Question: Assignment One Q# 2 : What are the main types of decisions that financial managers make? Describe each of those decisions. Answer: Q# 3 :

Assignment One Q#: What are the main types of decisions that financial managers make? Describe each

of those decisions.

Answer:

Q#: Which legal form of business organization is most common and why? Explain why

corporations face a double taxation problem.

Answer: Q#: Define agency problems and describe how they give rise to agency costs. How do

market forcesboth shareholder activism and the threat of takeoverprevent or minimize

the agency problem? What role do institutional investors play in shareholder activism?

Answer:

Q# : Mini Case #: Must Search Engines Screen Out Fake News?score:

During his January press conference, Presidentelect Donald Trump berated reporter

Jim Acosta and his employer, CNN saying, "You are fake news." For news organizations to

question the validity of facts cited by politicians was nothing unusual, especially during an

election year, but throughout the presidential election cycle, Trump turned that dynamic on

its head through his confrontations with CNN and other news organizations. These exchanges

sparked a debate about the responsibility of Google, Facebook, and other Internetbased

companies to identify websites spreading fake news.

Google offers an interesting case study on value maximization and corporate ethics. In

Google's founders provided An Owner's Manual" for shareholders, which stated that "Google

is not a conventional company" and that the company's ultimate goal is to develop services that

significantly improve the lives of as many people as possible." The founders stressed that

running a successful business is not enough; they also want Google to make the world a better

place. In light of that objective, what responsibility did Google have in helping voters distinguish

real news from fake news? Just one month before the election, Google introduced a new "fact check tag," to help readers assess the validity of news stories they were reading online. In

subsequent months, Google introduced the factcheck tag to markets in other countries where

elections

Google offers an interesting case study on value maximization and corporate ethics. In

Google's founders provided An Owner's Manual" for shareholders, which stated that "Google

is not a conventional company" and that the company's ultimate goal is to develop services that

significantly improve the lives of as many people as possible." The founders stressed that

running a successful business is not enough; they also want Google to make the world a better

place. In light of that objective, what responsibility did Google have in helping voters distinguish

real news from fake news? Just one month before the election, Google introduced a new "fact

check tag," to help readers assess the validity of news stories they were reading online. In

subsequent months, Google introduced the factcheck tag to markets in other countries where

elections were taking place, and it began new initiatives such as "Cross Check," an effort to

combine the work of human fact checkers with computer algorithms to identify fake news stories

in France during its election cycle.

Google's famous corporate motto, "Don't Be Evil," is intended to convey a willingness to do the

right thing even at the cost of shortrun sacrifice. Though Google may not always fully live up to

its lofty motto, the company's approach does not appear to be limiting its ability to maximize

value, as the share price increased almost from to

i Is the goal of maximizing shareholder wealth necessarily ethical or unethical?

ii What responsibility, if any, does Google have in helping users assess the veracity of

content they read online?Chapter Two: The Financial Market Environment Total score:

Questions:Score:

Q#: What are financial institutions? Describe the role they play within the financial market

environment.

Answer:

Q#: You are the chief financial officer CFO of Xerox Enterprises, an edgy fashion design

firm. Your firm needs $ million to expand production. How do you thi

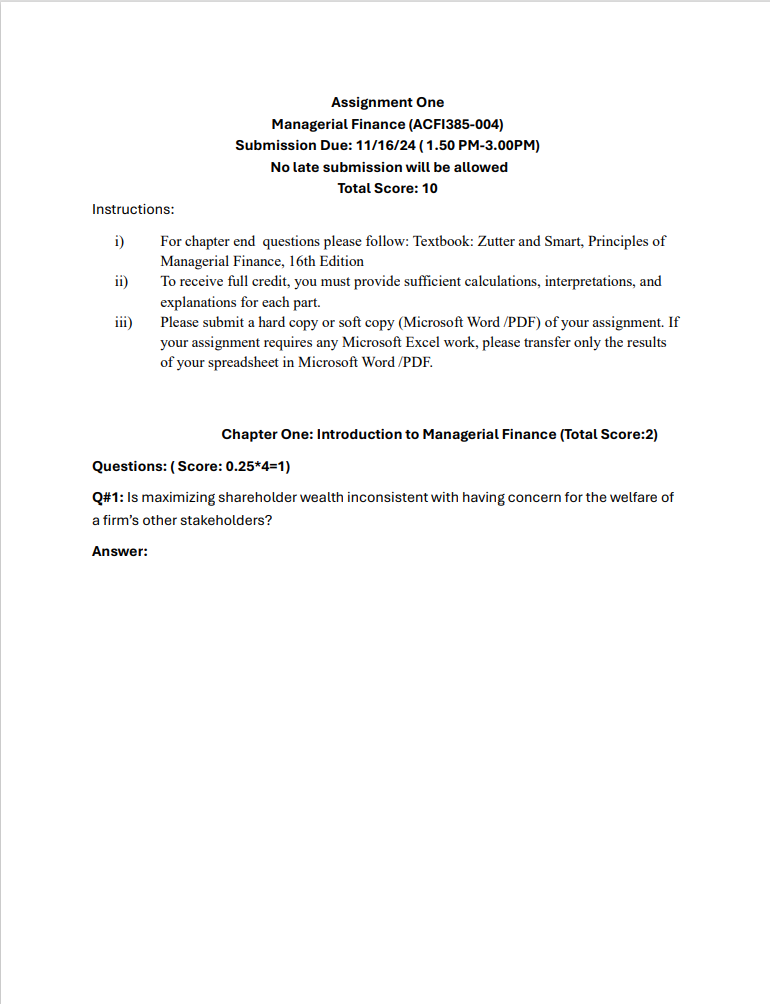

Managerial Finance ACFI

Submission Due: PMPM

No late submission will be allowed

Total Score:

Instructions:

i For chapter end questions please follow: Textbook: Zutter and Smart, Principles of Managerial Finance, th Edition

ii To receive full credit, you must provide sufficient calculations, interpretations, and explanations for each part.

iii Please submit a hard copy or soft copy Microsoft WordPDF of your assignment. If your assignment requires any Microsoft Excel work, please transfer only the results of your spreadsheet in Microsoft WordPDF

Chapter One: Introduction to Managerial Finance Total Score:

Questions: Score:

Q#: Is maximizing shareholder wealth inconsistent with having concern for the welfare of a firm's other stakeholders?

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock