Question: Assignment Task: As a junior equity analyst, you are assisting the fund manager to analyse the share price performance of listed companies and factors

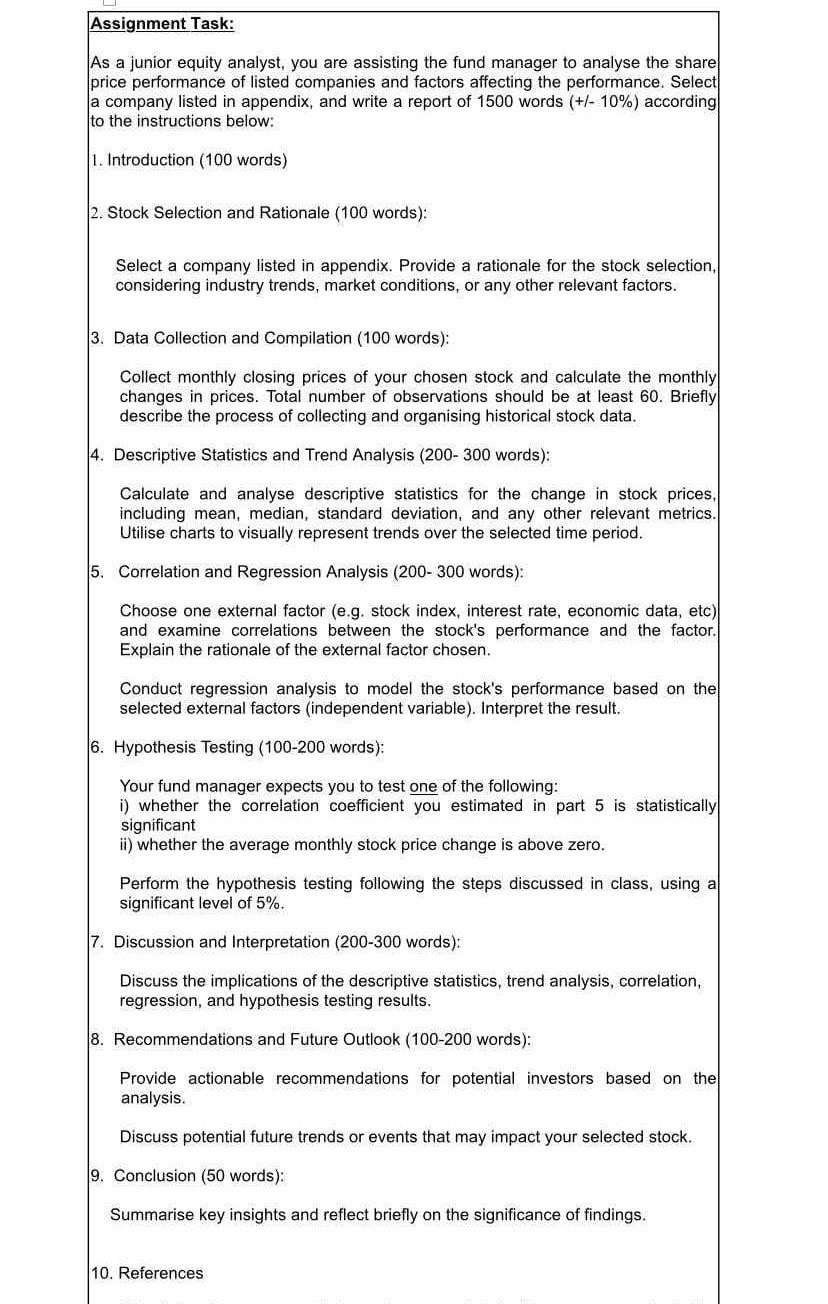

Assignment Task: As a junior equity analyst, you are assisting the fund manager to analyse the share price performance of listed companies and factors affecting the performance. Select a company listed in appendix, and write a report of 1500 words (+/- 10%) according to the instructions below: 1. Introduction (100 words) 2. Stock Selection and Rationale (100 words): Select a company listed in appendix. Provide a rationale for the stock selection, considering industry trends, market conditions, or any other relevant factors. 3. Data Collection and Compilation (100 words): Collect monthly closing prices of your chosen stock and calculate the monthly changes in prices. Total number of observations should be at least 60. Briefly describe the process of collecting and organising historical stock data. 4. Descriptive Statistics and Trend Analysis (200-300 words): Calculate and analyse descriptive statistics for the change in stock prices, including mean, median, standard deviation, and any other relevant metrics. Utilise charts to visually represent trends over the selected time period. 5. Correlation and Regression Analysis (200-300 words): Choose one external factor (e.g. stock index, interest rate, economic data, etc) and examine correlations between the stock's performance and the factor. Explain the rationale of the external factor chosen. Conduct regression analysis to model the stock's performance based on the selected external factors (independent variable). Interpret the result. 6. Hypothesis Testing (100-200 words): Your fund manager expects you to test one of the following: i) whether the correlation coefficient you estimated in part 5 is statistically significant ii) whether the average monthly stock price change is above zero. Perform the hypothesis testing following the steps discussed in class, using a significant level of 5%. 7. Discussion and Interpretation (200-300 words): Discuss the implications of the descriptive statistics, trend analysis, correlation, regression, and hypothesis testing results. 8. Recommendations and Future Outlook (100-200 words): Provide actionable recommendations for potential investors based on the analysis. Discuss potential future trends or events that may impact your selected stock. 9. Conclusion (50 words): Summarise key insights and reflect briefly on the significance of findings. 10. References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts