Question: Assignment Two [28 Marks) You have been given the expected return on three securities, 1, 2 and 3, and the variance/covariance matrix for these securities.

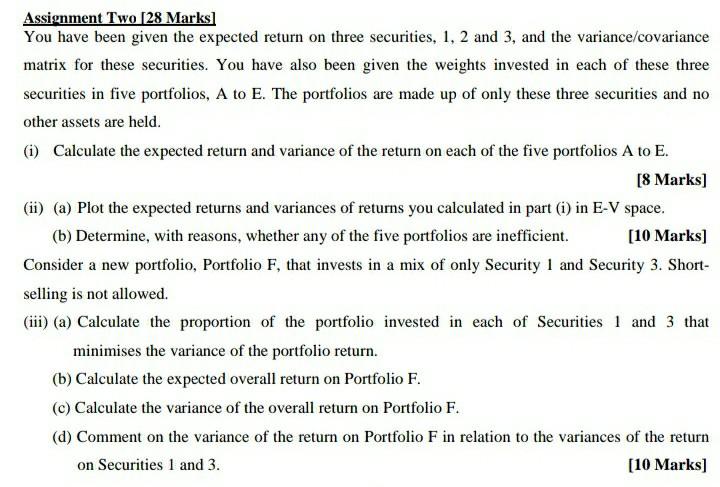

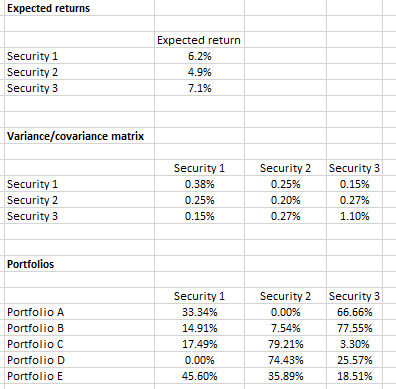

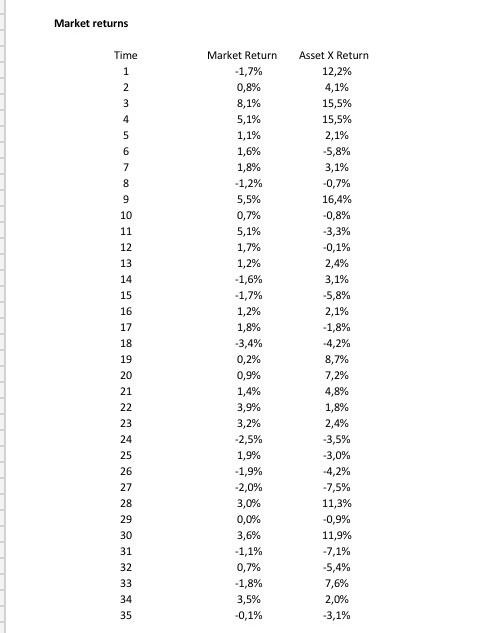

Assignment Two [28 Marks) You have been given the expected return on three securities, 1, 2 and 3, and the variance/covariance matrix for these securities. You have also been given the weights invested in each of these three securities in five portfolios, A to E. The portfolios are made up of only these three securities and no other assets are held. (i) Calculate the expected return and variance of the return on each of the five portfolios A to E. [8 Marks] (ii) (a) Plot the expected returns and variances of returns you calculated in part (i) in E-V space. (b) Determine, with reasons, whether any of the five portfolios are inefficient. [10 Marks) Consider a new portfolio, Portfolio F, that invests in a mix of only Security 1 and Security 3. Short- selling is not allowed. (iii) (a) Calculate the proportion of the portfolio invested in each of Securities 1 and 3 that minimises the variance of the portfolio return. (b) Calculate the expected overall return on Portfolio F. (c) Calculate the variance of the overall return on Portfolio F. (d) Comment on the variance of the return on Portfolio F in relation to the variances of the return on Securities 1 and 3. [10 Marks] Expected returns Security 1 Security 2 Security 3 Expected return 6.2% 4.9% 7.1% Variance/covariance matrix Security 1 Security 2 Security 3 Security 1 0.38% 0.25% 0.15% Security 2 0.25% 0.20% 0.27% Security 3 0.15% 0.27% 1.10% Portfolios Portfolio A Portfolio B Portfolio C Portfolio D Portfolio E Security 1 33.34% 14.91% 17.49% 0.00% 45.60% Security 2 0.00% 7.54% 79.21% 74.43% 35.89% Security 3 66.66% 77.55% 3.30% 25.57% 18.51% Market returns Time 1 2 3 4 5 6 7 UD 000 un 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Market Return -1,7% 0,8% 8,1% 5,1% 1,1% 1,6% 1,8% -1,2% 5,5% 0,7% 5,1% 1,7% 1,2% -1,6% -1,7% 1,2% 1,8% -3,4% 0,2% 0,9% 1,4% 3,9% 3,2% -2,5% 1,9% -1,9% -2,0% 3,0% 0,0% 3,6% -1,1% 0,7% -1,8% 3,5% -0,1% Asset X Return 12,2% 4,1% 15,5% 15,5% 2,1% -5,8% 3,1% -0,7% 16,4% -0,8% -3,3% -0,1% 2,4% 3,1% -5,8% 2,1% -1,8% -4,2% 8,7% 7,2% 4,8% 1,8% 2,4% -3,5% -3,0% -4,2% -7,5% 11,3% -0,9% 11,9% -7,1% -5,4% 7,6% 2,0% -3,1% Assignment Two [28 Marks) You have been given the expected return on three securities, 1, 2 and 3, and the variance/covariance matrix for these securities. You have also been given the weights invested in each of these three securities in five portfolios, A to E. The portfolios are made up of only these three securities and no other assets are held. (i) Calculate the expected return and variance of the return on each of the five portfolios A to E. [8 Marks] (ii) (a) Plot the expected returns and variances of returns you calculated in part (i) in E-V space. (b) Determine, with reasons, whether any of the five portfolios are inefficient. [10 Marks) Consider a new portfolio, Portfolio F, that invests in a mix of only Security 1 and Security 3. Short- selling is not allowed. (iii) (a) Calculate the proportion of the portfolio invested in each of Securities 1 and 3 that minimises the variance of the portfolio return. (b) Calculate the expected overall return on Portfolio F. (c) Calculate the variance of the overall return on Portfolio F. (d) Comment on the variance of the return on Portfolio F in relation to the variances of the return on Securities 1 and 3. [10 Marks] Expected returns Security 1 Security 2 Security 3 Expected return 6.2% 4.9% 7.1% Variance/covariance matrix Security 1 Security 2 Security 3 Security 1 0.38% 0.25% 0.15% Security 2 0.25% 0.20% 0.27% Security 3 0.15% 0.27% 1.10% Portfolios Portfolio A Portfolio B Portfolio C Portfolio D Portfolio E Security 1 33.34% 14.91% 17.49% 0.00% 45.60% Security 2 0.00% 7.54% 79.21% 74.43% 35.89% Security 3 66.66% 77.55% 3.30% 25.57% 18.51% Market returns Time 1 2 3 4 5 6 7 UD 000 un 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Market Return -1,7% 0,8% 8,1% 5,1% 1,1% 1,6% 1,8% -1,2% 5,5% 0,7% 5,1% 1,7% 1,2% -1,6% -1,7% 1,2% 1,8% -3,4% 0,2% 0,9% 1,4% 3,9% 3,2% -2,5% 1,9% -1,9% -2,0% 3,0% 0,0% 3,6% -1,1% 0,7% -1,8% 3,5% -0,1% Asset X Return 12,2% 4,1% 15,5% 15,5% 2,1% -5,8% 3,1% -0,7% 16,4% -0,8% -3,3% -0,1% 2,4% 3,1% -5,8% 2,1% -1,8% -4,2% 8,7% 7,2% 4,8% 1,8% 2,4% -3,5% -3,0% -4,2% -7,5% 11,3% -0,9% 11,9% -7,1% -5,4% 7,6% 2,0% -3,1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts