Question: Assignment Question One i. Explain the objectives of material control? ii. It is said that in any system of material control there are always two

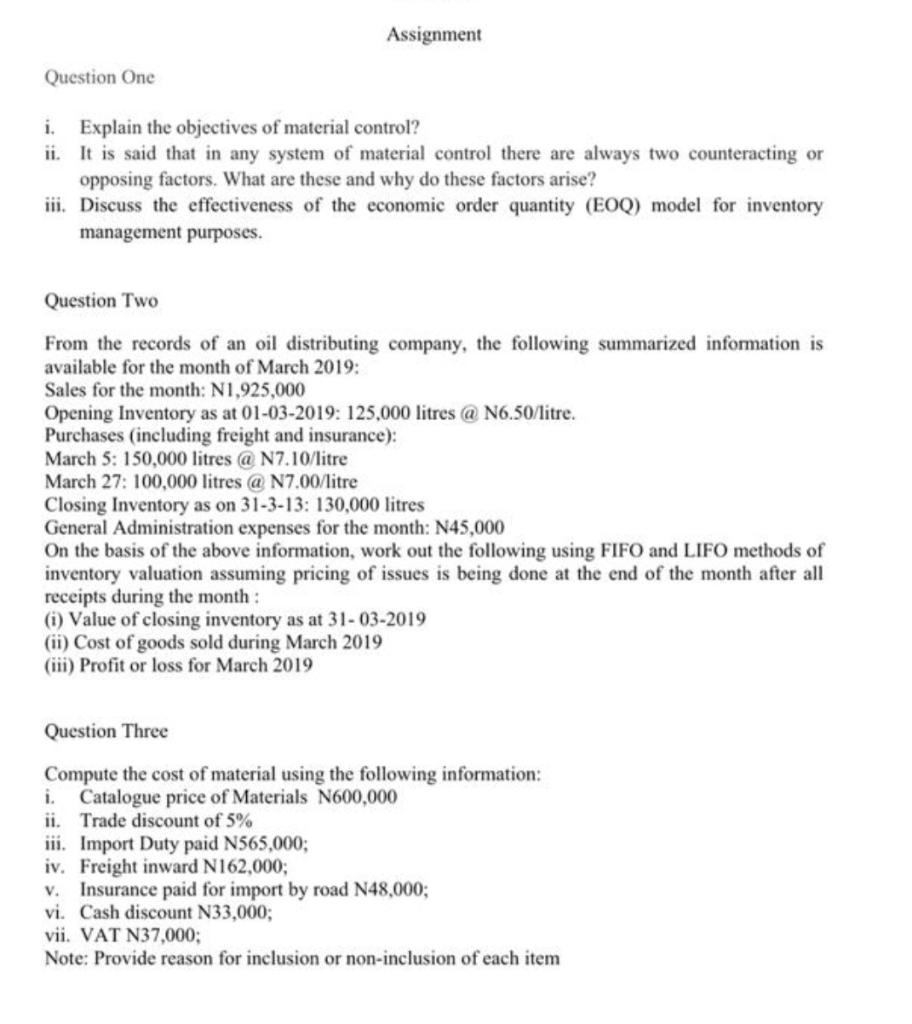

Assignment Question One i. Explain the objectives of material control? ii. It is said that in any system of material control there are always two counteracting or opposing factors. What are these and why do these factors arise? iii. Discuss the effectiveness of the economic order quantity (EOQ) model for inventory management purposes. Question Two From the records of an oil distributing company, the following summarized information is available for the month of March 2019: Sales for the month: N1,925,000 Opening Inventory as at 01-03-2019: 125,000 litres @ N6.50/litre. Purchases (including freight and insurance): March 5: 150,000 litres @ N7.10/litre March 27: 100,000 litres @ N7.00/litre Closing Inventory as on 31-3-13: 130.000 litres General Administration expenses for the month: N45,000 On the basis of the above information, work out the following using FIFO and LIFO methods of inventory valuation assuming pricing of issues is being done at the end of the month after all receipts during the month : (1) Value of closing inventory as at 31-03-2019 (ii) Cost of goods sold during March 2019 (iii) Profit or loss for March 2019 Question Three Compute the cost of material using the following information: i. Catalogue price of Materials N600,000 ii. Trade discount of 5% iii. Import Duty paid N565,000; iv. Freight inward N162,000; v. Insurance paid for import by road N48,000; vi. Cash discount N33,000; vii. VAT N37,000; Note: Provide reason for inclusion or non-inclusion of each item Assignment Question One i. Explain the objectives of material control? ii. It is said that in any system of material control there are always two counteracting or opposing factors. What are these and why do these factors arise? iii. Discuss the effectiveness of the economic order quantity (EOQ) model for inventory management purposes. Question Two From the records of an oil distributing company, the following summarized information is available for the month of March 2019: Sales for the month: N1,925,000 Opening Inventory as at 01-03-2019: 125,000 litres @ N6.50/litre. Purchases (including freight and insurance): March 5: 150,000 litres @ N7.10/litre March 27: 100,000 litres @ N7.00/litre Closing Inventory as on 31-3-13: 130.000 litres General Administration expenses for the month: N45,000 On the basis of the above information, work out the following using FIFO and LIFO methods of inventory valuation assuming pricing of issues is being done at the end of the month after all receipts during the month : (1) Value of closing inventory as at 31-03-2019 (ii) Cost of goods sold during March 2019 (iii) Profit or loss for March 2019 Question Three Compute the cost of material using the following information: i. Catalogue price of Materials N600,000 ii. Trade discount of 5% iii. Import Duty paid N565,000; iv. Freight inward N162,000; v. Insurance paid for import by road N48,000; vi. Cash discount N33,000; vii. VAT N37,000; Note: Provide reason for inclusion or non-inclusion of each item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts