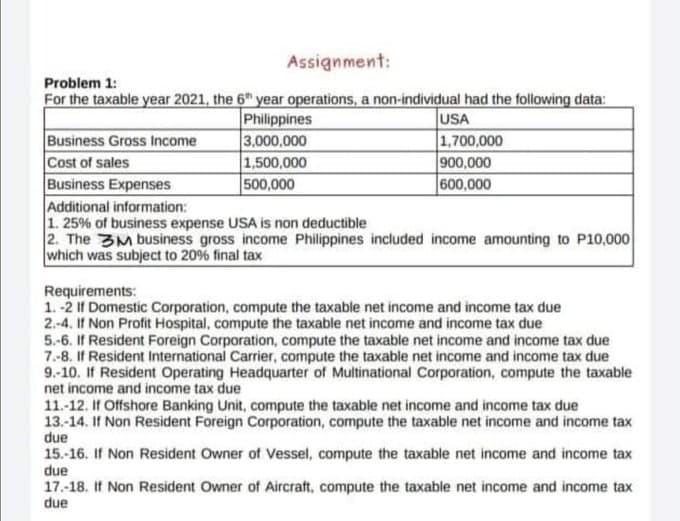

Question: Assignment: Problem 1: For the taxable year 2021, the 6 year operations, a non-individual had the following data: Philippines USA Business Gross Income 3,000,000 1.700,000

Assignment: Problem 1: For the taxable year 2021, the 6 year operations, a non-individual had the following data: Philippines USA Business Gross Income 3,000,000 1.700,000 Cost of sales 1,500,000 900,000 Business Expenses 500,000 600,000 Additional information: 1. 25% of business expense USA is non deductible 2. The 3M business gross income Philippines included income amounting to P10,000 which was subject to 20% final tax Requirements: 1.-2 11 Domestic Corporation, compute the taxable net income and income tax due 2.-4. If Non Profit Hospital, compute the taxable net income and income tax due 5.-6. If Resident Foreign Corporation, compute the taxable net income and income tax due 7.-8. If Resident International Carrier, compute the taxable net income and income tax due 9.-10. If Resident Operating Headquarter of Multinational Corporation, compute the taxable net income and income tax due 11.-12. If Offshore Banking Unit, compute the taxable net income and income tax due 13.-14. If Non Resident Foreign Corporation, compute the taxable net income and income tax due 15.-16. If Non Resident Owner of Vessel, compute the taxable net income and income tax due 17.-18. If Non Resident Owner of Aircraft compute the taxable net income and income tax due Assignment: Problem 1: For the taxable year 2021, the 6 year operations, a non-individual had the following data: Philippines USA Business Gross Income 3,000,000 1.700,000 Cost of sales 1,500,000 900,000 Business Expenses 500,000 600,000 Additional information: 1. 25% of business expense USA is non deductible 2. The 3M business gross income Philippines included income amounting to P10,000 which was subject to 20% final tax Requirements: 1.-2 11 Domestic Corporation, compute the taxable net income and income tax due 2.-4. If Non Profit Hospital, compute the taxable net income and income tax due 5.-6. If Resident Foreign Corporation, compute the taxable net income and income tax due 7.-8. If Resident International Carrier, compute the taxable net income and income tax due 9.-10. If Resident Operating Headquarter of Multinational Corporation, compute the taxable net income and income tax due 11.-12. If Offshore Banking Unit, compute the taxable net income and income tax due 13.-14. If Non Resident Foreign Corporation, compute the taxable net income and income tax due 15.-16. If Non Resident Owner of Vessel, compute the taxable net income and income tax due 17.-18. If Non Resident Owner of Aircraft compute the taxable net income and income tax due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts