Question: Assignment This is what you are asked to complete using the transactions (on the next slide) 1. Set up an expanded accounting equation spreadsheet using

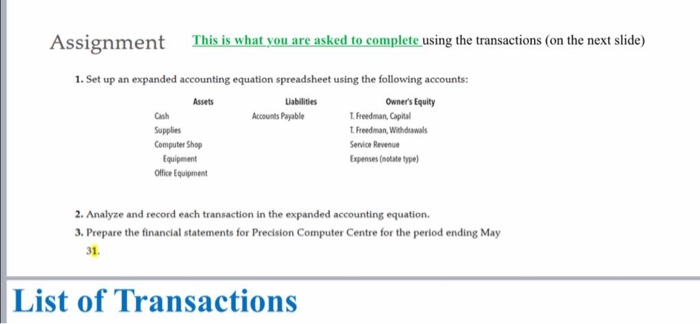

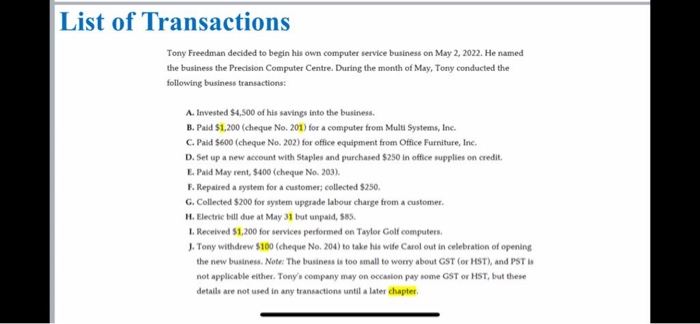

Assignment This is what you are asked to complete using the transactions (on the next slide) 1. Set up an expanded accounting equation spreadsheet using the following accounts: Assets Liabilities Owner's Equity Accounts Payable 1. Freedman, Capital Supplies 1. Freedman, Withdrawals Computer Shop Service Revenue Equipment Expenses (notate type) Office Equipment 2. Analyze and record each transaction in the expanded accounting equation. 3. Prepare the financial statements for Precision Computer Centre for the period ending May 31 List of Transactions List of Transactions Tony Freedman decided to begin his own computer service business on May 2, 2022. He named the business the Precision Computer Centre. During the month of May, Tony conducted the following business transactions: A. Invested $4,500 of his savings into the business. B. Paid $1,200 (cheque No. 201) for a computer from Multi Systems, Inc. C. Paid $600 (cheque No. 202) for office equipment from Office Furniture, Inc. D. Set up a new account with Staples and purchased $250 in office supplies on credit. E. Pald May rent, $400 (cheque No. 203). F. Repaired a system for a customer collected $250. G. Collected $200 for system upgrade labour charge from a customer. H. Electric bill due at May 31 but unpaid, $85. 1. Received $1,200 for services performed on Taylor Golf computers, J. Tony withdrew $100 (cheque No. 204) to take his wife Carol out in celebration of opening the new business. Note: The business is too small to worry about GST (or HST), and PST IS not applicable either. Tony's company may on occasion pay some GST or HST, but these details are not used in any transactions until a later chapter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts