Question: Assignment Problem Three - 5 (Taxable Automobile Benefits) It is the policy of Dorsey Ltd. to provide automobiles to four of their senior executives. The

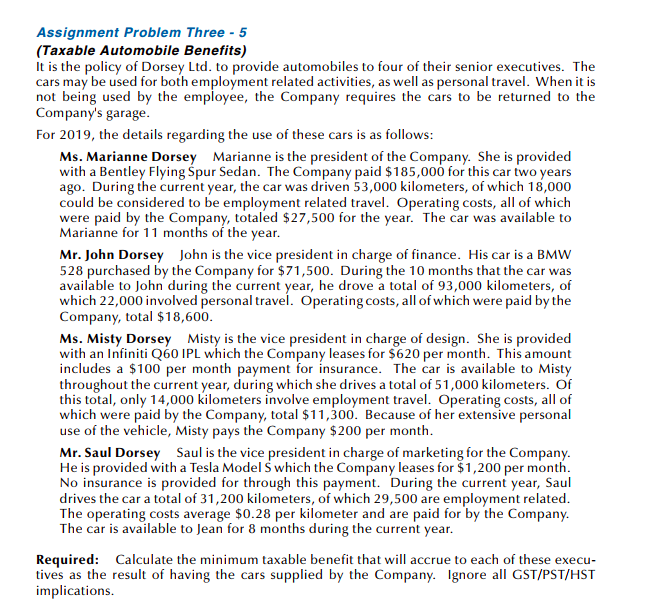

Assignment Problem Three - 5 (Taxable Automobile Benefits) It is the policy of Dorsey Ltd. to provide automobiles to four of their senior executives. The cars may be used for both employment related activities, as well as personal travel. When it is not being used by the employee, the Company requires the cars to be returned to the Company's garage. For 2019, the details regarding the use of these cars is as follows: Ms. Marianne Dorsey Marianne is the president of the Company. She is provided with a Bentley Flying Spur Sedan. The Company paid $185,000 for this car two years ago. During the current year, the car was driven 53,000 kilometers, of which 18,000 could be considered to be employment related travel. Operating costs, all of which were paid by the Company, totaled $27,500 for the year. The car was available to Marianne for 11 months of the year. Mr. John Dorsey John is the vice president in charge of finance. His car is a BMW 528 purchased by the Company for $71,500. During the 10 months that the car was available to John during the current year, he drove a total of 93,000 kilometers, of which 22,000 involved personal travel. Operating costs, all of which were paid by the Company, total $18,600. Ms. Misty Dorsey Misty is the vice president in charge of design. She is provided with an Infiniti Q60 IPL which the Company leases for $620 per month. This amount includes a $100 per month payment for insurance. The car is available to Misty throughout the current year, during which she drives a total of 51,000 kilometers. Of this total, only 14,000 kilometers involve employment travel. Operating costs, all of which were paid by the Company, total $11,300. Because of her extensive personal use of the vehicle, Misty pays the Company $200 per month. Mr. Saul Dorsey Saul is the vice president in charge of marketing for the Company. He is provided with a Tesla Model S which the Company leases for $1,200 per month. No insurance is provided for through this payment. During the current year, Saul drives the car a total of 31,200 kilometers, of which 29,500 are employment related. The operating costs average $0.28 per kilometer and are paid for by the Company. The car is available to Jean for 8 months during the current year. Required: Calculate the minimum taxable benefit that will accrue to each of these execu- tives as the result of having the cars supplied by the Company. Ignore all GST/PST/HST implications. Assignment Problem Three - 5 (Taxable Automobile Benefits) It is the policy of Dorsey Ltd. to provide automobiles to four of their senior executives. The cars may be used for both employment related activities, as well as personal travel. When it is not being used by the employee, the Company requires the cars to be returned to the Company's garage. For 2019, the details regarding the use of these cars is as follows: Ms. Marianne Dorsey Marianne is the president of the Company. She is provided with a Bentley Flying Spur Sedan. The Company paid $185,000 for this car two years ago. During the current year, the car was driven 53,000 kilometers, of which 18,000 could be considered to be employment related travel. Operating costs, all of which were paid by the Company, totaled $27,500 for the year. The car was available to Marianne for 11 months of the year. Mr. John Dorsey John is the vice president in charge of finance. His car is a BMW 528 purchased by the Company for $71,500. During the 10 months that the car was available to John during the current year, he drove a total of 93,000 kilometers, of which 22,000 involved personal travel. Operating costs, all of which were paid by the Company, total $18,600. Ms. Misty Dorsey Misty is the vice president in charge of design. She is provided with an Infiniti Q60 IPL which the Company leases for $620 per month. This amount includes a $100 per month payment for insurance. The car is available to Misty throughout the current year, during which she drives a total of 51,000 kilometers. Of this total, only 14,000 kilometers involve employment travel. Operating costs, all of which were paid by the Company, total $11,300. Because of her extensive personal use of the vehicle, Misty pays the Company $200 per month. Mr. Saul Dorsey Saul is the vice president in charge of marketing for the Company. He is provided with a Tesla Model S which the Company leases for $1,200 per month. No insurance is provided for through this payment. During the current year, Saul drives the car a total of 31,200 kilometers, of which 29,500 are employment related. The operating costs average $0.28 per kilometer and are paid for by the Company. The car is available to Jean for 8 months during the current year. Required: Calculate the minimum taxable benefit that will accrue to each of these execu- tives as the result of having the cars supplied by the Company. Ignore all GST/PST/HST implications

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts