Question: Assignment requirement I Q 2 - 1 A rookie NBA player now is facing his first NBA contract. There are following options for him to

Assignment requirement I

Q

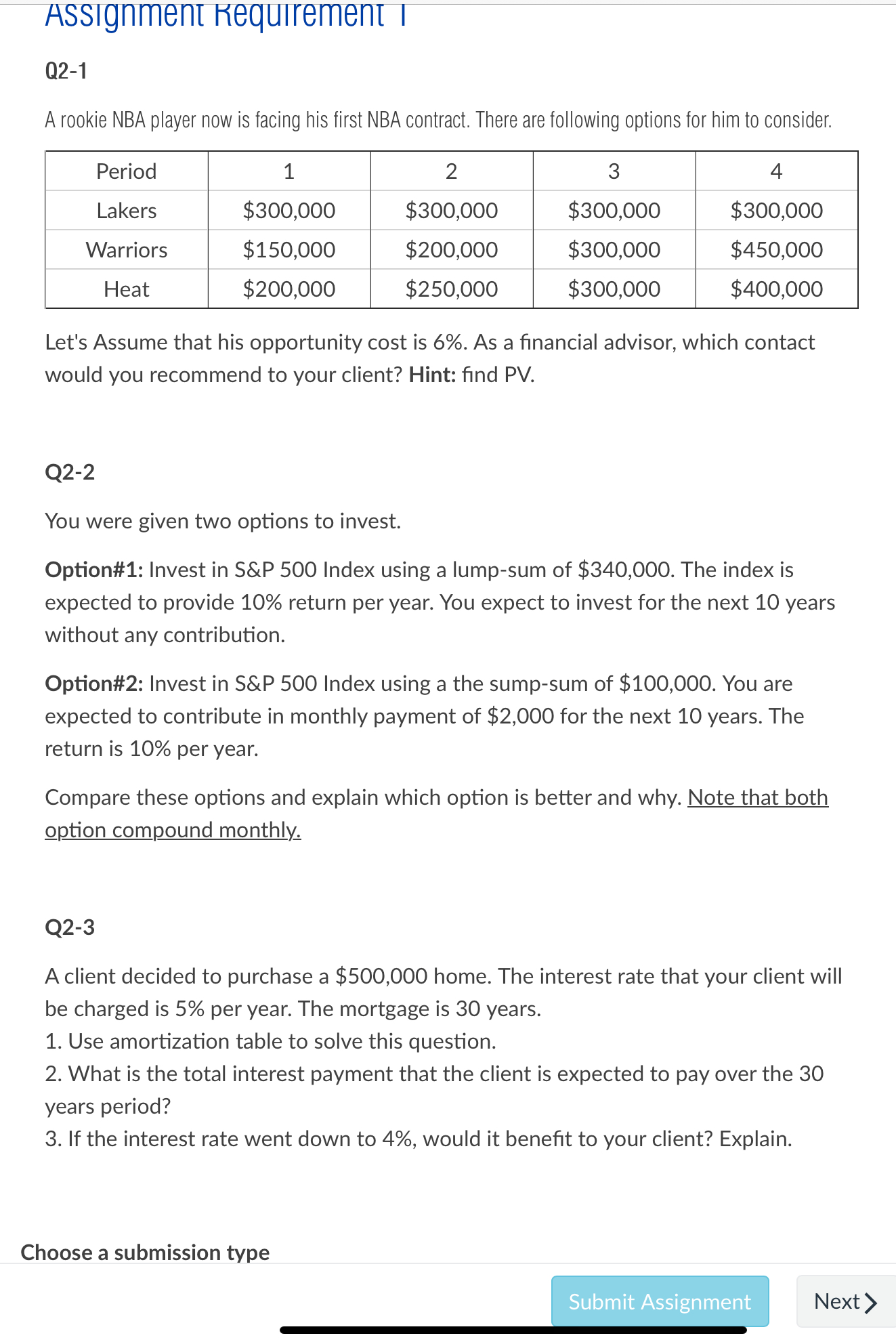

A rookie NBA player now is facing his first NBA contract. There are following options for him to consider.

Let's Assume that his opportunity cost is As a financial advisor, which contact would you recommend to your client? Hint: find PV

Q

You were given two options to invest.

Option#: Invest in S&P Index using a lumpsum of $ The index is expected to provide return per year. You expect to invest for the next years without any contribution.

Option#: Invest in S&P Index using a the sumpsum of $ You are expected to contribute in monthly payment of $ for the next years. The return is per year.

Compare these options and explain which option is better and why. Note that both option compound monthly.

Q

A client decided to purchase a $ home. The interest rate that your client will be charged is per year. The mortgage is years.

Use amortization table to solve this question.

What is the total interest payment that the client is expected to pay over the years period?

If the interest rate went down to would it benefit to your client? Explain.

Choose a submission type

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock