Question: Assignment Questions: 1. (20 points) For models 2, 2a, and 2b: What is the best way to minimize the weighted average cost of capital? What

Assignment Questions:

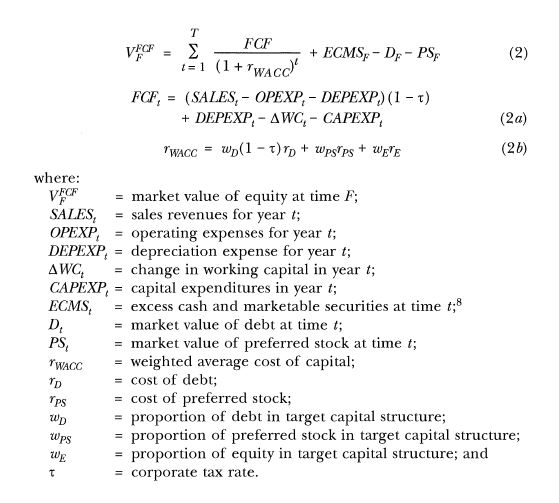

1. (20 points) For models 2, 2a, and 2b:

What is the best way to minimize the weighted average cost of capital?

What is the effect of the weighted average cost of capital on the market value?

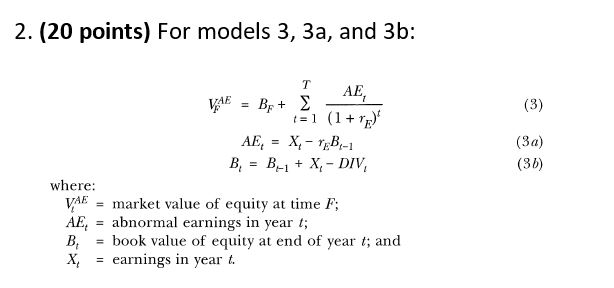

2. (20 points) For models 3, 3a, and 3b:

What is the relationship between book value of equity and time t-1 and the market value of the equity?

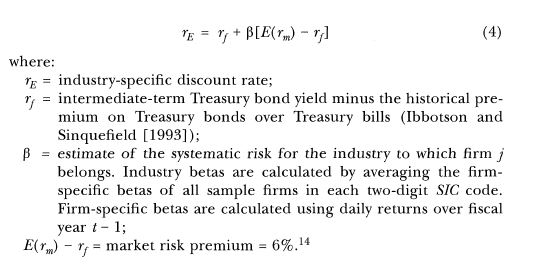

3. (20 points) Discuss model 4 which is the image just below this text and expand on the importance and the meaning of the market risk premium.

I need atleast 600-700 words on this PLEASE, no short paragraphs or one liners

+ ECMS DF- PS 1TWACC FCF, = (SALES:-OPEXR-DEPEXP) (1-t) +DEPEXP AWC CAPEXP. (2a) (2b) where: FCF = market value of equity at time F. SALES, sales revenues for year t; OPEXP = operating expenses for year t; DEPEXP -depreciation expense for year t; WCt = change in working capital in year t; CAPEXP, capital expenditures in year t ECMS, excess cash and marketable securities at time t;8 PS r WACC = rnarket value of debt at time t; = market value of preferred stock at time t; = weighted average cost of capital; cost of debt; = cost of preferred stock; = proportion of debt in target capital structure; = proportion of preferred stock in target capital structure; = proportion of equity in target capital structure; and = corporate tax rate PS Wp LU PS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts