Question: + Assignment Print View O X + ezto.mheducation.com/ext/map/index.html?_c... * * ... C 4 ezto.mheducation.com/hm.tpx?t... * *@ ... State Uni. Cengage login BLAW Other bookmarks Reading

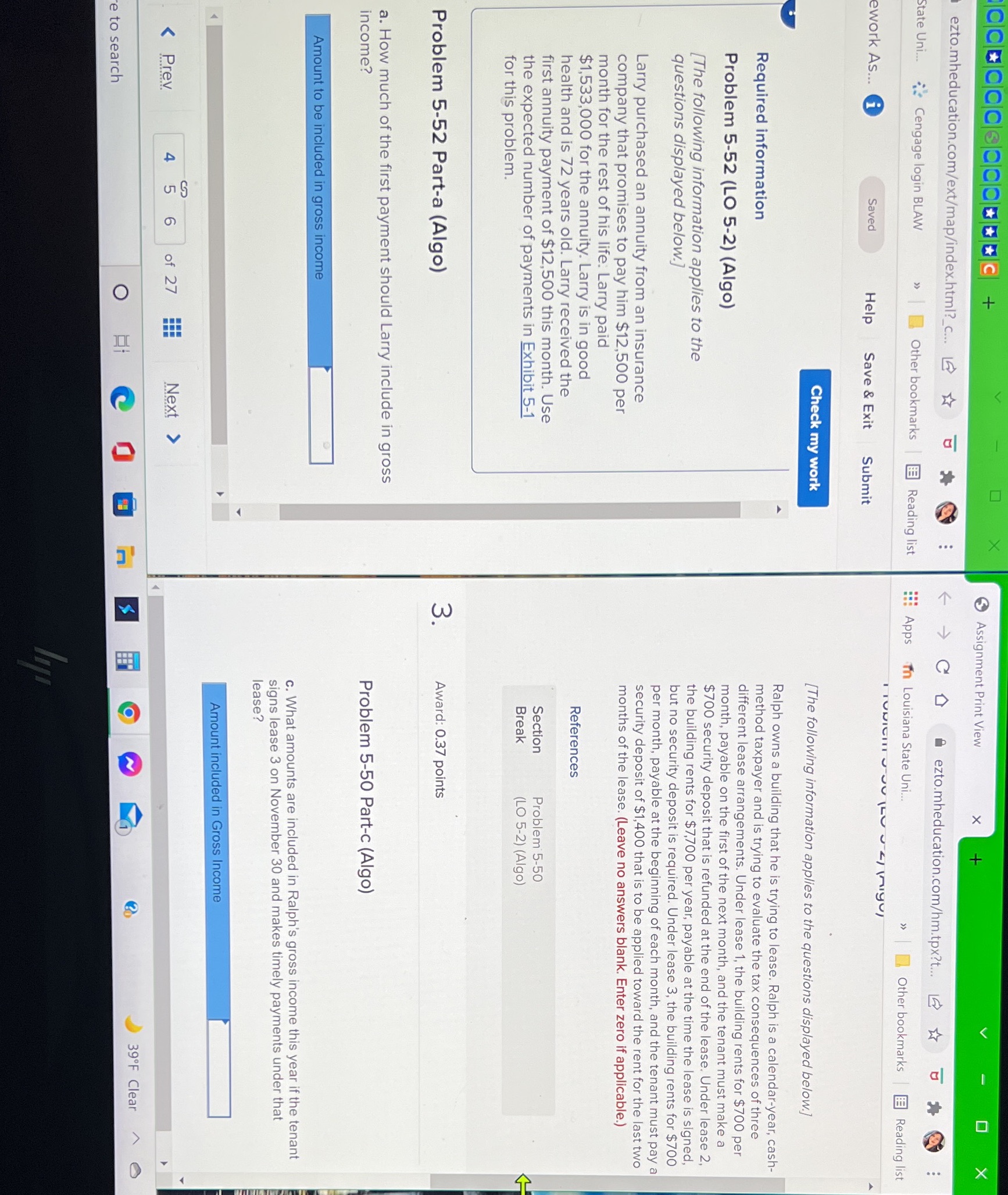

+ Assignment Print View O X + ezto.mheducation.com/ext/map/index.html?_c... * * ... C 4 ezto.mheducation.com/hm.tpx?t... * *@ ... State Uni. Cengage login BLAW Other bookmarks Reading list Apps Th Louisiana State Uni.. Other bookmarks Reading list ework As... i Saved Help Save & Exit Submit Check my work [The following information applies to the questions displayed below.] Ralph owns a building that he is trying to lease. Ralph is a calendar-year, cash- Required information method taxpayer and is trying to evaluate the tax consequences of three different lease arrangements. Under lease 1, the building rents for $700 per Problem 5-52 (LO 5-2) (Algo) month, payable on the first of the next month, and the tenant must make a $700 security deposit that is refunded at the end of the lease. Under lease 2, [The following information applies to the the building rents for $7,700 per year, payable at the time the lease is signed, questions displayed below.] but no security deposit is required. Under lease 3, the building rents for $700 per month, payable at the beginning of each month, and the tenant must pay a Larry purchased an annuity from an insurance security deposit of $1,400 that is to be applied toward the rent for the last two company that promises to pay him $12,500 per months of the lease. (Leave no answers blank. Enter zero if applicable.) month for the rest of his life. Larry paid $1,533,000 for the annuity. Larry is in good References health and is 72 years old. Larry received the first annuity payment of $12,500 this month. Use Section Problem 5-50 the expected number of payments in Exhibit 5-1 Break (LO 5-2) (Algo) for this problem. Problem 5-52 Part-a (Algo) m Award: 0.37 points a. How much of the first payment should Larry include in gross income ? Problem 5-50 Part-c (Algo) Amount to be included in gross income c. What amounts are included in Ralph's gross income this year if the tenant signs lease 3 on November 30 and makes timely payments under that lease? Amount included in Gross Income 39.F Clear e to search O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts