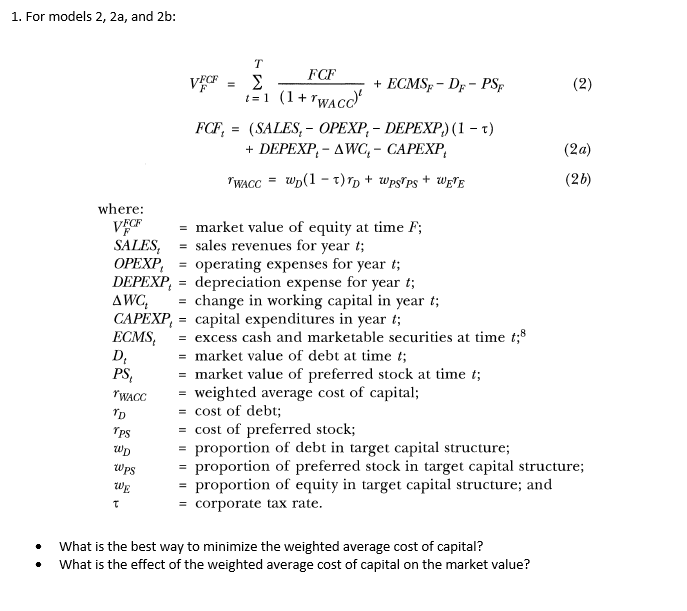

Question: For models 2, 2a, and 2b: V_F^FCF/(1 + r_WACC)^t + ECMS_F - D_F - PS_F FCF_t = (SALES_t - OPEXP_t - DEPEXP_t) (1 - tau)

For models 2, 2a, and 2b: V_F^FCF/(1 + r_WACC)^t + ECMS_F - D_F - PS_F FCF_t = (SALES_t - OPEXP_t - DEPEXP_t) (1 - tau) + DEPEXP_t - Delta WC_i - GAPEXP_t r_WACC = w_D(1 - tau)r_D + w_PS r_PS + w_E r_E where: V_F^FCF = market value of equity at time F; SALES_t = sales revenues for year t; OPEXP_t = operating expenses for year t; DEPEXP_t = depreciation expense for year t; Delta WC_t = change in working capital in year t; CAPEXP_t = capital expenditures in year t; ECMS_t = excess cash and marketable securities at time t; D_t = market value of debt at time t; PS_t = market value of preferred stock at time t; r_WACC = weighted average cost of capital; r_D = cost of debt; r_PS = cost of preferred stock; w_D = proportion of debt in target capital structure; w_PS = proportion of preferred stock in target capital structure; w_E = proportion of equity in target capital structure; and tau = corporate tax rate. What is the best way to minimize the weighted average cost of capital? What is the effect of the weighted average cost of capital on the market value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts