Question: Assignment Score: 27.27% Assignment: 25-1B Save Exit Email instructor Submit Assignment for Grading Questions Problem 25-1 (Algorithmic) Question 1 of 1 Hint(s) Check My Work

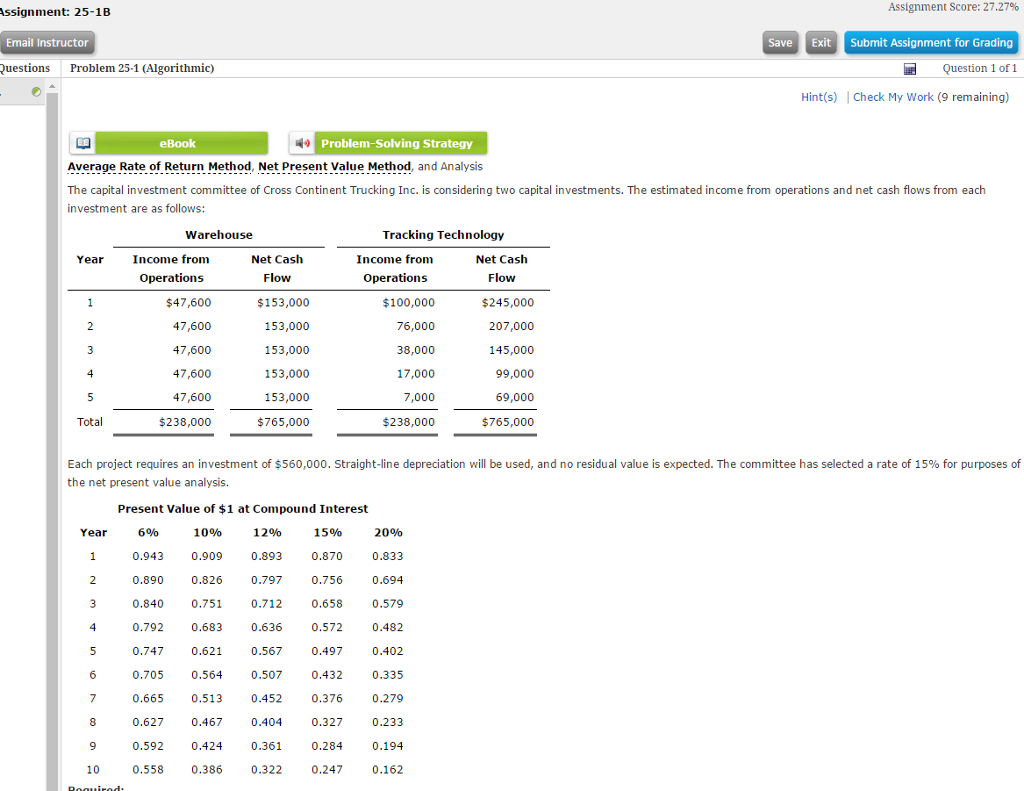

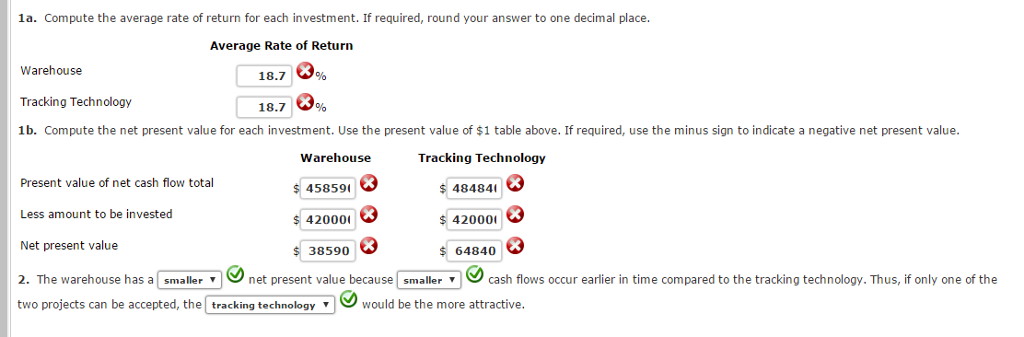

Assignment Score: 27.27% Assignment: 25-1B Save Exit Email instructor Submit Assignment for Grading Questions Problem 25-1 (Algorithmic) Question 1 of 1 Hint(s) Check My Work (9 remaining) Problem-Solving Strategy Average Rate of Return Method, Net Present Value Method and Analysis The capital investment committee of Cross Continent Trucking Inc. is considering two capital investments. The estimated income from operations and net cash flows from each investment are as follows: Warehouse Tracking Technology Income from Year Income from Net Cash Net Cash Operations Operations Flow Flow $47,600 $153,000 $100,000 $245,000 207,000 153,000 47,600 76,000 153,000 38,000 7,600 145,000 153,000 99,000 7,600 17,000 69,000 153,000 $238,000 $765,000 $238,000 $765,000 ota Each project requires an investment of $560,000. Straight-line depreciation will be used, and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Present Value of $1 at Compound Interest 6% 10% 12% 15% 20% Year 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 0.705 0.564 0.507 0.432 0.335 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts