During the first half of the tax year 2020, SEA PIC experienced operational problems and as a result, taxes were paid late. SEA Plc paid the taxes on the following dates: Tax Date when paid Provisional income tax for the quarter ended 31 March 2020 14 June 2020 Provisional income tax for the quarter ended 30 June 2020 14 August 2020 Balance of income tax for the tax year 2019 15 September 2020 SEA Plc filed (submitted) the return of provisional income for the tax year 2020 on 14 June 2020. SEA Plc filed (submitted the final self-assessment income tax return for the tax year 2019 on 15 September 2020 The Bank of Zambia discount rate is 19.25% You should assume that the Company Income Tax rates for the tax year 2020 apply to all tax years before the tax year 2020 Year 2019 Required: (a) Calculate the balance of Company Income Tax payable by SEA Plc for the tax and state the due date when it should have been paid [4 Marks] (b) Calculate the Provisional Company Income Tax payable by SEA Plc for the tax year 2020 and prepare a schedule showing the due date and the amount payable on each due date. [4 Marks] (c) Calculate the penalties chargeable on SEA Pic on all late payments of taxes made up to and including 15 September 2020. [6 Marks] (d) Calculate the interest on overdue taxes chargeable on SEA Plc on all late payments of taxes made up to and including 15 September 2020 [6 Marks] [TOTAL: 20 MARKS] W S Assignment One Due May 4th.pdf Adobe Reader View Window Help 8 / 14 75% TAGUMU QUESTION FOUR SEA Plc is a Zambian resident compariy that obtained a listing of the Lusaka Securities Exchange (LUSE) on 1 January 2019. The company issued 3,122,345 ordinary shares to the public and 1,040,990 of these ordinary shares were bought by indigenous Zambians. None of the indigenous Zambians who bought the shares when the company obtained a listing on the LUSE has made any share disposals. For the tax year 2019, SEA Ple's provisional income was K2,800,000. The company's provisional company income tax for the tax year 2019 of K784,000 was paid in four quarterly instalments of K196,000 each on the due dates. The company's return of provisional income for the tax year 2019 was filed on the due date. For the tax year 2019, income that SEA Plc actually earned was as follows: 2,895,000 Taxable business profit Investment Income: Dividend received from Zambian companies Royalties received Bank interest received 582,250 454,325 85,000 Page 8 of 14 The amounts of investment income are the actual amounts received and withholding tax had w X OM Assignment One Due May 4th.pdf - Adobe Reader View Window Help 9 / 14 75% The amounts of investment income are the actual amounts received and withholding tax had been deducted at source where applicable. SEA Pic's provisional income for the tax year 2020 was K3,800,000. This figure of provisional income comprises business profit only and it does not include any expected amounts of investment income for the tax year 2020. During the first half of the tax year 2020, SEA PIC experienced operational problems and as a result, taxes were paid late. SEA Plc paid the taxes on the following dates: Tax Date when paid Provisional income tax for the quarter ended 31 March 2020 14 June 2020 Provisional income tax for the quarter ended 30 June 2020 14 August 2020 Balance of income tax for the tax year 2019 15 September 2020 SEA Plc filed (submitted) the return of provisional income for the tax year 2020 on 14 June 2020. SEA Plc filed (submitted the final self-assessment income tax return for the tax year 2019 on 15 September 2020 The Bank of Zambia discount rate is 19.25% You should assume that the Company Income Tax rates for the tax year 2020 apply to all tax years before the tax year 2020 Year 2019 Required: (a) Calculate the balance of Company Income Tax payable by SEA Plc for the tax and state the due date when it should have been paid [4 Marks] (b) Calculate the Provisional Company Income Tax payable by SEA Plc for the tax year 2020 and prepare a schedule showing the due date and the amount payable on each due date. [4 Marks] (c) Calculate the penalties chargeable on SEA Pic on all late payments of taxes made up to and including 15 September 2020. [6 Marks] (d) Calculate the interest on overdue taxes chargeable on SEA Plc on all late payments of taxes made up to and including 15 September 2020 [6 Marks] [TOTAL: 20 MARKS] W S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts