Question: Assignment Problem 1 (speculation) Suppose the current exchange for Euros is $1.48/ and the 6-month forward rate is $1.52/. A speculator believes that Euro will

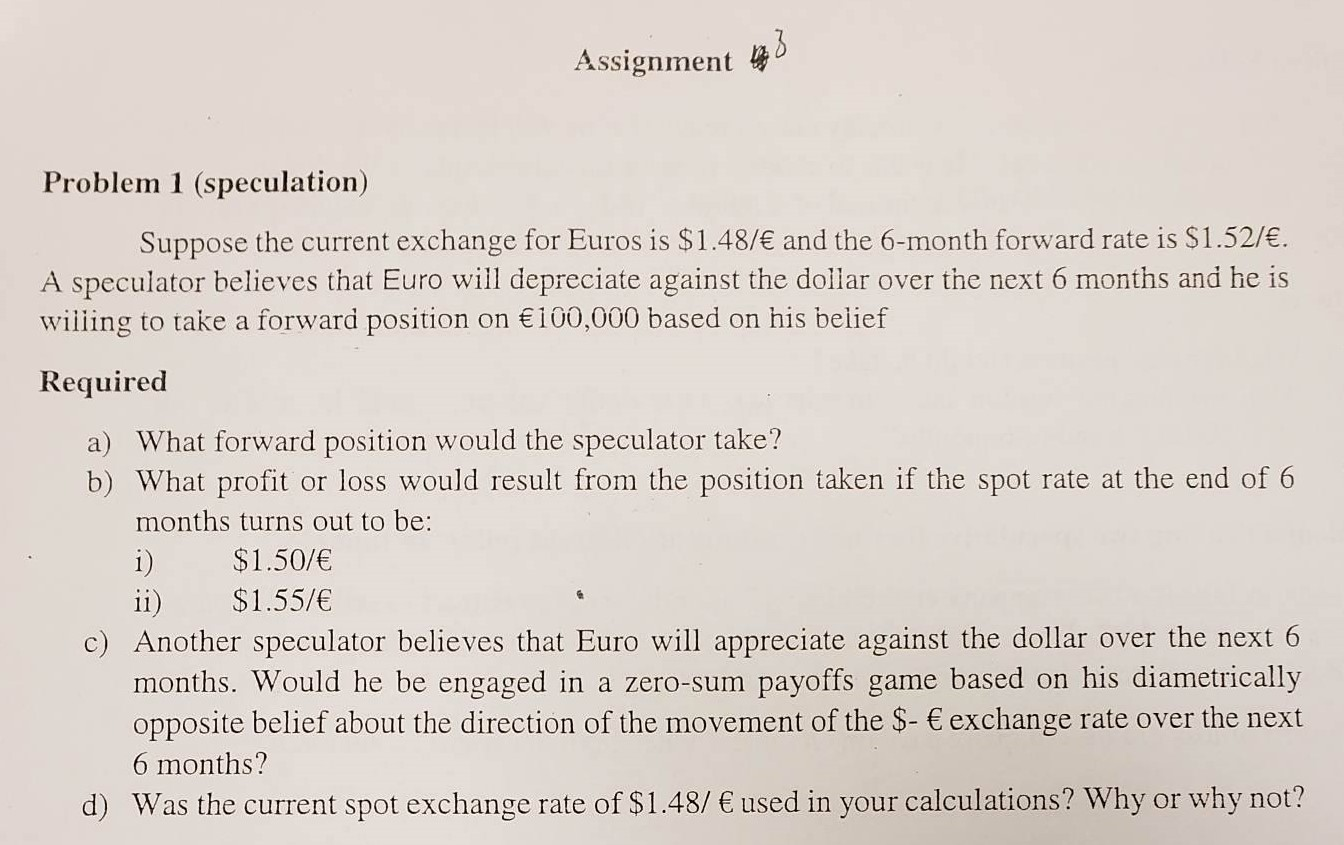

Assignment Problem 1 (speculation) Suppose the current exchange for Euros is $1.48/ and the 6-month forward rate is $1.52/. A speculator believes that Euro will depreciate against the dollar over the next 6 months and he is wiling to take a forward position on 100,000 based on his belief Required a) What forward position would the speculator take? b) What profit or loss would result from the position taken if the spot rate at the end of 6 months turns out to be: $1.50/ i) ii) c) Another speculator believes that Euro will appreciate against the dollar over the next 6 months. Would he be engaged in a zero-sum payoffs game based on his diametrically opposite belief about the direction of the movement of the $- exchange rate over the next $1.55/ 6 months? d) Was the current spot exchange rate of $1.48/used in your calculations? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts