Question: Assignment Part 2 is the continuation of Assignment Part 1, involving the tax affairs of Samantha Smith, In Assignment Part 1, you were required

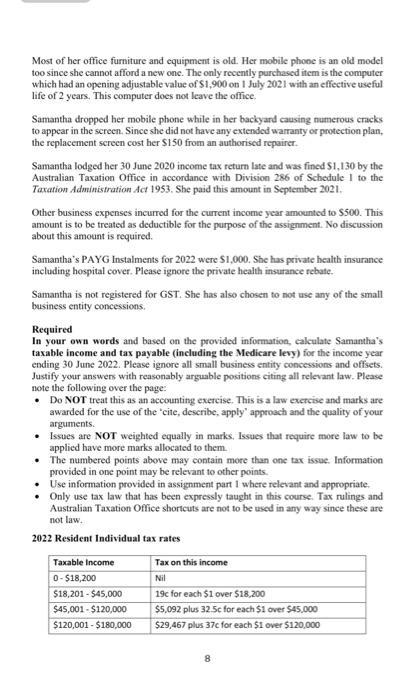

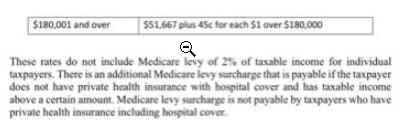

Assignment Part 2 is the continuation of Assignment Part 1, involving the tax affairs of Samantha Smith, In Assignment Part 1, you were required to calculate assessable income based on the information provided. For this second part, you should assume that her assessable income is $25,000 and take that as the starting point to deal with the following additional information (which is relevant for the year ending 30 June 2022 unless otherwise stated) to determine Samantha's taxable income and tax payable including Medicare levy for the year ending 30 June 2022 Due to the COVID-19 pandemic, Samantha began offering yoga lessons online (as stated in assignment part 1). She set aside a room in her house to conduct the classes and take care of business matters. The room contained a desk, chair, printer, all in one desktop computer with video camera in the screen, and a mat to do the yoga on. The floor area of the room is 1/8* of the total floor area of her house. The room is used for classes and business administration 30% of the time used for her studies the remainder of the time. The room, which contains all her stationery, is only used for her business and her studies. Prior to the COVID-19 pandemic, Samantha conducted her yoga classes in local parks with her students at pre-arranged times, but always completed any required administration at home. All correspondence for the business goes to her home which is also registered as her place of business with relevant government authorities. Details of various total costs are provided below. Due to the extra time at home, there were extra amounts spent on someOms such as coffee, milk, sugar and toilet paper. Samantha estimates that she spent ele the amount on these items that she normally would have if she did not have to perform all her activities mainly at home. Diaries of telephone and Internet usage show that the business use portion for each is 50%. Her mobile phone plan is a 'bring your own device' type and there are no handset repayments in the amounts paid. All the costs are paid to third party providers (ie not related parties) for commercial amounts. She could be on cheaper plans for Internet, telephone and electricity, but is happy with the service provided, especially for the Internet since the classes require a fast, reliable connection Electricity Stationery Mobile phone Internet Rent Cleaning products Coffee Milk S1,500 $150 S500 S1,000 S19,000 S200 S150 $250 $120 $300 Sugar Toilet paper All these amounts were paid for in the 2022 income tax year, except for the electricity, telephone and Internet for which she received invoices for $300, S40 and S80 respectively in late June 2022 but these were not paid until carly July 2022. Samantha received invoices related to the same three items totalling S250, S35 and S100 respectively in late June 2021 which were paid in July 2021. Most of her office furniture and equipment is old. Her mobile phone is an old model too since she cannot afford a new one. The only recently purchased item is the computer which had an opening adjustable value ofs1,900 on I July 2021 with an effective useful life of 2 years. This computer does not leave the office. Samantha dropped her mobile phone while in her backyard causing numerous cracks to appear in the screen. Since she did not have any extended warranty or protection plan, the replacement screen cost her S150 from an authorised repairer. Samantha lodged her 30 June 2020 income tax return late and was fined $1,130 by the Australian Taxation Office in accordance with Division 286 of Schedule I to the Taxation Administration Act 1953. She paid this amount in September 2021. Other business expenses incurred for the current income year amounted to $500. This amount is to be treated as deductible for the purpose of the assignment. No discussion about this amount is required. Samantha's PAYG Instalments for 2022 were $1,000. She has private health insurance including hospital cover. Piease ignore the private health insurance rebate. Samantha is not registered for GST. She has also chosen to not use any of the small business entity concessions. Required In your own words and based on the provided information, calculate Samantha's taxable income and tax payable (including the Medicare levy) for the income year ending 30 June 2022. Please ignore all small business entity concessions and offsets. Justify your answers with reasonably arguable positions citing all relevant law. Please note the following over the page: Do NOT treat this as an accounting exercise. This is a law exercise and marks are awarded for the use of the "cite, describe, apply" approach and the quality of your arguments. Issues are NOT weighted equally in marks. Issues that require more law to be applied have more marks allocated to them. The numbered points above may contain more than one tax issue. Information provided in one point may be relevant to other points. Use information provided in assignment part I where relevant and appropriate. Only use tax law that has been expressly taught in this course. Tax rulings and Australian Taxation Office shortcuts are not to be used in any way since these are not law. 2022 Resident Individual tax rates Taxable Income Tax on this income 0- $18,200 Nil $18,201 - $45,000 19c for each $1 over $18,200 $45,001 - $120,000 $5,092 plus 32.5c for each $1 over $45,000 $120,001 - $180,000 $29,467 plus 37c for each $1 over S120,000 $180,001 and over $51,667 plus 45c for each $1 over S180,000 These rates do not include Medicare levy of 2% of taxable income for individual taxpayers. There is an additional Medicare levy surcharge that is payable if the taxpayer does not have private health insurance with hospital cover and has taxable income above a certain amount. Medicare levy surcharge is not payable by taxpayers who have private health insurance including hospital cover.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Taxable income and Tax payable for Samantha 2022 Assessable income 25000 ... View full answer

Get step-by-step solutions from verified subject matter experts