Question: Assignments x @ Take a Test - natalie va x Mathway | Algebra Pro x Forever - YouTube 4 x | M Inbox (1) -

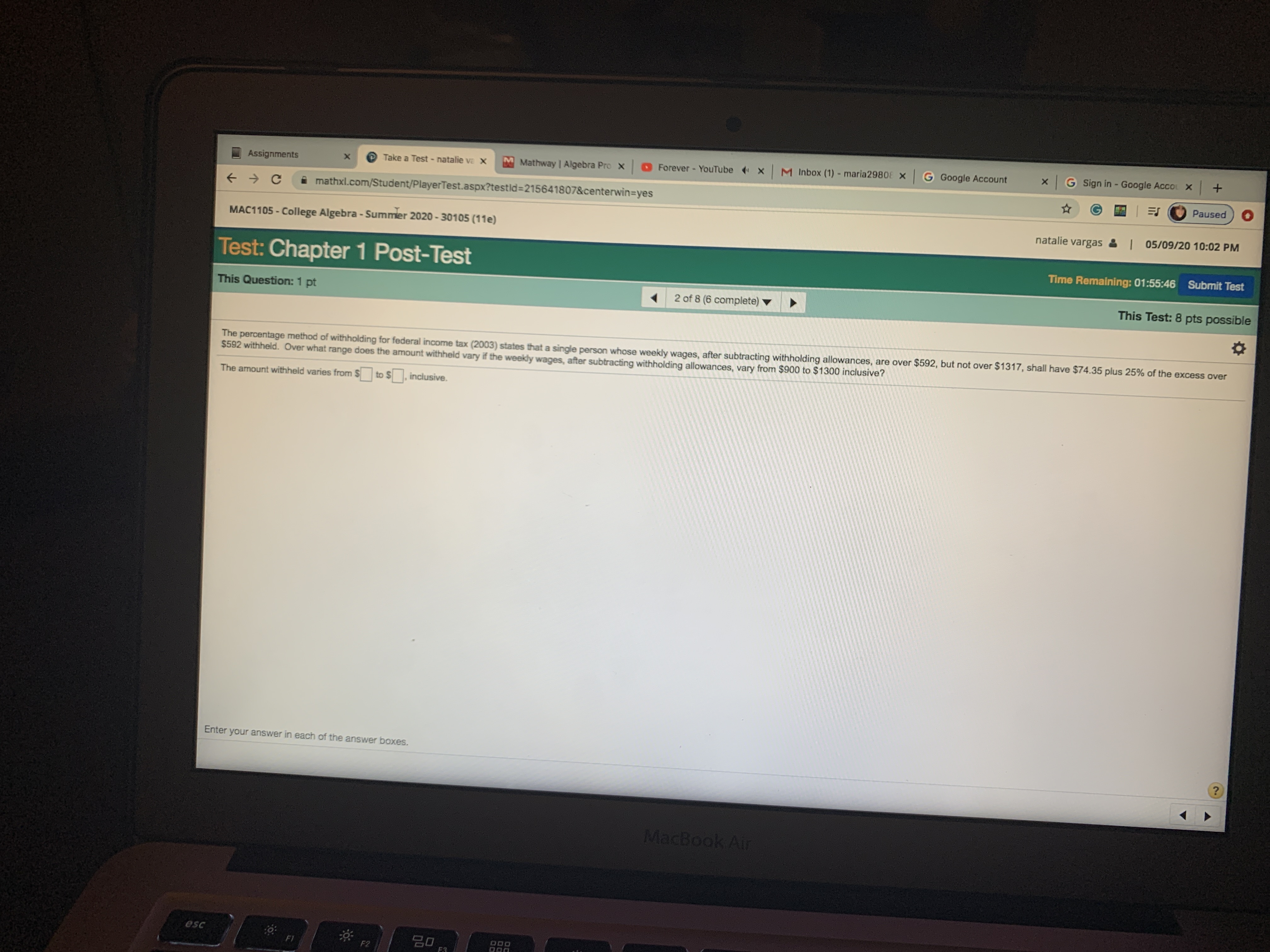

Assignments x @ Take a Test - natalie va x Mathway | Algebra Pro x Forever - YouTube 4 x | M Inbox (1) - maria29808 x | G Google Account x |G Sign in - Google Accol x + ( > C # mathxl.com/Student/PlayerTest.aspx?testid=215641807¢erwin=yes G Paused MAC1105 - College Algebra - Summer 2020 - 30105 (11e) natalie vargas & | 05/09/20 10:02 PM Test: Chapter 1 Post-Test Time Remaining: 01:55:46 Submit Test This Question: 1 pt 2 of 8 (6 complete) This Test: 8 pts possible The percentage method of withholding for federal income tax (2003) states that a single person whose weekly wages, after subtracting withholding allowances, are over $592, but not over $1317, shall have $74.35 plus 25% of the excess over $592 withheld. Over what range does the amount withheld vary if the weekly wages, after subtracting withholding allowances, vary from $900 to $1300 inclusive? The amount withheld varies from $ to $ , inclusive. Enter your answer in each of the answer boxes. ? MacBook Air esc F2 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts