Question: ASSIGNMENT TWO (DUE DATE 31/10/18) PART ONE Wind energy ltd is a Zambian Company that develops wind farms and harnesses wind energy in North Western

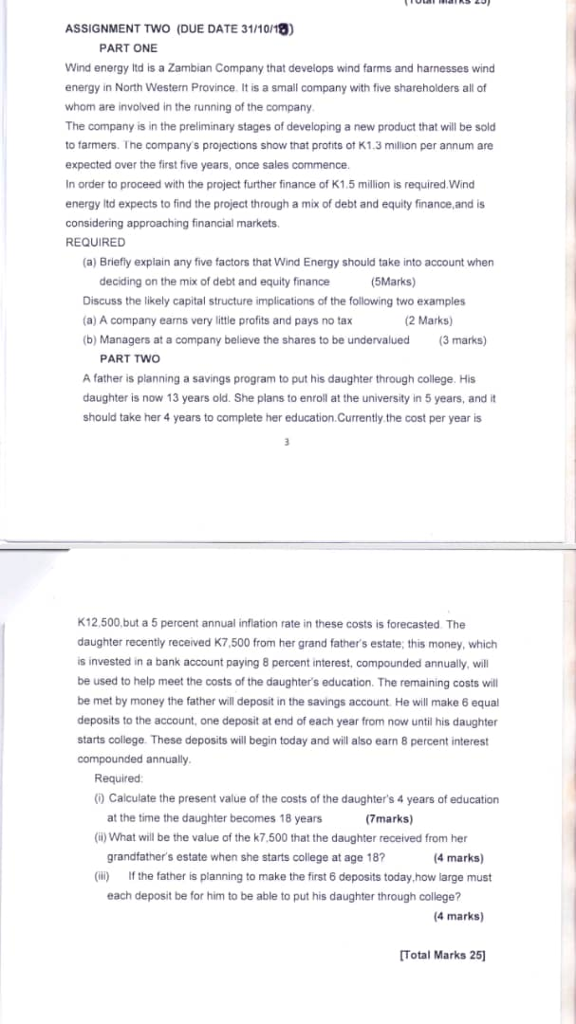

ASSIGNMENT TWO (DUE DATE 31/10/18) PART ONE Wind energy ltd is a Zambian Company that develops wind farms and harnesses wind energy in North Western Province. It is a small company with five shareholders all of whom are involved in the running of the company The company is in the preliminary stages of developing a new product that will be sold to farmers. The companys projections show that protits of K1.3 million per annum are expected over the first five years, once sales commence In order to proceed with the project further finance of K1 5 million required wind energy itd expects to find the project through a mix of debt and equity finance,and is considering approaching financial markets. REQUIRED (a) Briefly explain any five factors that Wind Energy should take into account when (5Marks) deciding on the mix of debt and equity finance Discuss the likely capital structure implications of the following two examples (a) A company earns very little profits and pays no tax (b) Managers at a company believe the shares to be undervalued (3 marks) 2 Marks) PART TWO A father is planning a savings program to put his daughter through college. His daughter is now 13 years old. She plans to enroll at the university in 5 years, and it should take her 4 years to complete her education.Currently the cost per year is K12,500,but a 5 percent annual inflation rate in these costs is forecasted The daughter recently received K7,500 from her grand father's estate; this money, which s invested in a bank account paying 8 percent interest, compounded annually, will be used to help meet the costs of the daughter's education. The remaining costs will be met by money the father will deposit in the savings account. He will make 6 equal deposits to the account, one deposit at end of each year from now until his daughter starts college. These deposits will begin today and will also earn 8 percent interest compounded annually Required: Calculate the present value of the costs of the daughter's 4 years of education at the time the daughter becomes 18 yeans (7marks) () What will be the value of the k7,500 that the daughter received from her grandfather's estate when she starts college at age 18 4 marks) () If the father is planning to make the first 6 deposits today.how large must each deposit be for him to be able to put his daughter through college? 4 marks) Total Marks 25 ASSIGNMENT TWO (DUE DATE 31/10/18) PART ONE Wind energy ltd is a Zambian Company that develops wind farms and harnesses wind energy in North Western Province. It is a small company with five shareholders all of whom are involved in the running of the company The company is in the preliminary stages of developing a new product that will be sold to farmers. The companys projections show that protits of K1.3 million per annum are expected over the first five years, once sales commence In order to proceed with the project further finance of K1 5 million required wind energy itd expects to find the project through a mix of debt and equity finance,and is considering approaching financial markets. REQUIRED (a) Briefly explain any five factors that Wind Energy should take into account when (5Marks) deciding on the mix of debt and equity finance Discuss the likely capital structure implications of the following two examples (a) A company earns very little profits and pays no tax (b) Managers at a company believe the shares to be undervalued (3 marks) 2 Marks) PART TWO A father is planning a savings program to put his daughter through college. His daughter is now 13 years old. She plans to enroll at the university in 5 years, and it should take her 4 years to complete her education.Currently the cost per year is K12,500,but a 5 percent annual inflation rate in these costs is forecasted The daughter recently received K7,500 from her grand father's estate; this money, which s invested in a bank account paying 8 percent interest, compounded annually, will be used to help meet the costs of the daughter's education. The remaining costs will be met by money the father will deposit in the savings account. He will make 6 equal deposits to the account, one deposit at end of each year from now until his daughter starts college. These deposits will begin today and will also earn 8 percent interest compounded annually Required: Calculate the present value of the costs of the daughter's 4 years of education at the time the daughter becomes 18 yeans (7marks) () What will be the value of the k7,500 that the daughter received from her grandfather's estate when she starts college at age 18 4 marks) () If the father is planning to make the first 6 deposits today.how large must each deposit be for him to be able to put his daughter through college? 4 marks) Total Marks 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts